Sinohope Know-how Holdings Restricted (HKG:1611) shares have continued their current momentum with a 37% achieve within the final month alone. The final month tops off an enormous improve of 250% within the final 12 months.

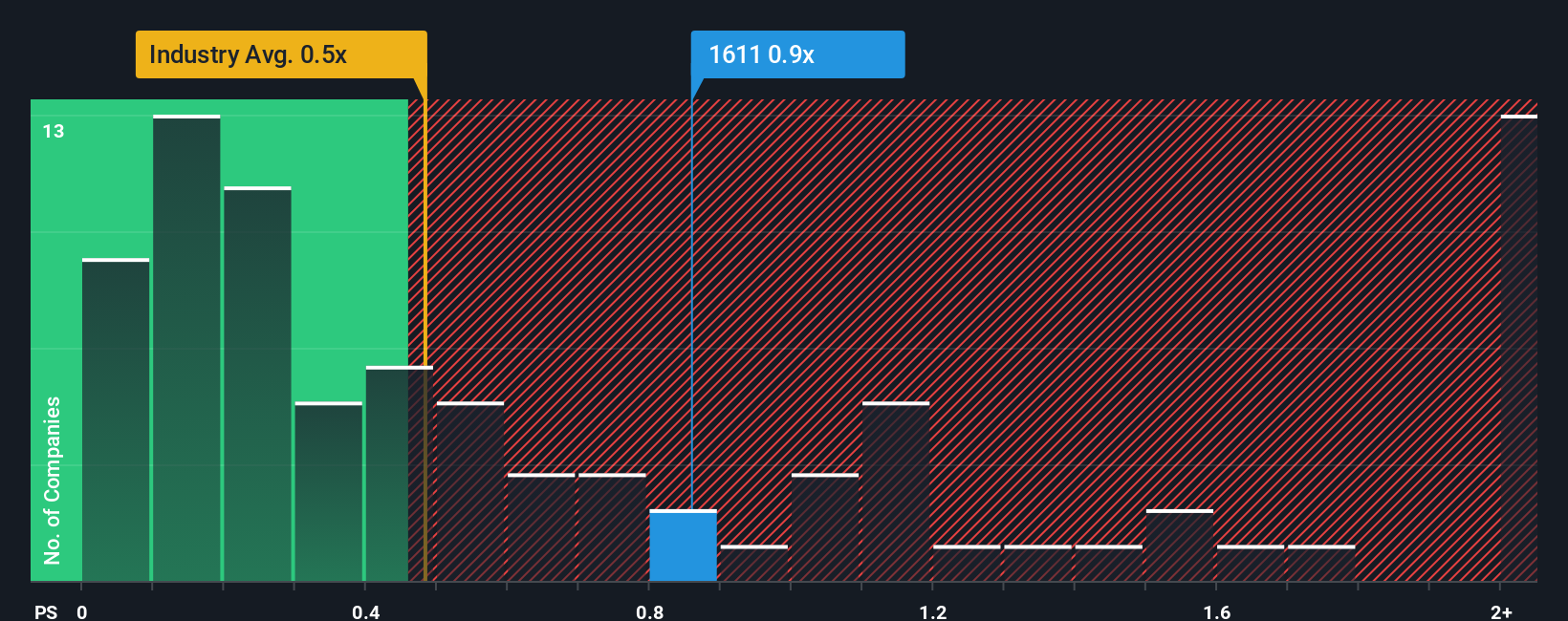

Even after such a big soar in value, you would nonetheless be forgiven for feeling detached about Sinohope Know-how Holdings’ P/S ratio of 0.9x, because the median price-to-sales (or “P/S”) ratio for the Digital business in Hong Kong can also be near 0.5x. Whereas this may not elevate any eyebrows, if the P/S ratio shouldn’t be justified buyers may very well be lacking out on a possible alternative or ignoring looming disappointment.

See our latest analysis for Sinohope Technology Holdings

What Does Sinohope Know-how Holdings’ Current Efficiency Look Like?

Current occasions have been fairly advantageous for Sinohope Know-how Holdings as its income has been rising very briskly. The P/S might be reasonable as a result of buyers assume this sturdy income development may not be sufficient to outperform the broader business within the close to future. When you like the corporate, you would be hoping this is not the case in order that you would doubtlessly decide up some inventory whereas it is not fairly in favour.

Though there are not any analyst estimates obtainable for Sinohope Know-how Holdings, check out this free data-rich visualisation to see how the corporate stacks up on earnings, income and money circulation.

What Are Income Progress Metrics Telling Us About The P/S?

There’s an inherent assumption that an organization ought to be matching the business for P/S ratios like Sinohope Know-how Holdings’ to be thought of cheap.

Looking again first, we see that the corporate’s revenues underwent some rampant development over the past 12 months. Spectacularly, three 12 months income development has additionally set the world alight, because of the final 12 months of unimaginable development. Accordingly, shareholders would have been over the moon with these medium-term charges of income development.

Evaluating that current medium-term income trajectory with the business’s one-year development forecast of 16% exhibits it is noticeably extra engaging.

With this data, we discover it fascinating that Sinohope Know-how Holdings is buying and selling at a reasonably comparable P/S in comparison with the business. Apparently some shareholders imagine the current efficiency is at its limits and have been accepting decrease promoting costs.

The Closing Phrase

Its shares have lifted considerably and now Sinohope Know-how Holdings’ P/S is again inside vary of the business median. Sometimes, we would warning in opposition to studying an excessive amount of into price-to-sales ratios when deciding on funding selections, although it might probably reveal a lot about what different market members take into consideration the corporate.

To our shock, Sinohope Know-how Holdings revealed its three-year income tendencies aren’t contributing to its P/S as a lot as we might have predicted, given they appear higher than present business expectations. It might be honest to imagine that potential dangers the corporate faces may very well be the contributing issue to the decrease than anticipated P/S. Whereas current income tendencies over the previous medium-term counsel that the danger of a value decline is low, buyers seem to see the chance of income fluctuations sooner or later.

Having stated that, remember Sinohope Technology Holdings is showing 3 warning signs in our funding evaluation, and a pair of of these are regarding.

If these dangers are making you rethink your opinion on Sinohope Know-how Holdings, discover our interactive list of high quality stocks to get an thought of what else is on the market.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join an infinite variety of Portfolios and see your complete in a single forex

• Be alerted to new Warning Indicators or Dangers by way of e mail or cellular

• Monitor the Truthful Worth of your shares

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to carry you long-term centered evaluation pushed by basic information. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.