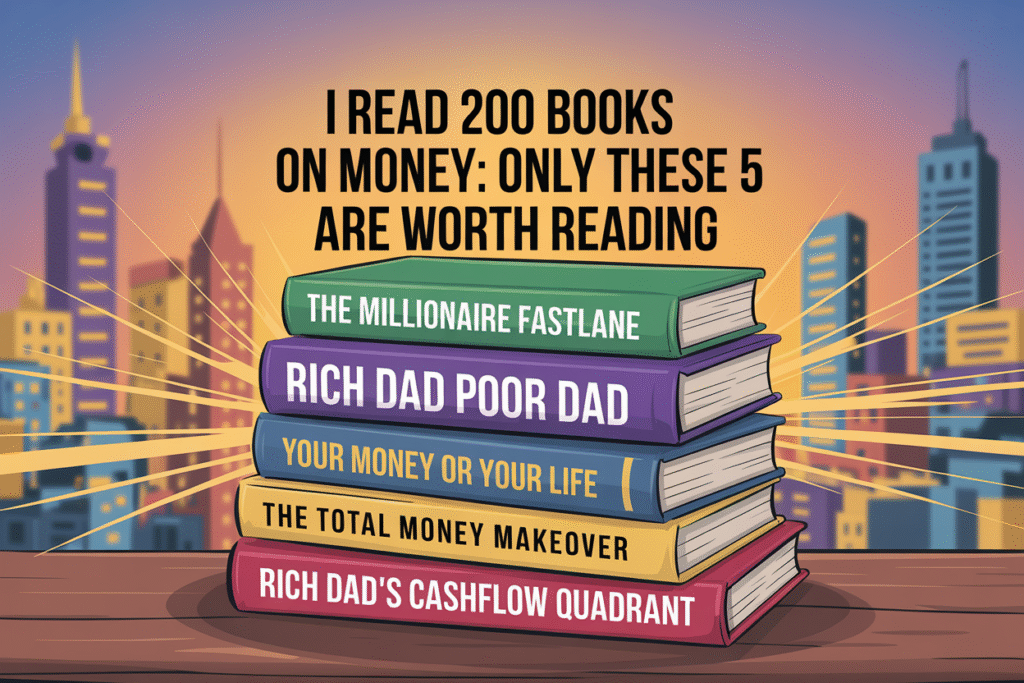

After spending a long time immersed in monetary literature—and studying over 200 books on private finance and cash administration—I’ve come to a shocking conclusion: most of them recycle the identical ideas with completely different packaging.

Solely 5 books on this matter, out of this intensive studying journey, basically remodeled my relationship with cash and altered my monetary life. These aren’t simply books I loved; they triggered measurable shifts in my internet value and financial mindset.

In case you’re overwhelmed by the countless stream of economic recommendation, listed below are the one 5 books it’s essential learn.

1. The Millionaire Fastlane by M.J. DeMarco

DeMarco’s profound critique of the standard “get an excellent job, save, and retire at 65” path utterly upended my understanding of wealth creation. He labels this conventional method the “Sluggish Lane”—a decades-long journey of sacrifice and scrimping that will or could not result in monetary freedom in your golden years. His different—the “Fastlane”—focuses on building scalable business systems that can compress wealth creation from a long time into simply years.

This book is revolutionary as a result of DeMarco identifies the mathematical limitations of buying and selling time for cash. Regardless of how well-paid your profession is, a wage usually creates linear progress, whereas entrepreneurial programs can generate exponential returns.

After studying, you’ll consider your earnings supply via this new lens of scalability and leverage. Your snug job may suddenly appear as a wealth constraint somewhat than a path to abundance.

Impressed by Fastlane rules, you might be impressed to construct a facet enterprise centered on creating programs with minimal private time necessities after preliminary setup. This shift requires considerably extra upfront effort than merely incomes a paycheck, however the potential for detaching earnings from hours labored makes it worthwhile.

DeMarco’s framework for assessing enterprise alternatives—analyzing their management, entry, want, time, and scale elements—continues to information my entrepreneurial selections at present.

2. Wealthy Dad Poor Dad by Robert T. Kiyosaki

Few books have shattered standard monetary considering, like Kiyosaki’s comparability between his organic father (the academically profitable however financially struggling “Poor Dad”) and his good friend’s father (the less-educated however rich “Wealthy Dad”). The book’s easy but profound redefinition of property and liabilities without end remodeled my buying and funding selections.

Kiyosaki argues that an asset places cash in your pocket, whereas a legal responsibility takes cash out—no matter what accountants or banks may name them. By this lens, I noticed that my dwelling, automobile, and most possessions weren’t property however liabilities draining my assets month-to-month. This revelation hit arduous twenty-five years in the past after I first learn it: I had collected liabilities whereas believing I used to be constructing wealth.

