Over the previous week, a lot media house was dedicated to discussions across the measurement of India’s financial system relative to different economies of the world. These discussions had been primarily based on the brand new estimates of the Gross Home Product (GDP) of varied international locations for 2024 by the Worldwide Financial Fund (IMF), and its annual projections from 2025 until 2030. As per these projections, India’s GDP in 2025 was prone to be $4,187.03 billion, which might be marginally greater than the GDP of Japan at $4,186.43 billion. Thus, possibly, India would be the fourth largest financial system of the world in 2025 after the U.S., China and Germany.

These discussions have stirred the political pot as effectively. Authorities sources attributed the improved rank to the management capabilities of the Prime Minister. It was additionally argued that India might develop to be the third largest financial system of the world in 2028, and a high-income, developed nation (viksit bharat) by 2047.

The numerous GDPs

The GDP of a rustic tells us little or no about how its folks reside and work, how wholesome or educated its individuals are, and the way unequally its mixture earnings is distributed. GDP estimates additionally miss out on measuring a number of essential facets of financial exercise that aren’t coated by markets, such because the unpaid work of ladies. Therefore, there have been repeated calls to revise nationwide account programs, finish the predominant use of GDP to evaluate the whole lot, and use different indicators that permit us to review socio-economic achievements higher. But, the dominant use of GDP has continued in international and home discourse.

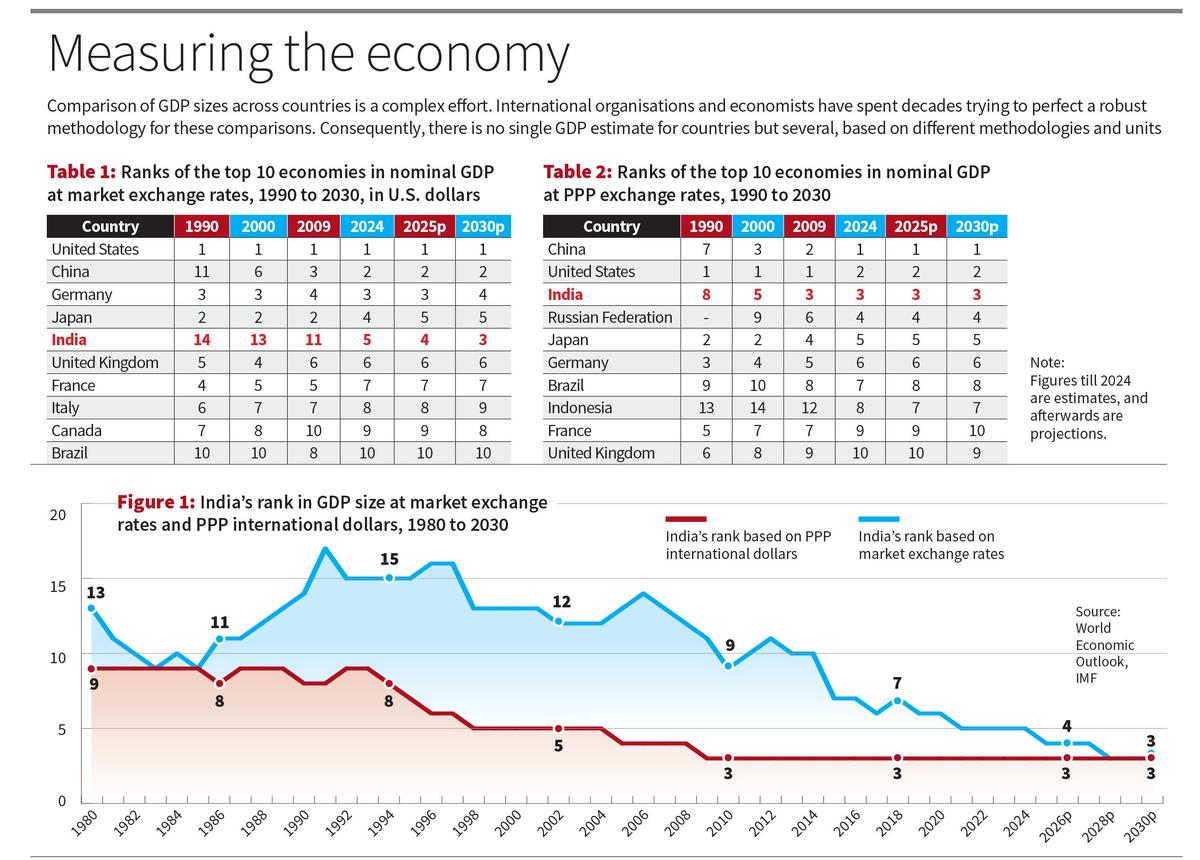

Lately, the politicisation of statistical programs has clouded any goal evaluation of India’s financial standing. The discussions round India’s rank in GDP measurement are simply an instance. Comparability of GDP sizes throughout international locations is a fancy effort. Worldwide organisations and economists have spent many years attempting to good a strong methodology for these comparisons. Consequently, there isn’t a single GDP estimate for international locations. There are a number of GDP estimates primarily based on completely different methodologies and items.

The methodology of estimating GDP in several international locations is basically standardised whilst there are variations within the high quality of knowledge assortment. However these estimates can be found solely within the nationwide currencies of every nation. So, how does one examine the GDP measurement of India and, say, the U.S.? To match, one wants the GDP estimates of all international locations to be in a single widespread unit. This widespread unit is the U.S. greenback.

On figuring out the GDP

However issues stay. There are two methods of changing a GDP estimate in a nationwide foreign money to a GDP estimate in U.S. {dollars}. First, one might use market alternate charges from the international alternate markets. On the time of writing this text, one greenback was valued at ₹85.69. One might merely divide India’s nominal GDP by ₹85.69 to get a GDP estimate in U.S. {dollars}, after which repeat that for all different international locations and rank them.

