Alkami Know-how, Inc. (NASDAQ:ALKT) shareholders are little question happy to see that the share value has bounced 31% within the final month, though it’s nonetheless struggling to make up just lately misplaced floor. Taking a wider view, though not as robust because the final month, the complete yr acquire of 12% can also be pretty cheap.

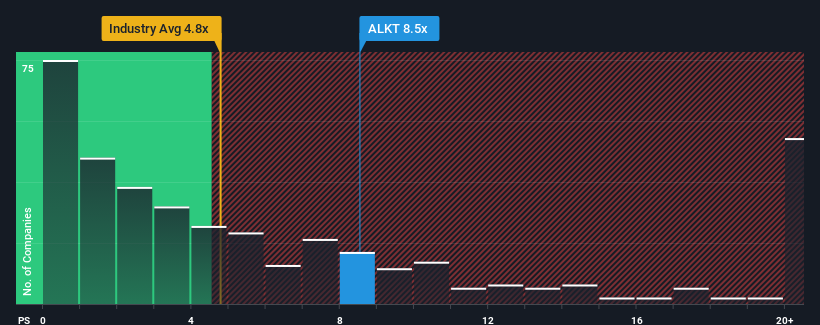

Since its value has surged increased, Alkami Know-how could also be sending very bearish indicators in the mean time with a price-to-sales (or “P/S”) ratio of 8.5x, since nearly half of all corporations within the Software program business in the US have P/S ratios beneath 4.8x and even P/S decrease than 1.7x aren’t uncommon. Nonetheless, we would have to dig a bit of deeper to find out if there’s a rational foundation for the extremely elevated P/S.

See our latest analysis for Alkami Technology

What Does Alkami Know-how’s Current Efficiency Look Like?

Alkami Know-how definitely has been doing a very good job recently as it has been rising income greater than most different corporations. The P/S might be excessive as a result of traders suppose this robust income efficiency will proceed. If not, then present shareholders could be a bit of nervous in regards to the viability of the share value.

Eager to learn the way analysts suppose Alkami Know-how’s future stacks up towards the business? In that case, our free report is a great place to start.

What Are Income Development Metrics Telling Us About The Excessive P/S?

To be able to justify its P/S ratio, Alkami Know-how would wish to provide excellent development that is effectively in extra of the business.

If we assessment the final yr of income development, the corporate posted a terrific improve of 27%. Pleasingly, income has additionally lifted 117% in mixture from three years in the past, because of the final 12 months of development. So we will begin by confirming that the corporate has executed a fantastic job of rising income over that point.

Wanting forward now, income is anticipated to climb by 33% in the course of the coming yr based on the ten analysts following the corporate. With the business solely predicted to ship 15%, the corporate is positioned for a stronger income consequence.

With this data, we will see why Alkami Know-how is buying and selling at such a excessive P/S in comparison with the business. It appears most traders expect this robust future development and are prepared to pay extra for the inventory.

The Key Takeaway

Shares in Alkami Know-how have seen a powerful upwards swing recently, which has actually helped increase its P/S determine. Sometimes, we would warning towards studying an excessive amount of into price-to-sales ratios when selecting funding choices, although it will probably reveal a lot about what different market individuals take into consideration the corporate.

Our look into Alkami Know-how reveals that its P/S ratio stays excessive on the benefit of its robust future revenues. Proper now shareholders are snug with the P/S as they’re fairly assured future revenues aren’t beneath risk. It is laborious to see the share value falling strongly within the close to future beneath these circumstances.

Earlier than you compromise in your opinion, we have found 1 warning sign for Alkami Technology that you need to be conscious of.

If you happen to’re not sure in regards to the power of Alkami Know-how’s enterprise, why not discover our interactive list of stocks with solid business fundamentals for another corporations you might have missed.

If you happen to’re seeking to commerce Alkami Know-how, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With shoppers in over 200 nations and territories, and entry to 160 markets, IBKR enables you to commerce shares, choices, futures, foreign exchange, bonds and funds from a single built-in account.

Take pleasure in no hidden charges, no account minimums, and FX conversion charges as little as 0.03%, much better than what most brokers supply.

Sponsored Content material

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory traders, and it is free.

• Join an infinite variety of Portfolios and see your complete in a single forex

• Be alerted to new Warning Indicators or Dangers by way of electronic mail or cell

• Monitor the Truthful Worth of your shares

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We goal to carry you long-term targeted evaluation pushed by elementary knowledge. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.