Skip to content

With Christmas, Hanukkah, and different vacation observances dominating the calendar for the subsequent two weeks, there may be little or no on the US financial knowledge schedule that can demand consideration. Many of the numbers will put the ultimate touches on perceptions of financial situations because the fourth quarter 2024 attracts to an in depth. Most notable would be the remaining numbers associated to the housing market in November and situations in manufacturing in December.

Pivotal to deciphering the November housing knowledge would be the FOMC resolution and forecast launched on December 18. Whereas the FOMC lowered short-term charges by 25 foundation factors, its collective forecast indicated that fee cuts can be fewer in 2025. An economic system that continues to broaden at the next tempo than forecast, a labor market that has cooled however not gone chilly, and inflation that’s gradual to exit as expressed within the measures of upward worth stress means Fed policymakers can take their time in easing restrictive financial coverage. Fed Chair Jerome Powell has referred to as the present fed funds goal fee of 4.25-4.50 % “meaningfully” restrictive whereas on the similar time the speed has been reduce a big 100 foundation factors from its latest peak.

The affect on monetary markets is that long-term charges – notably mortgage charges – are going to stay increased in the intervening time. This can have an effect on lending and borrowing selections by way of creditworthiness versus willingness to borrow at present charges. Customers and companies will probably be extra prone to make selections primarily based on necessity reasonably than much less demanding standards.

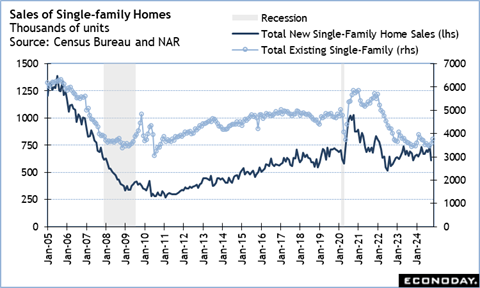

Whereas gross sales of current single-family properties got here in at stable 3.76 million items in November at a seasonally adjusted annual fee, gross sales of latest single-family properties might not maintain tempo. November current house gross sales benefited from elevated provide and a dip in mortgage charges in September and the motivation of rising mortgage charges in October to get contracts signed in these months and closed in November. New house gross sales are for contracts signed in November when the speed was going up once more. The Freddie Mac fee for a 30-year fastened fee mortgage had a month-to-month common of 6.18 % in September, rising to six.51 % in October and 6.81 % in November. Charges moderated a bit in early December however that reversed after the FOMC resolution.

The NAR pending house gross sales index for November goes to even be an rate of interest story the place homebuyers who locked in a decrease fee in October signed contracts earlier than fee locks expired. This most likely means house resales will probably be stable for December. January could also be a unique story.

Three of the 5 Fed district financial institution surveys of producing in December have been revealed – New York, Philadelphia, and Kansas Metropolis. The Richmond Fed manufacturing composite index is about for launch at 10:00 ET on Tuesday, December 24 and the Dallas basic exercise index is at 10:30 ET on Monday December 30. To this point it seems to be like December will finish the 12 months on a down be aware for the issue sector whereas expectations for six months from now are usually extra cautious, if for average exercise.

Share This Story, Select Your Platform!