After internalizing this precept, I ruthlessly evaluated each buy: “Is that this an asset or a legal responsibility?” Cash beforehand directed towards standing symbols and depreciating items began flowing towards income-producing investments and cashflowing property as a substitute.

This isn’t only a money move change—it represents an entire reversal in your method to constructing wealth. Somewhat than specializing in showing wealthy via consumption, give attention to turning into rich via asset acquisition.

3. Your Cash or Your Life by Vicki Robin and Joe Dominguez

This book stands aside by addressing the philosophical dimension of cash. Robin and Dominguez introduce the revolutionary idea of cash as “life vitality”—the irreplaceable hours of your life exchanged for {dollars}. By calculating what number of precise hours of life every buy prices (accounting for commuting, work garments, decompression time, and different work-related bills), I developed a a lot larger threshold for what constituted a worthwhile expenditure.

Following the ebook’s steering, I started meticulously monitoring each cent flowing into and out of my life and asking whether or not every expense introduced success proportionate to its life vitality value. This observe shortly revealed quite a few bills that failed this take a look at—subscription companies used as soon as month-to-month, impulse purchases that supplied fleeting satisfaction, and standing upgrades that impressed others however introduced me little pleasure.

The idea of “sufficient”—the purpose the place further consumption not will increase well-being—changed my countless pursuit of extra. This shift introduced one thing sudden: contentment alongside monetary progress.

By making use of this “life vitality” valuation to all earnings sources—from employment, investments, or enterprise—I gained readability about which monetary actions genuinely enhanced my existence somewhat than merely filling my calendar. I knew lots of what this ebook teaches intuitively, however it confirmed my beliefs and clarified how to consider it.

4. The Whole Cash Makeover by Dave Ramsey

This is the first book most individuals must learn to start their monetary journey. Dave Ramsey is the creator who began me on my path to monetary success. I learn his first self-published ebook “Monetary Peace” in 1992.

When drowning in client debt within the early Nineteen Nineties, Ramsey’s simple debt elimination technique supplied precisely the tactical method I wanted. The debt snowball methodology—paying minimal funds on all money owed whereas throwing extra cash on the smallest stability first—provided psychological wins that maintained my motivation via a difficult monetary interval.

Following Ramsey’s Child Steps, I constructed my first emergency fund of $1,000 and systematically eradicated hundreds in client debt over 12 months. The liberty created by eliminating these month-to-month funds generated instant respiratory room in my funds and dramatically lowered monetary stress—advantages I felt earlier than reaching full monetary independence years later.

Whereas some monetary consultants advocate mathematically optimum approaches like paying highest-interest money owed first, Ramsey’s psychologically optimized methodology proved excellent for my scenario. The simplicity of his program—with clear, sequential steps—supplied construction when monetary chaos threatened to overwhelm me.

This ebook delivers one thing invaluable for these starting their monetary journey or recovering from monetary missteps: a transparent path ahead with out confusion or complexity.

5. Wealthy Dad’s CASHFLOW Quadrant by Robert T. Kiyosaki

This CASHFLOW book is the follow-up to “Wealthy Dad Poor Dad,” which clarified my monetary path within the early 2000s via Kiyosaki’s framework of 4 earnings varieties: Worker, Self-employed, Enterprise proprietor, and Investor. I spotted I had been firmly entrenched within the E (worker) quadrant, with all its limitations in earnings potential and tax disadvantages.

The ebook illuminates structural variations between left-side quadrants (E and S), the place earnings stays capped by private effort and time, and right-side quadrants (B and I), the place programs and property generate earnings with minimal direct involvement.

This framework helped me perceive why sure profession strikes may improve earnings with out bettering my monetary place—they saved me in the identical quadrant with the identical basic limitations.

Motivated by this understanding, I started intentionally progressing towards the B (enterprise) and I (investor) quadrants. I restructured my facet enterprise to operate with out fixed involvement and allotted extra assets towards funding alternatives.

This strategic shift steadily elevated my monetary resilience by diversifying earnings streams and lowering dependence on any supply—a useful profit throughout economic downturns like 2008. The rules on this ebook helped me climb to millionaire standing and monetary freedom over time.

Conclusion

When taken collectively, these 5 books type a complete monetary schooling system. “Wealthy Dad, Poor Dad” and “Your Cash or Your Life” set up the philosophical basis—redefining property and connecting cash to life’s objective. “The Whole Cash Makeover gives tactical steering for escaping debt and constructing preliminary stability. Lastly, “The Millionaire Fastlane” and “CASHFLOW Quadrant” supply strategic frameworks that speed up readers towards monetary independence via enterprise programs and investments.

What makes these books distinctive isn’t simply their ideas however their capability to encourage motion. Whereas different monetary books left me nodding in settlement, these 5 remodeled my habits and, consequently, my monetary actuality. In case you’re trying to lower via the noise of economic recommendation and give attention to rules that drive actual outcomes, these 5 books are all you want.