It’s essential to full your 2024-2025 ‘Declaración de la Renta’ (annual earnings tax return) earlier than June thirtieth 2025. This step-by-step information will help you full the method.

Taxes in Spain might be very complicated, notably if you happen to’re new right here or you may have a number of sources of earnings.

So in case you have any doubts it might be advisable to contact a gestor to go over your scenario and make it easier to full la declaración de la renta.

Nevertheless, if you wish to reduce out further prices and your earnings supply is pretty simple (you are a contract employee), this information will make it easier to with the totally different steps to fill out and submit your annual earnings tax declaration.

You are able to do it on-line, offered you may have a Digital Certificate or a Cl@ve pin.

Anybody resident in Spain who earned over €22,000 from a single employer in 2024 should current an earnings tax return, in addition to those that earned greater than €15,876 from two or extra employers.

For those who’re self-employed, it is essential to recollect you’ll now be obliged to file an earnings tax return no matter how a lot you earned, even if you happen to made a loss. Anybody who rents out property and earns over €1,000 per yr should additionally full it.

The marketing campaign for submitting your taxes for 2024 opened on April 2nd 2025 and can shut on June thirtieth 2025.

To start, click on right here to entry the Agencia Tributaria website, then click on the hyperlink that claims ‘Servicio de tramitación borrador/declaración (Renta WEB)’, underneath Gestiones destacadas. This can take you to the declaration kind.

La Renta: The important income tax deadlines in Spain in 2025

Commercial

Step 1:

The primary display screen will ask you to establish your self utilizing your Digital Certificates or Cl@ve pin. You’re additionally in a position to establish your self together with your NIE, however provided that you accomplished the Declaración de la Renta within the earlier yr and have the reference quantity.

For those who’ve recognized your self together with your Digital Certificates or Cl@ve pin, you may be taken to a display screen containing your private particulars, akin to identify and tackle. If the whole lot is right, you wish to click on on the button that claims ‘ratificar’. If it’s worthwhile to change sure particulars, click on on ‘modificar’, then press ‘continuar’ to proceed to the following web page.

Examine that every one your particulars are right to proceed. Picture: Agencia Tributaria

Step 2:

For those who recognized your self together with your NIE and reference quantity, you may be taken on to the following web page.

Right here, you will notice a web page itemizing the totally different ‘Servicios Disponibles’ or Out there Companies. Click on on ‘Borrador/Declaración (RENTA WEB)‘ to entry and full your tax return.

On the following display screen, you’ll once more see a abstract of your private particulars – identify, tackle, birthdate, NIE and so forth. You have to to ensure that these are right earlier than persevering with. Additionally, you will must know the referencia catastral of the property you’re dwelling in. For those who personal your property, this ought to be on the deeds to your own home, however in case you are renting, you could find it out here.

READ ALSO: The changes to Spain’s income tax declaration in 2025

Commercial

The shape will even ask you questions on your marital standing and provide the choice of declaring as a person or collectively together with your partner. Chances are you’ll wish to contact a gestor or a tax lawyer to search out out which might be greatest for you, as a result of it may imply paying kind of tax, relying in your particular person circumstances.

READ ALSO: Is it better to do a joint or separate tax declaration if you’re a couple in Spain?

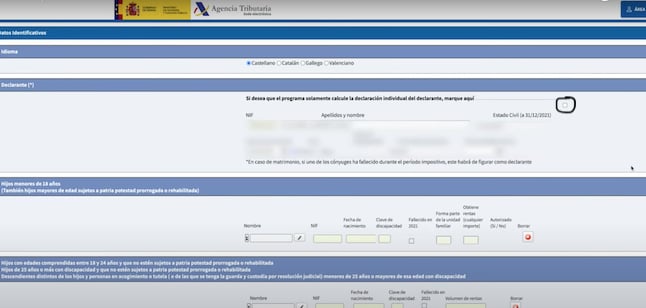

Fill out all of your private particulars. Picture: Agencia Tributaria

If you wish to do it as a person, test the field that claims ‘Si desea que el programa solamente calcula de la declaración particular person del declarante, marque aqui’.

Whenever you’re executed checking and finishing all of your private particulars, click on on ‘Aceptar’ to proceed.

