Adtec Plasma Expertise Co., Ltd. (TSE:6668) shares have had a horrible month, dropping 27% after a comparatively good interval beforehand. As an alternative of being rewarded, shareholders who’ve already held by means of the final twelve months are actually sitting on a 34% share value drop.

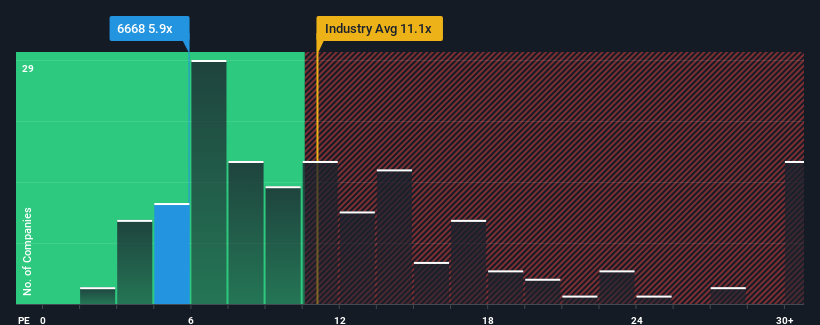

Even after such a big drop in value, given about half the businesses in Japan have price-to-earnings ratios (or “P/E’s”) above 13x, you should still contemplate Adtec Plasma Expertise as a extremely engaging funding with its 5.9x P/E ratio. Nonetheless, we might have to dig a bit deeper to find out if there’s a rational foundation for the extremely diminished P/E.

Adtec Plasma Expertise has been doing job recently as it has been rising earnings at a strong tempo. One chance is that the P/E is low as a result of traders suppose this respectable earnings progress would possibly truly underperform the broader market within the close to future. When you like the corporate, you would be hoping this is not the case in order that you might doubtlessly decide up some inventory whereas it is out of favour.

Check out our latest analysis for Adtec Plasma Technology

We do not have analyst forecasts, however you’ll be able to see how latest tendencies are organising the corporate for the long run by testing our free report on Adtec Plasma Technology’s earnings, income and money movement.

What Are Progress Metrics Telling Us About The Low P/E?

There’s an inherent assumption that an organization ought to far underperform the marketplace for P/E ratios like Adtec Plasma Expertise’s to be thought of cheap.

Having a look again first, we see that the corporate managed to develop earnings per share by a useful 12% final yr. The strong latest efficiency means it was additionally in a position to develop EPS by 23% in whole over the past three years. Due to this fact, it is honest to say the earnings progress just lately has been respectable for the corporate.

That is in distinction to the remainder of the market, which is predicted to develop by 10% over the subsequent yr, materially greater than the corporate’s latest medium-term annualised progress charges.

In mild of this, it is comprehensible that Adtec Plasma Expertise’s P/E sits under the vast majority of different corporations. Apparently many shareholders weren’t snug holding on to one thing they consider will proceed to path the bourse.

The Remaining Phrase

Shares in Adtec Plasma Expertise have plummeted and its P/E is now low sufficient to the touch the bottom. It is argued the price-to-earnings ratio is an inferior measure of worth inside sure industries, however it may be a robust enterprise sentiment indicator.

As we suspected, our examination of Adtec Plasma Expertise revealed its three-year earnings tendencies are contributing to its low P/E, given they appear worse than present market expectations. Proper now shareholders are accepting the low P/E as they concede future earnings in all probability will not present any nice surprises. If latest medium-term earnings tendencies proceed, it is laborious to see the share value rising strongly within the close to future beneath these circumstances.

You need to all the time take into consideration dangers. Working example, we have noticed 3 warning signs for Adtec Plasma Technology try to be conscious of.

In fact, you may additionally have the ability to discover a higher inventory than Adtec Plasma Expertise. So chances are you’ll want to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

When you’re trying to commerce Adtec Plasma Expertise, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With shoppers in over 200 nations and territories, and entry to 160 markets, IBKR enables you to commerce shares, choices, futures, foreign exchange, bonds and funds from a single built-in account.

Get pleasure from no hidden charges, no account minimums, and FX conversion charges as little as 0.03%, much better than what most brokers supply.

Sponsored Content material

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory traders, and it is free.

• Join an infinite variety of Portfolios and see your whole in a single forex

• Be alerted to new Warning Indicators or Dangers by way of electronic mail or cell

• Observe the Truthful Worth of your shares

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to convey you long-term centered evaluation pushed by elementary information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.