In line with the GDP estimates primarily based on market alternate charges, India was ranked the fifth largest financial system from 2021 (Desk 1 and Determine 1). Taken ahead, the IMF tasks that India would be the fourth largest financial system in 2025 and the third largest financial system in 2028. The U.S. is ranked first, and China is ranked second.

However is that this the one technique to check GDP sizes? It’s globally accepted that conversions primarily based on market alternate charges are sturdy solely when the outcomes are carefully linked to the prevailing alternate charges. Transactions within the “present account” of an financial system are a working example, which includes the move of monetary sources throughout international locations. For instance, how a lot did every nation export in worth phrases? How a lot remittances did worldwide migrants from every nation ship again house?

The PPP comparability

After we attempt to examine GDP sizes throughout international locations and time, market alternate charges ship poorly. That is primarily as a result of first, market alternate charges are extremely risky, which creates issues for secure temporal comparisons (see the fluctuations in Determine 1). Secondly, market alternate charges don’t work effectively when “buying powers” of individuals are completely different between international locations. For instance, the value of a beer in New York could also be $5 however solely about ₹150 in Mumbai (or $1.80). The worth of a Huge Mac meal in McDonald’s could also be $12 in New York however solely about ₹385 (or $4.50) in Mumbai. Thirdly, the costs of non-traded items are typically far cheaper than traded items in growing international locations than in developed international locations. For instance, the month-to-month hire for a one-bedroom condo could also be about $4,000 in New York however solely about ₹70,000 (or $824) in Mumbai. The worth of a haircut in New York could also be $30, however solely about ₹200 (or $2.40) in Mumbai.

These variations throughout international locations come up primarily as a result of wages (and therefore costs) are decrease, and plenty of non-traded sectors are labour-intensive, in growing international locations than within the developed international locations. If analysts ignore these variations, they are going to be underestimating the buying energy of individuals in growing international locations, and, therefore, miserable their GDP estimates. Because of this a second technique is used to transform nationwide currencies into {dollars} — ‘PPP alternate charges’, the place PPP stands for Buying Energy Parity. Right here, the alternate charges used equate the price of a “typical” basket of products throughout international locations. When transformed to worldwide {dollars} primarily based on PPP alternate charges, the estimates of GDP for growing international locations, the place costs are comparatively low, would rise. In 2024, the GDP of the U.S. was 7.5 occasions greater than India’s GDP if the market alternate charges technique was used. But it surely was just one.8 occasions greater than India’s GDP if the PPP alternate charges technique was used.

If PPP-based GDP estimates are used to check GDP sizes, an fascinating discovering emerges (see Desk 2). India had already turn into the world’s third largest financial system in 2009 and has retained that rank for the previous 16 years (see Determine 1). Additionally, IMF’s PPP-based projections don’t present any enchancment in India’s rank between 2024 and 2030. It seems that the federal government has chosen to challenge and have fun India’s rank in GDP measurement primarily based on market alternate charges — and never PPP alternate charges — solely as a result of the result fits its favoured political narrative.

Enhancing the comparisons

There isn’t a doubt that the PPP technique permits for a greater comparability of GDP sizes than the market alternate charges technique. Nonetheless, the PPP technique must be employed fastidiously in order to keep away from deceptive inferences. PPPs are used exactly as a result of growing international locations have decrease wages, and therefore decrease costs and incomes, than within the developed international locations. To quote an occasion, about 76% of India’s informal staff in agriculture and about 70% of India’s informal staff in development don’t receive even the prescribed minimal wages (as per ILO’s India Employment Report 2024). As well as, international locations like India have a big casual sector, which is marked by extreme underemployment, and huge numbers of unpaid feminine staff.

In different phrases, the poorer and the extra underdeveloped a rustic is, the bigger might be its “inflation” of GDP by way of the PPP route. Consequently, the truth that India was the world’s third largest financial system from 2009 itself should not delude anybody into believing that its GDP differentials with, say, the U.S. are quickly narrowing, or that its GDP measurement is bigger than that of Japan or Germany. A wonderful instance of such a false impression is the declare by Suman Berry, the Vice-Chairperson of the Niti Aayog, that India’s GDP has already reached $15,000 billion (or $15 trillion) in PPP phrases, which is greater than thrice its GDP measurement at market alternate charges and constitutes half the scale of the U.S. GDP.

India has a big GDP measurement, however additionally it is host to the world’s largest inhabitants. One can boast about its GDP measurement solely till somebody sits down and divides the GDP by the inhabitants. The per capita GDP in India was $2,711 in 2024 in present greenback phrases, which positioned it on the decrease finish of the record of “decrease middle-income international locations”. In the identical 12 months, the per capita GDP in Sri Lanka was $4,325, and in Bhutan was $3,913. In 1991, India had the next per capita GDP at $304 than in Vietnam at $141. However by 2024, Vietnam’s per capita GDP had grown to $4,536 whereas India’s per capita GDP languished at $2,711. By way of market alternate charges, India’s rank in per capita GDP in 2024 was 144th amongst 196 international locations. Even by way of PPP worldwide {dollars}, India’s rank in per capita GDP in 2024 was 127th amongst 196 international locations. Both approach, we’re confronted with a “huge financial system phantasm”: India’s giant GDP measurement has little or no to do with the well-being of its folks.

A significantly better approach of realizing if India is extra developed or much less developed than the U.S., China, Japan or Germany may be to check a set of indicators throughout them that assist us meaningfully measure financial efficiency and social progress — indicators that signify basic parts of life and work that residents care about.

R. Ramakumar teaches on the Tata Institute of Social Sciences, Mumbai.

Printed – June 02, 2025 08:30 am IST