Tyler Cozzens, director of the Livestock Advertising Info Middle, offered his outlook on livestock and crops each nationally and in Colorado on the current Colorado State College Livestock & Forage Growers Replace.

Cozzens gives financial evaluation for the livestock and feed sectors at LMIC and analyzes the larger image concerning the financial system, massive components enjoying into it, and the way demand is formed. On the time of the webinar, the Shopper Value Index had simply been up to date, and he stated there was a 2.8% enhance within the general CPI. This index excludes extra risky items—like meals and power.

“So far as inflationary pressures go, positively an enchancment of the place we have been two to a few years in the past,” he stated.

Again then inflation was starting from 4 to eight%, however the financial system remains to be coping with lingering results.

Non-housing debt steadiness and bank card debt are a few home items Cozzens displays. Bank card debt on the finish of 2024 was greater than $2.1 trillion, a report excessive and that margin over the past 10 years has began to widen.

“It’s positively a type of that you simply take a look at so far as simply from a bigger financial system standpoint of shoppers,” he stated. “Are they placing extra purchases on that bank card? What purchases are they placing on that and are they capable of repay that bank card on the finish of the month? And I might argue a few of this stems from simply the general inflation that we noticed a few years in the past.”

He hopes shoppers will pay down their debt and “nonetheless preserve a few of their buying energy on a bigger scale,” he stated. “It’s vital to acknowledge the general buying energy of the patron and the way they spur on the financial system.”

Agricultural financial system

For the agricultural and livestock sector, Cozzens begins with rates of interest. These have “positively elevated over that 5% charge over the previous couple of months and years,” he stated. Cozzens typically observes the feeder cattle variable rates of interest from Dallas and working mortgage charges from Kansas Metropolis. These two objects typically have an analogous pattern to what the Fed fund charge is reporting.

“The factor I wish to level out is we’re sitting at a variable rate of interest for these working loans versus feeder cattle that’s simply above 8%,” he stated. “So, we evaluate that to roughly a decade in the past, you may see that 3 to 4 share level enhance.”

A decade in the past was the final time there was a major herd rebuilding effort.

It’s additionally costing producers extra to do enterprise.

“That borrowing capital from a financial institution is greater than it was a decade in the past, and so positively a headwind to the general skill of the producer to start out increasing their operation, in the event that they wish to, or simply borrow capital,” Cozzens stated. “This isn’t one thing that’s distinctive to simply the agricultural trade or livestock sector. This goes throughout the financial system as an entire. The rate of interest is form of a type of levers that’s fairly straightforward for us to make use of to throttle the financial system.”

Hay

Trying on the forage, Cozzens checked out United States complete hay shares and when he peeked on the Dec. 1 all-hay shares, he observed a few developments.

Previously couple of years he has watched the provides develop with extra manufacturing. If the demand has not modified that can transfer costs decrease, he stated. He expects hay costs can be a bit of bit decrease nationally and in Colorado when in comparison with a 12 months in the past.

