Skip to content

The September 2 week begins with the Labor Day observance on Monday with a full market shut within the US for shares and bonds. The information calendar could have just a few shifts within the regular launch schedule with the weekly MBA numbers on mortgage functions on Thursday as a substitute of Wednesday, and the month-to-month ADP report additionally on Thursday as a substitute of Wednesday.

Now that Fed Chair Jerome Powell has given an unmistakable message for a charge minimize on the September 17-18 FOMC assembly, hypothesis will likely be concerning the measurement and timing of future charge cuts. Might the FOMC impose a 50-basis level minimize in September quite than the 25-basis factors that’s broadly anticipated? Will the FOMC forecast one or two extra cuts in 2024? Will it decide up the tempo for future charge hikes in 2025 and 2026? Might it decrease the projected path of the fed funds goal charge?

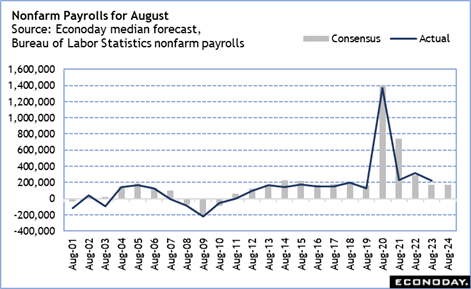

A few of these questions hinge on the contents of the month-to-month employment report for August when it’s launched at 8:30 ET on Friday. The July report offered a draw back shock with a payroll enhance of 114,000 and a downward web revision of 29,000 to the prior two months, mixed with a 2 tenths enhance within the unemployment charge to 4.3 p.c. The outcomes sparked worries that the labor market was cooling extra shortly than beforehand thought. A second below-expectations report might be extra worrisome. Nevertheless, it must also be famous that nonfarm payrolls steadily are available in under the market consensus and are subsequently revised greater.

Early forecasts for nonfarm payrolls search for a rise of someplace between 150,000-175,000 in August. The unemployment charge is anticipated to retreat by a tenth to 4.2 p.c. If realized, this could supply some reassurance that although the labor market has cooled, it’s not worrisomely weaker.

Powell lately mentioned, “We don’t search or welcome additional cooling in labor market circumstances.” Towards this backdrop a weak August employment report might have an effect on the FOMC’s collective forecast when it updates the abstract of financial projections (SEP) on the upcoming assembly. However Fed policymakers are going to delve deep into the totality of the information concerning the labor market, not only one report.

The week will even embrace necessary knowledge Challenger numbers on introduced layoff intentions for July at 7:30 ET on Thursday and ADP’s nationwide employment report for August at 8:15 ET on Thursday. Different readings on job openings and labor turnover (JOLTS) will likely be a bit of behind with numbers for July, however ought to assist form the labor market image when the information are reported at 10:00 ET on Wednesday.

Share This Story, Select Your Platform!