- Earlier this week, Seagate Expertise was highlighted by analysts as a beneficiary of accelerating AI-driven knowledge storage demand, with its transition towards mass-capacity options for knowledge facilities receiving explicit focus.

- An fascinating improvement is Seagate’s elevated attraction amongst momentum development traders, partly resulting from rising gross margins, improved free money circulate, and administration’s resumption of share repurchases.

- We’ll look at how Seagate’s increasing position in large-scale AI knowledge storage strengthens its long-term funding outlook and enterprise development prospects.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Uncover why earlier than your portfolio feels the commerce struggle pinch.

Seagate Expertise Holdings Funding Narrative Recap

Proudly owning Seagate Expertise sometimes comes all the way down to believing within the ongoing surge in knowledge storage demand, particularly as AI and cloud adoption drive knowledge middle development globally. Whereas the latest rise in Seagate’s share value following analyst optimism highlights momentum within the AI-driven storage market, it doesn’t essentially change the first short-term catalyst, accelerating mass-capacity drive adoption, or the continued largest danger round aggressive know-how shifts, reminiscent of SSDs difficult HDD market share. For now, the most recent information reinforces present traits with out essentially altering the near-term outlook.

Amongst latest firm developments, Seagate’s July announcement of delivery over a million Mozaic exhausting drives and launching new 30TB HAMR-based fashions stands out, aligning intently with the catalyst of product innovation to seize development in high-capacity storage markets. These technological advances are geared towards capturing the increasing wants of enormous knowledge middle and cloud prospects, which is on the coronary heart of what’s fueling present analyst enthusiasm for the inventory.

But, regardless of sector tailwinds, traders also needs to think about the continuing danger of speedy know-how shifts in storage {hardware}, since…

Read the full narrative on Seagate Technology Holdings (it’s free!)

Seagate Expertise Holdings is projected to achieve $12.0 billion in income and $2.5 billion in earnings by 2028. This outlook assumes annual income development of 9.5% and a $1.0 billion improve in earnings from the present $1.5 billion.

Uncover how Seagate Technology Holdings’ forecasts yield a $204.35 fair value, a 13% draw back to its present value.

Exploring Different Views

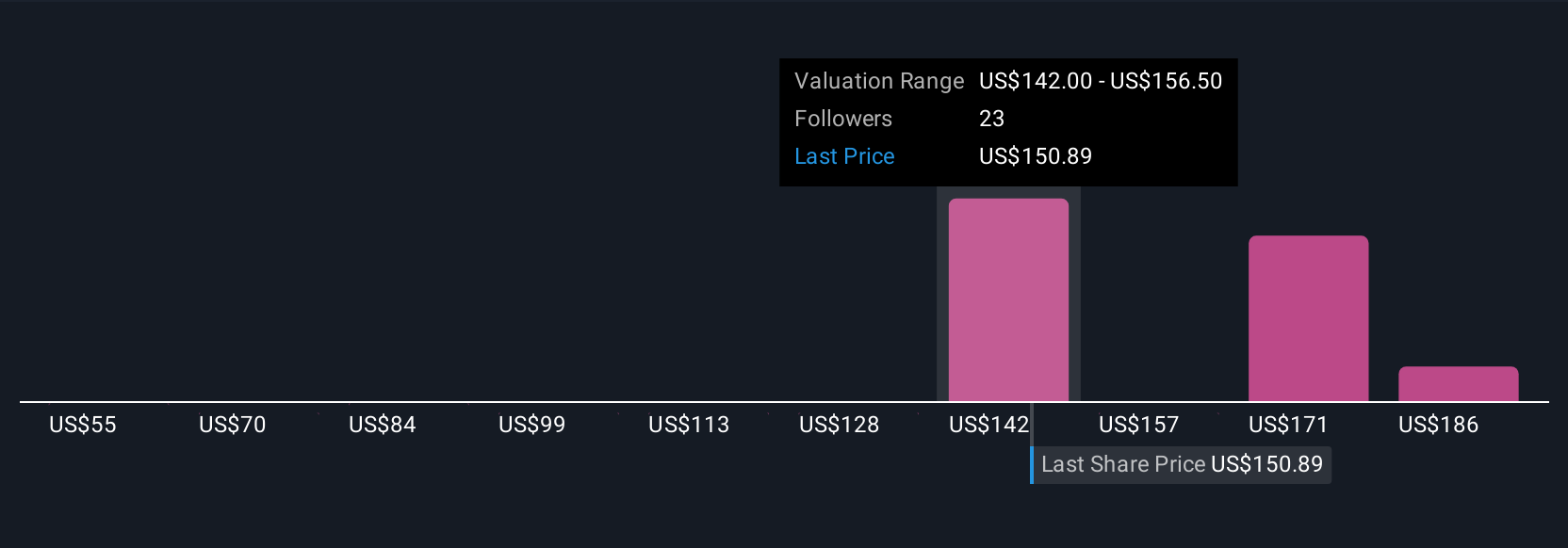

Merely Wall St Neighborhood truthful worth estimates for Seagate Applied sciences vary from US$97 to US$230 based mostly on 4 analyses, displaying huge opinion variations. Whereas mass-capacity storage demand might increase development, know-how competitors stays a key consideration for the corporate’s outlook.

Explore 4 other fair value estimates on Seagate Technology Holdings – why the inventory could be value as a lot as $230.17!

Construct Your Personal Seagate Expertise Holdings Narrative

Disagree with current narratives? Create your own in under 3 minutes – extraordinary funding returns hardly ever come from following the herd.

Prepared To Enterprise Into Different Funding Kinds?

These shares are moving-our evaluation flagged them at the moment. Act quick earlier than the value catches up:

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge

and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your

monetary scenario. We intention to convey you long-term centered evaluation pushed by elementary knowledge.

Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials.

Merely Wall St has no place in any shares talked about.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory traders, and it is free.

• Join a limiteless variety of Portfolios and see your whole in a single foreign money

• Be alerted to new Warning Indicators or Dangers by way of electronic mail or cell

• Monitor the Truthful Worth of your shares

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team@simplywallst.com