Commercial

Step 3:

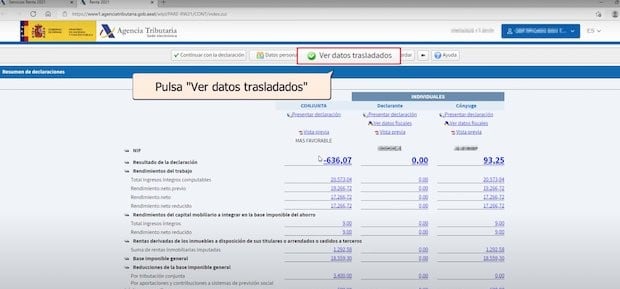

On the following web page, you will notice a lot of numbers, detailing all of the tax deductions and funds made by you in 2024. For those who have been employed, quite than self-employed you’ll be able to click on on ‘ver datos fiscales’ in an effort to test that the whole lot is identical as on the certificado de retenciones or withholding certificates issued by your employer.

In case you are self-employed, you’ll be able to test that every one the quantities match the quantities you declared and paid in every trimester of 2024 as it is best to have already submitted tax returns for the 4 trimesters of final yr.

If there’s something it’s worthwhile to add in manually, you are able to do this by clicking on the button on the prime which says ‘Ver datos trasladados’. Right here, you’ll be able to add something that was not already included. Whenever you’re executed with this click on on ‘Volver’ to return to the primary web page.

Examine that every one the quantities for 2023 are right. Picture: Agencia Tributaria.

Step 4:

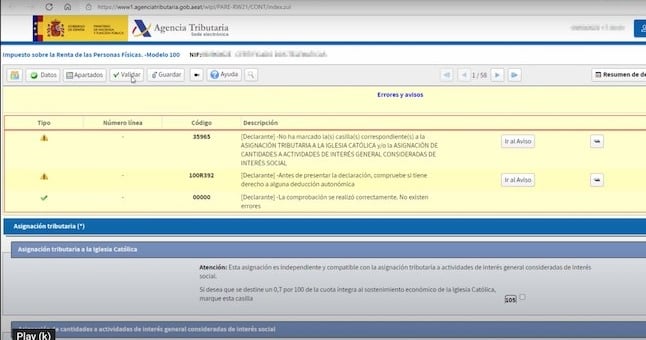

You’ll now see a 58-page doc that includes a variety of questions and eventualities. This consists of the whole lot from asking if you wish to donate cash to the Catholic church to any curiosity you could have earned on financial savings or something you may need inherited throughout the earlier yr. You may click on the arrows to maneuver by every web page or click on on ‘Apartados‘ within the prime left-hand nook to see a drop-down menu of every part and go on to totally different components of the shape.

Click on on the arrows to maneuver by every web page and reply the questions. Picture: Agencia Tributaria

Step 5:

Whenever you’ve stuffed the whole lot out, click on on ‘Validar‘ within the prime left-hand nook in an effort to see in case you have made any errors or errors. It can spotlight something it’s worthwhile to have a look at in yellow and allow you to know what you have executed fallacious.

Click on on ‘Validar’ to see if you happen to’ve made any errors. Picture: Agencia Tributaria

Step 6:

Whenever you’ve checked the whole lot by, return to the primary web page to see the ultimate results of how a lot tax it’s worthwhile to pay or certainly if you happen to’re owed a tax rebate. Whenever you’re proud of the whole lot, click on on ‘Presentar Declaración’ on the prime. It can ask you who’s declaring, you because the Declarante or your partner Conyuge. Do not forget that even in case you are presenting your tax return collectively, you’ll nonetheless must additionally ensure you current your declaration individually and log in once more, it is simply that the calculations for each might be taken under consideration.

Current your tax return by clicking right here. Picture: Agencia Tributaria

Lastly, you may be taken to a web page the place you’ll need to fill out your financial institution particulars in case you are owed cash or the fee particulars, if you must pay. You may select if you wish to pay in instalments or unexpectedly. Lastly, click on on ‘Aceptar‘ to finalise and submit the whole lot. Keep in mind, if at any time you wish to cease and proceed later, you’ll be able to all the time click on on ‘Guardar‘ or Save on the prime and are available again to it.