NEWNow you can hearken to Fox Information articles!

When you thought the Biden economy was bad, try to be afraid of Vice President Kamala Harris.

If elected president, she’s going to possible spend her first yr combating to kill the expiring provisions of former President Donald Trump’s 2017 tax minimize legislation whereas pushing for increased taxes on job creators and a dramatic taxpayer-funded growth of the welfare state. The results can be as predictable as they are going to be painful: much less cash in working-class Individuals’ pockets due to tax hikes and misplaced wages, thousands and thousands of fewer jobs, and thousands and thousands extra individuals swapping gainful employment for a authorities test.

That’s our conclusion after analyzing most of the policies that Harris has supported. Her first yr in workplace would give her a golden alternative to enact a sweeping financial agenda. On the finish of 2025, many of the private and small enterprise tax cuts of the 2017 legislation will expire. Harris, who has lengthy opposed each a part of that legislation, may result in one of many largest tax hikes in American historical past with out lifting a finger.

VP HARRIS’ TIEBREAKER VOTES IN SENATE WERE KEY TO INFLATION-BOOSTING BIDEN POLICIES: EXPERT

In a forthcoming research, we present simply how damaging that will be. If the non-public earnings tax cuts have been allowed to run out, Individuals would see their federal earnings taxes rise by $1,100, on common. Moreover, each earnings decile would see their common after-tax earnings drop.

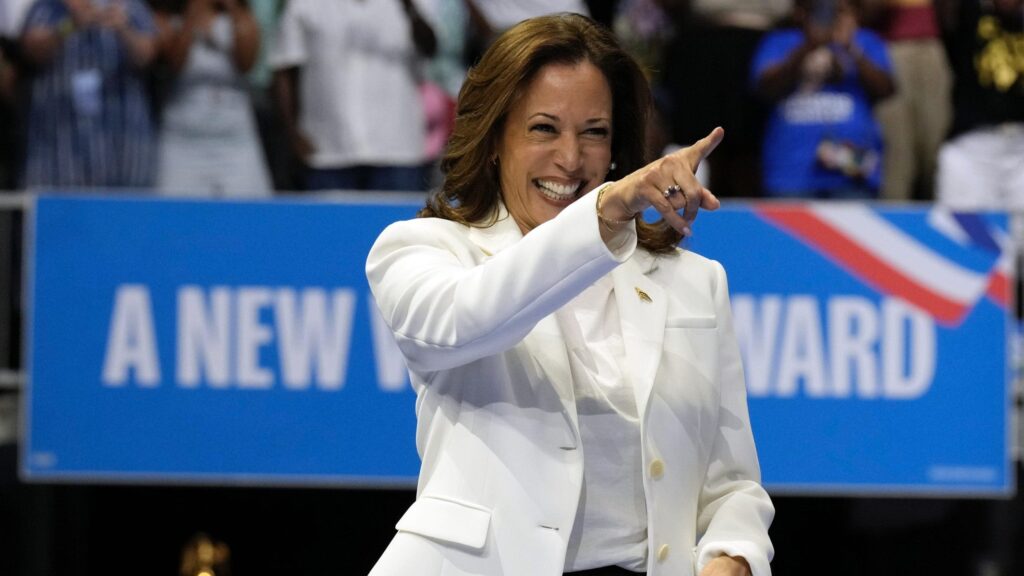

Vice President Kamala Harris has repeatedly stated she would overturn the Trump tax cuts. (AP Picture/Jacquelyn Martin)

Working-class Individuals could be the toughest hit. For instance, a family of 4 incomes the median earnings with typical deductions would see their tax invoice rise by $1,500, in response to the Tax Basis. A single mother with one baby incomes roughly half the median earnings would fork over $800 extra to the federal authorities.

That single mother and people married dad and mom may get hit once more by job losses. We estimate that the expiration of the 2017 tax cuts would destroy practically 2 million full-time jobs. That is sensible: Small companies have used the legislation’s 20% pass-through deduction to fund a brand new period of development. Take the deduction away and lots of can be compelled to shrink. Job creators will even undergo as a result of the upper earnings tax charges will depart households with much less cash to spend.

Harris could let a few of these tax cuts partially survive, probably due to opposition from Congress. She may additionally really feel strain to preserve her latest promise to not increase taxes on the center class. However in trade, she’ll possible demand a heavy value — possible a wealth tax or elevating the company tax price from 21% to twenty-eight%. The 2017 legislation completely minimize that price from 35%, sparking dramatic wage development and job creation.

CLICK HERE FOR MORE FOX NEWS OPINION

Whereas Harris claims that elevating company taxes will “put a reimbursement within the pockets of working individuals,” it would inevitably do the other by slicing wages, killing jobs, and elevating costs on Individuals already combating inflation. The harm will possible offset any advantages from extending different elements of the tax cuts.

Whether or not from an earnings tax hike or a company tax hike, Harris can have tons of of billions of {dollars} to spend, and she or he’s already made clear her intentions. In her August 16 financial speech, she endorsed a everlasting expanded Little one Tax Credit score, modeled on the short-term model President Joe Biden signed into legislation in 2021.

Our modeling suggests her proposal would value practically $1.2 trillion over the subsequent decade. She concurrently referred to as for increasing the credit score even additional, calling for a $6,000 test for households with newborns — one other $100 billion expense.

That is an assault on work, plain and easy, as a result of Harris desires to successfully make the credit score a money subsidy, distributed month-to-month, that’s utterly disconnected from work. As certainly one of us confirmed in a 2021 research, the expanded Little one Tax Credit score mixed with different federal handouts paid greater than the median wage, discouraging recipients from searching for work.

CLICK HERE TO GET THE FOX NEWS APP

We estimate that the expiration of the 2017 tax cuts would destroy practically 2 million full-time jobs.

College of Chicago researchers estimated that if the coverage have been made everlasting, 1.5 million dad and mom would cease working altogether, but deep baby poverty would stay unchanged. Along with her doubly expanded credit score, Harris would push much more dad and mom out of labor and onto everlasting welfare. The inevitable consequence can be a weaker financial system that generates much less development and tax income—at the same time as taxpayers spend considerably extra on politically favored handouts.

That is the Harris financial system in a nutshell: Larger taxes, decrease wages, fewer jobs, and a vicious cycle. One in all her marketing campaign’s primary themes is “shifting ahead,” however Kamala Harris will inevitably take our financial system backward.

Michael Greibrok is senior analysis fellow for the Basis for Authorities Accountability.