Skip to content

The November 11 week is shortened by the federal vacation on Monday to watch Veterans Day. It’s a full market shut within the US for inventory and bond markets. Not all companies are closed; some will save the vacation time for November 29 to create a four-day weekend. The three-day weekend will likely be one other mile marker on the highway within the winter vacation procuring season. Retailers will likely be providing reductions and incentives to get customers into shops.

The 2 studies prone to stand out within the week are the October numbers on retail gross sales at 8:30 ET on Friday and the buyer worth index (CPI) at 8:30 ET on Wednesday.

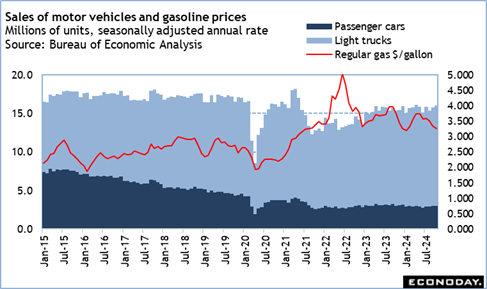

In retail, ongoing restoration efforts after Hurricanes Helene and Milton are doubtless to offer some enhance to general spending at the beginning of the third quarter. Shoppers might want to exchange family items of every type destroyed within the winds and water dumped by the storms. The primary stable trace of that is gross sales of motor autos which rose to 16.0 million items at a seasonally adjusted annual fee for October after a achieve to fifteen.8 million items in September which in flip was above 15.328 million in August. Gasoline costs have been on the decline in October, in order that most likely received’t make a lot of a contribution to gross sales. Nevertheless, customers will likely be shopping for constructing supplies for repairs and changing home equipment and electronics. Closets and pantries will have to be replenished. Additionally in October, Amazon held a Prime Day gross sales occasion on October 8-9 which might add to gross sales at nonstore retailers which incorporates on-line procuring.

The buyer worth index report could not really feel fairly as compelling because it has in current months. The October index will most likely mirror the year-over-year change within the all-items CPI as persevering with to pattern decrease and transfer inside attain of the Fed’s 2 p.c inflation goal. Nevertheless, the core CPI will most likely be nearer to three p.c from a 12 months in the past. The issue for Fed policymakers is that whereas commodities costs have moderated, and in some instances fallen, companies prices stay stubbornly elevated, particularly for shelter. The FOMC could also be able to take away some restriction of financial coverage as a way to keep forward of the “lengthy and variable lag” to drive inflation, however it should proceed cautiously after the cumulative 75 foundation factors in fee cuts since September.

Share This Story, Select Your Platform!