Skip to content

There are three stories within the January 13 week which are prone to stand out, particularly within the context of the upcoming FOMC assembly on January 28-29. The numbers accessible for the labor market via December recommend that the utmost employment aspect of the Fed’s twin mandate is in fine condition. Comparatively little layoff exercise and tempered hiring is maintaining the unemployment fee at ranges according to wholesome situations in a position to soak up new employees and supply jobs for these energetic within the labor market.

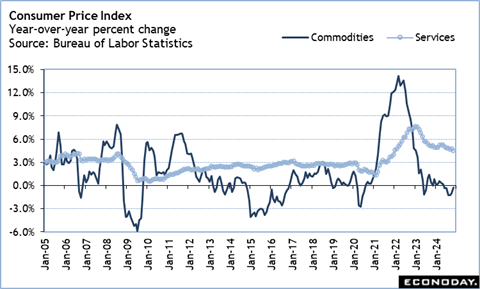

What can be vital for Fed policymakers is getting a learn on inflation for the value stability aspect of the twin mandate. The buyer value index (CPI) report is at 8:30 ET on Wednesday. The uptick within the year-over-year improve for the all-items CPI to up 2.7 p.c in November got here on the heels of a 2.6 p.c rise in October that in flip was up two-tenths from the month earlier than. General costs have been pushed increased by some short-term components – like meals and gasoline, or insurance coverage premiums. What’s extra related is that the core CPI is caught at up 3.3 p.c year-over-year for the September-November interval and has proven just about no progress since Could 2024. The speedy declines in commodities prices that powered disinflation over the previous two years are beginning to stage off whereas providers prices – which have come down considerably in lots of classes – are slowing the tempo of deceleration. A touch that the tempered tempo of disinflation is resuming in December can be welcome, however not sufficient to encourage the FOMC to chop charges once more at its January deliberations.

The December numbers on retail and meals providers gross sales at 8:30 ET on Thursday might finish the fourth quarter 2024 on a strong achieve. The Redbook weekly information on gross sales at comparable shops confirmed good year-over-year will increase as December progressed, suggesting that buyers have been within the temper to buy. On-line retailers have been actively providing offers and promoting closely to seize a number of the vacation spending. Vacation journey in all probability means a rise within the quantity of gross sales at gasoline stations, in addition to extra consuming out. Greater costs for sure meals gadgets – notably poultry and eggs – might imply the upper spending at grocery shops. And a powerful year-end for motorcar gross sales ought to increase the greenback worth of spending in that class.

Though not arduous information, the Fed’s Beige Ebook at 14:00 ET on Wednesday is a supply of insights that feeds into the FOMC’s consideration of financial situations throughout the 12 districts. The anecdotal proof offered will cowl roughly the interval between mid-November and early January. It ought to embody the preliminary restoration efforts after Hurricanes Helene and Milton, post-election reactions from companies and shoppers, and the fading prospects of additional rate of interest cuts by the FOMC. The prior Beige Ebook launched on December 4 indicated that the US financial system had moved extra decisively again into broad-based progress. This could largely be maintained, however uncertainties in regards to the outlook have grown.

Share This Story, Select Your Platform!