Skip to content

The presence of the January FOMC assembly on Tuesday and Wednesday places a lot of the financial knowledge within the shade. After the chilly tone to the FOMC assertion and forecasts out of the December 17-18 assembly, expectations for a fee reduce this week are virtually nonexistent. When the assembly assertion is launched at 14:00 ET on Wednesday, it’s unlikely to introduce any heat. Fed Chair Jerome Powell’s press briefing at 14:30 ET on Wednesday will mirror the renewed warning about inflation and uncertainties concerning the financial outlook and circumstances within the labor market.

Within the absence of an rate of interest transfer and with no replace to the quarterly abstract of financial projections (SEP), what can the assertion and Powell’s query and reply interval have to inform?

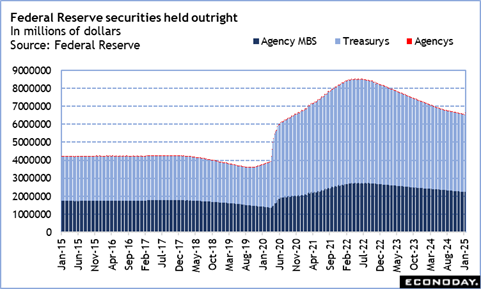

Primarily, there would be the preliminary communications concerning steadiness sheet coverage. The Fed’s holdings of US treasuries and company mortgage-backed securities is down practically $2 trillion since June 2022 when this system to scale back the huge purchases of securities accomplished through the pandemic disaster. On January 1, 2020 the overall for US treasuries and company mortgage-backed securities was about $3.74 trillion. To supply stimulus through the financial disruptions related to the pandemic and since the fed funds goal fee vary was close to the efficient decrease certain, the FOMC started one other program of large-scale asset purchases – so-called quantitative easing or QE. The purchases peaked with holdings at $8.45 trillion within the August 3, 2022 week.

Powell has beforehand spoken about returning holdings of reserve property from “considerable” to “ample” over time. The present steadiness of round $6.62 trillion is considerably increased than the June 2022 place to begin. Nonetheless, the steadiness was by no means going to be as gradual because it was within the pre-pandemic interval since holdings are likely to drift increased over time to satisfy technical necessities past financial coverage issues. The steadiness goes to return down a bit extra since any change to this system will most likely be set for at the very least a few months from now. The beginning of the second quarter 2025 is an inexpensive guess. An finish to this system is a risk because the cap on reinvestments of treasuries is $25.0 billion and the $35.0 billion cap for mortgage-backed securities isn’t, if ever, met. Whether or not an finish or a discount in caps, the Fed’s reserve financial institution holdings will proceed to fall, however extra slowly over an extended interval.

On a aspect word, now that President Trump is in workplace, Powell is prone to obtain plenty of questions on fiscal coverage and the independence of the central financial institution and its policymakers. Powell will reiterate and reinforce a message that he has usually delivered – that the Fed doesn’t make coverage aside from on the out there details about the financial system and market circumstances, and solely seeks to meet the twin mandate of value stability and most employment. Fiscal coverage he leaves to elected officers.

Among the many financial knowledge, the advance estimate of fourth quarter 2024 GDP at 8:30 ET on Thursday would be the most attention-grabbing merchandise on the calendar. The three district financial institution GDP Nowcasts are more-or-less in alignment The St. Louis Actual GDP Nowcast seems to be for progress of two.39 p.c and the New York Fed Employees Nowcast is at up 2.56 p.c for the quarter. The Atlanta Fed’s GDPNow has the perfect monitor document for predicting BEA advance estimate – though it and the opposite forecasts not often hit the button. Averaging the three estimates tends to do a bit higher and would level to progress within the fourth quarter at round 2.65 p.c.

Fed policymakers gained’t have the GDP quantity in hand after they make their choice, however they will actually discover sufficient knowledge to evaluate US financial circumstances as reasonably expansionary and supportive of the labor market. That, together with an uptick in total inflation and inflation expectations is sufficient to preserve financial coverage on maintain in the meanwhile.

Share This Story, Select Your Platform!