Key Factors

- Investec targets $1.7 billion market growth by enhancing enterprise banking with a brand new funds system.

- The financial institution leverages PayShap to supply streamlined fee companies, aiming to seize market share from South Africa’s dominant banks.

- Investec posted a 14.33% revenue surge, reaching $1.21 billion in 2024 underneath Fani Titi’s management.

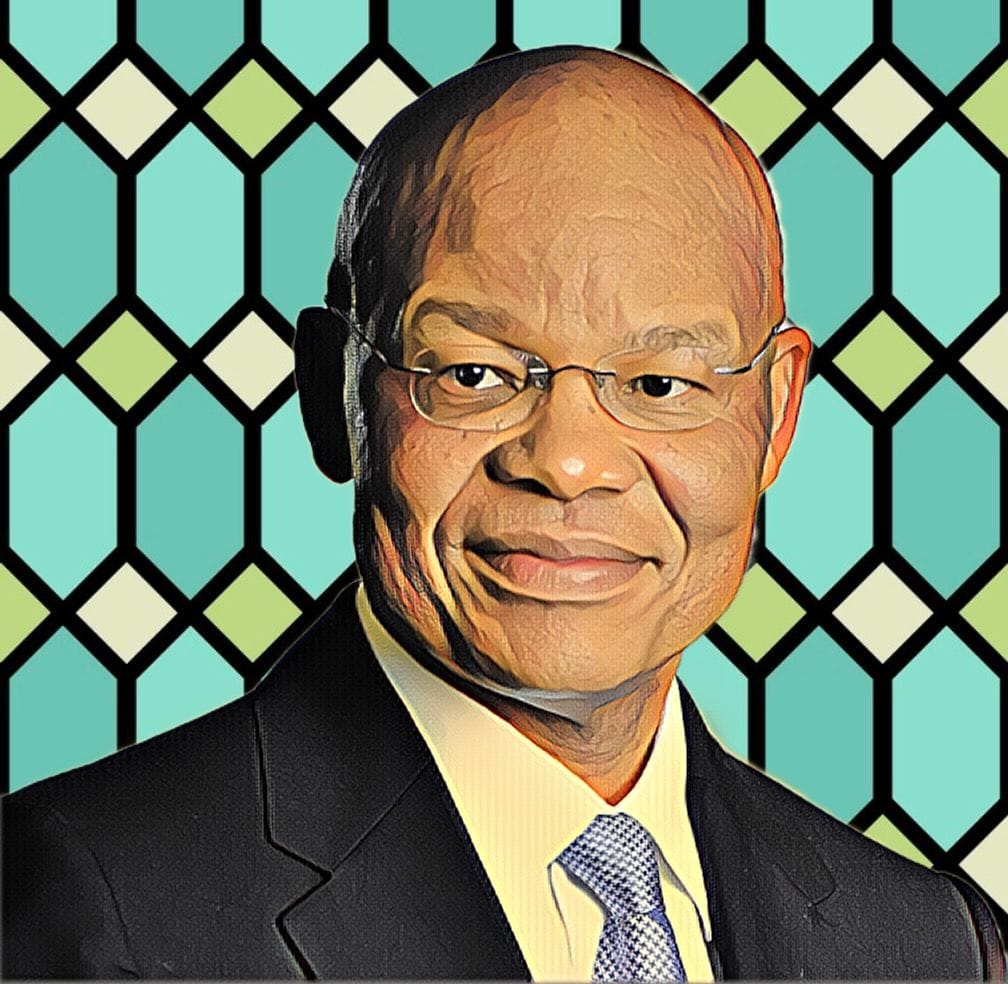

Investec Group, the Anglo-South African worldwide banking and wealth administration conglomerate led by South African govt Fani Titi, is setting its sights on a $1.7 billion market growth with the launch of a brand new funds system geared toward company shoppers.

This initiative is a part of Investec’s technique to safe a bigger slice of South Africa’s rising funds ecosystem, the place the demand for real-time, low-value funds has surged.

The brand new system is constructed to deal with high-volume, low-value transactions, that are more and more vital for company shoppers. Utilizing PayShap, South Africa’s real-time funds platform managed by BankservAfrica, Investec plans to streamline fee processes.

“We’re aiming to place Investec as a number one supplier of environment friendly fee options,” stated Kuben Naidoo, Investec’s head of company funds. Naidoo, who joined the financial institution in June after an extended tenure with the South African Reserve Financial institution, brings beneficial regulatory expertise to the position.

Investec faucets into $30 billion fee market

In an effort to seize market share from South Africa’s main banks, Investec is initially concentrating on companies with annual revenues between R30 million ($1.71 million) and R1.5 billion ($85.56 million). By 2026, the financial institution goals to supply a complete suite of fee companies, together with person-to-business and business-to-person choices.

At the moment, Investec holds a modest 1.2 % share of the transactional banking market, nevertheless it goals to develop that to five % over the subsequent few years, a shift that might place the financial institution to seize a considerable portion of the $30 billion fee companies market in South Africa.

To help this growth, Investec is testing a “request-to-pay” function with 5 company shoppers, set for broader launch early subsequent yr. PayShap, which was launched to advertise monetary inclusion and cut back money dependency, has garnered consideration as regulators search to duplicate the success of India’s UPI and Brazil’s PIX techniques.

International growth and revenue progress

Since Titi took the helm in 2020, Investec has seen strong revenue progress. In 2024, the group reported a 14.33 percent increase in profits, reaching a file $1.21 billion. The group has additionally prolonged its worldwide presence by opening a new office in Dubai, aiming to cater to South African expatriates and rich household places of work within the area.

Titi, who holds a 0.04 % stake in Investec valued at R41.25 million ($2.36 million), stays assured within the group’s trajectory. His management has solidified Investec’s place as a key participant within the worldwide banking sector, and this newest fee system launch alerts the agency’s ambitions to additional strengthen its company banking footprint in South Africa.