Skip to content

The financial knowledge calendar in February presents some challenges in deciphering the scheduled studies. Information for December and January is not going to embody newer developments. Furthermore, the January numbers might be affected by the extreme chilly and winter storms that disrupted some exercise. In a quickly altering geopolitical local weather, companies and shoppers are going through larger ranges of uncertainty in regards to the financial outlook. The penalties of those modifications – if any, and whether or not optimistic or detrimental for the financial system – could take one other month or two to be meaningfully seen as studies are printed.

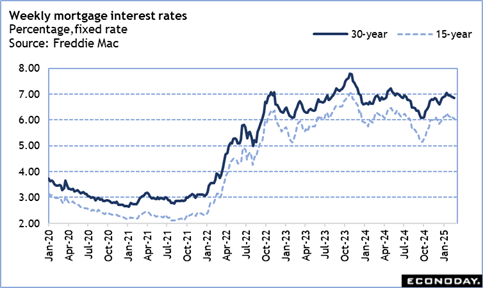

An instance of that is the housing knowledge. The February NAHB/Wells Fargo housing market index and weekly MBA report on mortgage purposes counsel that the housing market is weakening. Homebuilders are extra involved about future exercise each when it comes to client demand for newly constructed houses and their prices and availability of development provides and labor. Purposes for mortgages are usually not choosing up upfront of the spring shopping for season as shoppers are more and more fearful in regards to the financial system and job safety. Whereas house affordability is a little bit improved with charges for a 30-year fastened charge mortgage declining weekly since mid-January, it nonetheless stays uncomfortably near the 7 % mark.

The Freddie Mac charge for a 30-year fastened charge mortgage was as little as 6.60 % within the week of December 12, 2024, then rose to 7.04 % within the January 16, 2025 week from the place it has inched down to six.85 % as of February 20.

The housing-related knowledge within the week is not going to make clear the image. The FHFA home worth index and the Case-Shiller house worth index on Tuesday at 9:00 ET are each for December. These will verify the broad moderation in house costs up by means of the top of 2024, however not what impact circumstances in January had on costs.

Gross sales of recent single-family houses in January at 10:00 ET on Wednesday ought to be down as a result of adversarial climate circumstances that saved consumers at house in addition to the chilling in demand from financial uncertainty. Additionally, with extra present models to select from, consumers might be on the lookout for bargains and taking extra time to buy round, notably within the single-family market.

The NAR pending house gross sales index for January at 10:00 ET on Thursday might be for contracts signed in that month utilizing mortgages taken out in December when charges had been decrease. This can imply expectations for an uptick in present house gross sales in February that might not be sustained into March.

Share This Story, Select Your Platform!