Skip to content

It’s a pretty gentle knowledge launch schedule within the October 21 week. Markets are more likely to be jittery with the US presidential election on November 5 solely about two weeks distant. Then there’s the subsequent FOMC assembly on November 6-7 (Wednesday-Thursday) and together with it expectations for an additional charge reduce, albeit a smaller 25 foundation factors after the 50 foundation factors on September 18. Not solely might the result of the election change a number of the panorama for monetary markets, however Fed policymakers are data-dependent. Latest studies counsel that disinflation isn’t progressing as rapidly as could be hoped, though not stalled for the time being. Inflation expectations for the medium time period are additionally proving stubbornly reluctant to say no additional. And the underlying knowledge for the labor market factors to comparatively secure circumstances with hiring gradual, however job separations more-or-less regular. A vigilant FOMC is just not going to disregard the inflation knowledge and the dangers to the labor market seem much less. The outlook for removing of financial coverage restriction shall be for regular, cautious increments. The choice on September 18 was not unanimous and the present knowledge poses no sense of urgency for decreasing the fed funds goal vary in large chunks and/or at an accelerated tempo.

The communications blackout interval across the November FOMC assembly will go into impact at midnight on Sunday, October 27, sooner or later later than ordinary as a result of the assembly is beginning sooner or later later than the conventional Tuesday-Wednesday sample. Fed policymakers don’t meet on election day to keep away from any look of political bias.

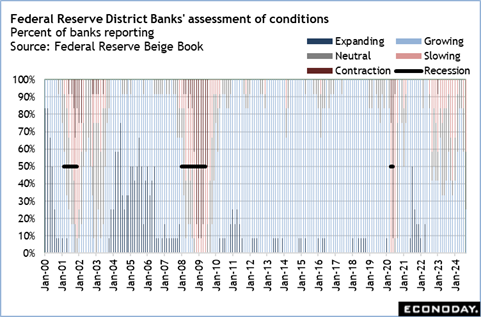

The subsequent Beige Guide is ready for launch on Wednesday at 14:00 PM and can cowl the interval between late August and mid-October. Given the impacts from Hurricanes Helene and Milton, studies out of Atlanta, Richmond, and St. Louis might effectively pull the general tone of the report down. Approaching the heels of a lackluster evaluation of circumstances within the prior Beige Guide, it might trigger some handwringing concerning the US economic system. Nonetheless, extreme climate impacts in a single report are often adopted by a rebound within the subsequent when restoration efforts have a stimulative impact. The troubles about labor market circumstances that prevailed within the prior report have largely been alleviated. Any recession alerts from two weak studies in a row ought to be taken in context and never provoke recession fears. The Beige Guide is anecdotal proof, whereas the arduous knowledge continues according to enlargement.

The September knowledge on gross sales of recent single-family properties on Thursday at 10:00 ET ought to replicate gross sales with mortgages taken out in that month when charges had been sliding to their lowest in two years. The favorable charges ought to encourage shopping for of models in any respect levels of development to safe decrease month-to-month funds. The September knowledge on gross sales of current properties on Wednesday at 10:00 ET shall be for contracts signed largely in July and August when mortgage charges had solely begun to reasonable. Gross sales of current properties could not appears to be like as sturdy compared with new development.

Share This Story, Select Your Platform!