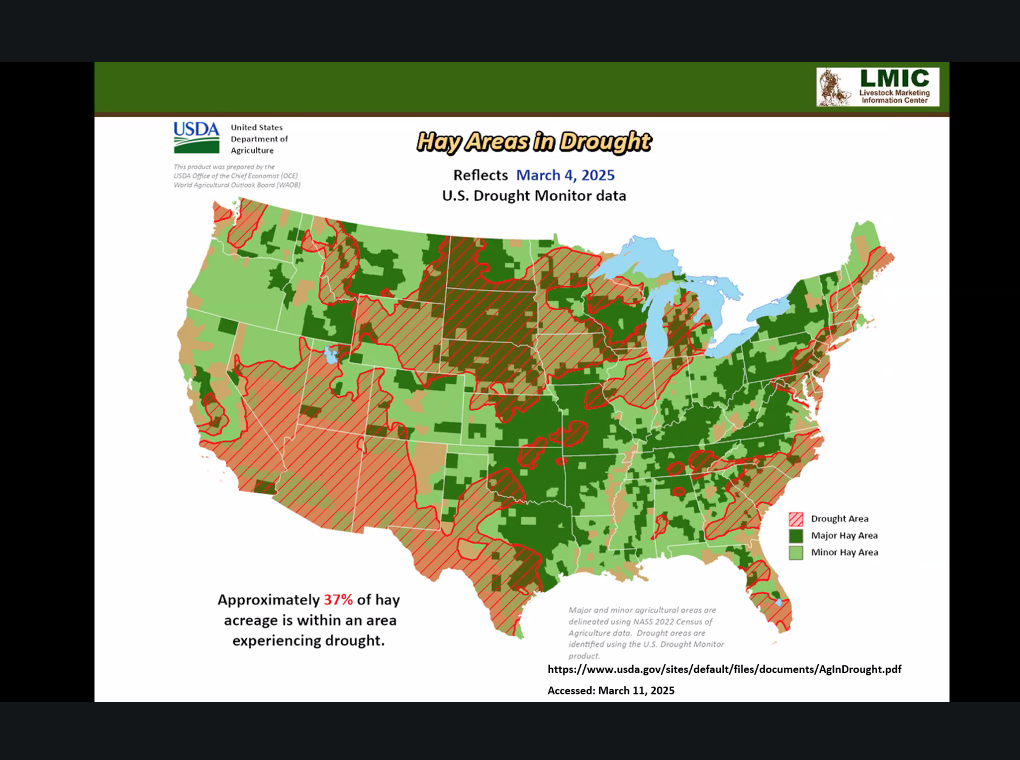

Drought and climate will play into the agricultural sector and several other main crop and livestock producing areas are affected by the dearth of precipitation. Hay acres aren’t immune both.

“Roughly 37% of the hay acreage is inside an space experiencing drought,” he stated. “There are doubtlessly some impacts to simply general hay manufacturing and hay provides doubtlessly as we get into 2025. Clearly, this can be a little bit extra short-term image as we take a look at the drought.”

Corn

Cozzens stated the U.S. Division of Agriculture introduced a couple of weeks in the past it forecasts 94 million acres of corn to be planted this 12 months.

If the pattern line towards yield progress happens it factors to greater corn provides, he stated.

That too is weighing on corn costs. There’s been a number of years of costs of greater than $6 a bushel, however there’s expectations for decrease costs this 12 months. Colorado has had stronger costs in comparison with nationwide costs, however it’s trending decrease.

That bodes nicely for livestock producers who can profit even when in comparison with these prices previously three years, he stated.

Market expectations

Cozzens stated Omaha corn costs greatest symbolize corn costs from a nationwide perspective, they usually’re “positively decrease than what the five-year common has been.”

“However in comparison with a 12 months in the past, we’re monitoring barely higher to even with the place we have been a 12 months in the past,” he stated. “The general market expectation for corn costs transferring ahead in 2025 is seeking to be about that $4.50 to perhaps $5 mark as the present (expectation) sits proper now.”

Corn hasn’t been put within the floor but, and there are unknowns concerning the general provides transferring ahead, he stated. Drought potential is a priority particularly for northeast and japanese Colorado in addition to main areas of the Corn Belt.

If drought happens largely of the Corn Belt that may slice yields and level towards doubtlessly greater costs, he stated.

Cattle

Stock numbers from the USDA, Nationwide Agricultural Statistics Service launched on the finish of January, Cozzens stated, and the largest takeaway for him was from an general provide image. General beef cows and beef cow replacements have been nonetheless down from a 12 months in the past, lower than 1%.

“We’re watching these two key classes as these give us form of our indication of general expectations of provides transferring ahead,” he stated. “Seeing these down from a 12 months in the past nonetheless paints an image that provides are going to be tight as we transfer by means of 2025.”

Many producers have financial considerations in the case of rebuilding the herds. Cozzens stated to remember the general rates of interest being provided and the way that influences choice making.

“There’s some producers on the market, perhaps a few of these smaller producers which have began to actively get a bit of bit extra aggressive about rebuilding their herds, however the calf crop’s down barely from a 12 months in the past,” he stated.

That also factors towards tight provides going by means of this 12 months. Some analysts see the potential for a rise in numbers later this 12 months. He believes there might be a rise in numbers the nearer 2026 comes.

“However I believe the rise—as we get by means of this 12 months and transferring to 2026—goes to be modest,” he stated. “I believe that is going to be a really measured method so far as the rebuilding efforts go on the cattle facet of issues.”

Wrap-up

Cozzens stated by means of his discussions and talks he’s given; drought and pasture circumstances proceed to be one of many larger challenges together with general feed availability and value.

“Now we have some bigger looming financial points right here—geopolitical points, inflation and commerce,” he stated. “I’ll simply deliver again the rate of interest dialogue. Demand held very robust right here in 2024 hoping to see that proceed in 2025 right here, however world demand remains to be a part of that image.”

So are exports, as excessive worth beef is an efficient portion of the meat going abroad. Alternate charges will play a task in that too.

“So just a few larger issues to remember and watch within the coming 12 months,” he stated.

Kylene Scott might be reached at 620-227-1804 or [email protected].