Skip to content

The financial knowledge calendar within the November 18 week is a lightweight one. The main focus of the week will most likely be on the housing numbers which embrace the NAHB/Wells Fargo housing market index at 10:00 ET on Monday, knowledge on housing begins and constructing permits issued at 8:30 ET on Tuesday, and the NAR report on gross sales of current properties at 10:00 ET on Thursday.

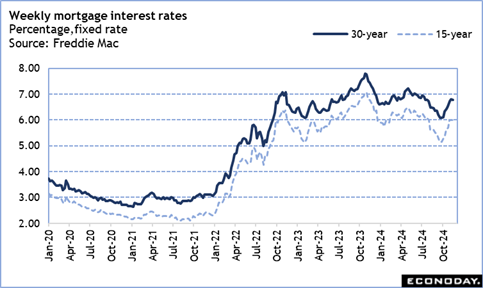

The principle driver behind the information would be the route of mortgage charges. The weekly Freddie Mac fee for a 30-year fastened fee mortgage has risen from the current low of 6.08 p.c within the September 26 week as much as 6.79 p.c and 6.78 p.c within the November 7 and 14 weeks, respectively. An enormous query for the housing market is that if potential homebuyers who’ve been hoping for an additional dip in charges will determine that’s not within the works. There’s a touch that that is the case within the newest MBA weekly numbers on buy purposes. If that’s the case, there might be much less cause to delay buying a house.

Nonetheless, the NAHB/Wells Fargo housing market index for November might fade from the studying of 43 in October. With extra stock of current items, homebuyers have extra choice and fewer sense of urgency in getting a contract signed. There’s additionally much less prospect that the FOMC goes to select up the tempo in lowering charges, particularly with issues that inflation goes to rise once more, or at the least not enhance additional.

Permits issued for brand spanking new properties in October might embrace some catastrophe restoration efforts. There have been quite a few properties within the Southeast that have been so badly broken they should be rebuilt from the bottom up after being demolished. It’s most likely too quickly to see precise housing begins if owners are ready for insurance coverage claims to settle, however some could also be shifting forward.

The NAR gross sales of current properties in October most likely received a lift from contracts signed in September when a quick drop in mortgage charges inspired patrons to make the most of better affordability. Nonetheless, charges have gone up once more since then and funky the housing market as soon as once more.

Share This Story, Select Your Platform!