It is in all probability not an enormous shock that the liberal-left mainstream legacy media are doing the whole lot they’ll to color a unfavourable image of President Donald Trump’s financial insurance policies.

Now, we have turn out to be accustomed to the political media going after Trump for years, with phony accusations and mistaken conclusions.

However now the pretend information has unfold to the financial and enterprise media. And that is actually a pity.

Respected economists and financial journalists are ganging up on Trump, utilizing tariffs as a follow beat him over the pinnacle.

It is just like the ‘Russia, Russia, Russia’ narrative has now come to financial protection. And, keep in mind, ‘Russia Russia Russia’ really turned out to be one massive hoax.

Effectively, now it is ‘recession, recession, recession’ — one more hoax.

Tariffs are going to trigger a recession. Tariffs are going to trigger inflation. Tariffs are driving down the inventory market.

‘Russia, Russia, Russia’ — that is what I am studying.

Folks want a filter to get by means of all this craziness.

Initially, there is no such thing as a recession.

In reality, Breitbart’s John Carney factors out that the labor market is definitely stronger than economists thought, and factory jobs are coming back. The January JOLTS report reveals 30,000 new manufacturing job openings, and 30,000 new manufacturing hiring. The quits price has gone up. The S&P world manufacturing PMI has hit its greatest stage since June of 2022. The February employment report was stable.

Some normally respected economists had been predicting a bulging February CPI report due to tariffs. However the tariffs have not actually kicked in but. And the report itself was lighter than anticipated, with the bottom quantity in a number of months.

And company income, the mom’s milk of shares and the lifeblood of the economic system, are nonetheless rising.

Bond yields and mortgage charges are literally falling. So are oil costs.

Former Treasury Secretary Steven Mnuchin stated that “individuals are overreacting to Trump insurance policies” and he doesn’t see indicators of an imminent slowdown within the U.S. economic system.

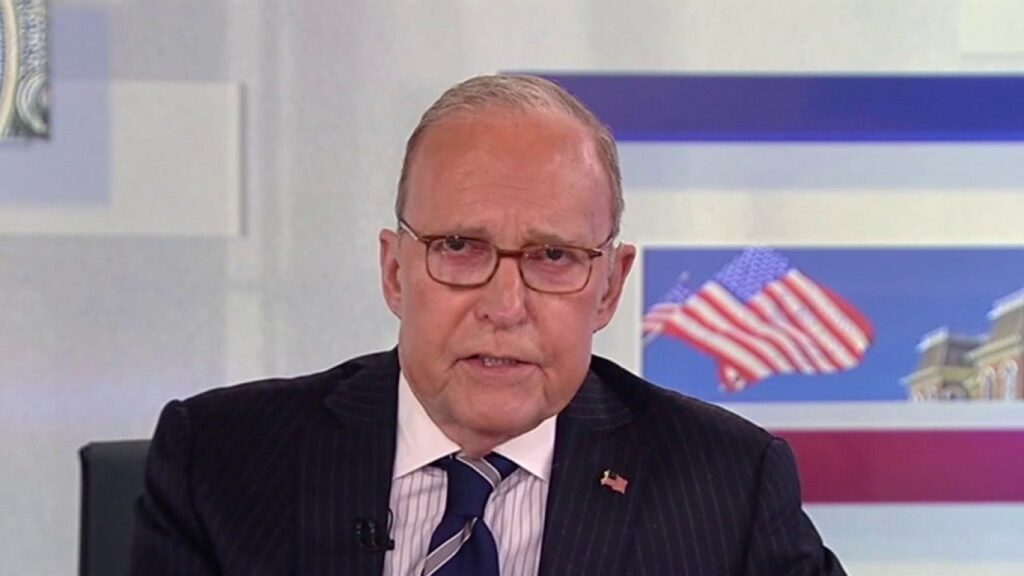

Let me quote my outdated buddy. “I do not suppose we will have a recession. I do not suppose the outlook seems to be like we will have a recession,” he told another network.

I feel he is completely proper.

Quick-term inventory corrections come and go. However Trump policies are profoundly pro-growth.

He goals to reprivatize the economic system — with tax cuts, deregulation, vitality manufacturing, and a reciprocal trade policy.

When these insurance policies are absolutely in place, there is a sturdy potential for 3% progress or higher, alongside diminished inflation.

And, concerning tariffs, let’s step again and see how this story seems within the subsequent six to 12 months.

It might effectively be that Mr. Trump, The Nice Negotiator, will wind up with much more tariff reductions than will increase.

And, anyway, his enterprise and private tax cuts are, frankly, much more vital to our financial future.