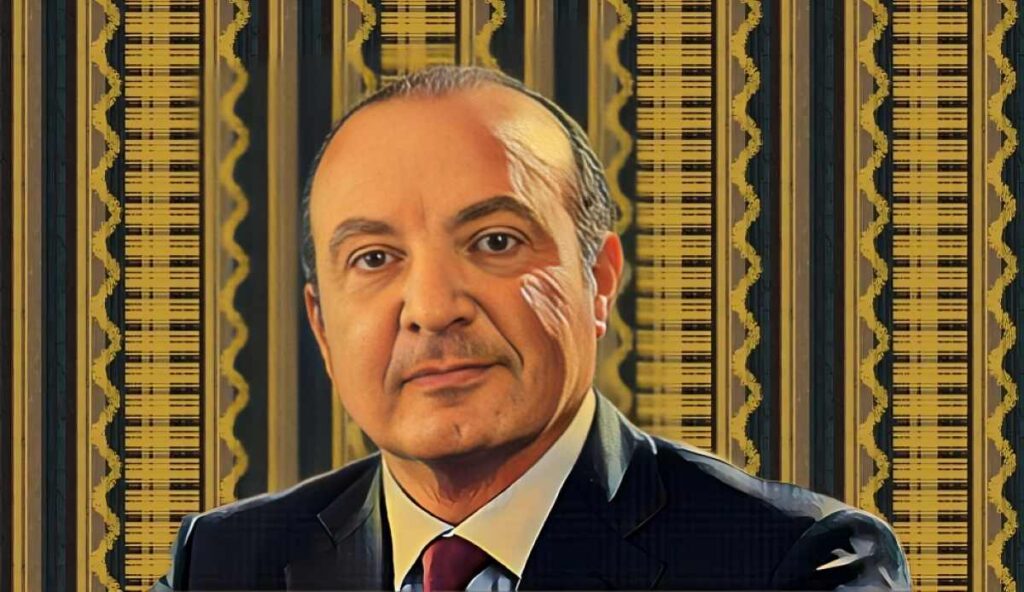

Egyptian tycoon Hani Berzi has seen the worth of his stake in Edita Meals Industries rebound sharply, recovering floor misplaced earlier in September. Over the previous week, the corporate’s inventory surged on the Egyptian Change (EGX), pushing Berzi’s holdings above $120 million.

Berzi, who serves as chairman and managing director, owns a 44.07 p.c stake in Edita by Quantum Make investments BV. His 308.5 million shares have gained $25.12 million in market worth, reversing declines recorded simply weeks in the past.

In mid-September, his stake had fallen $11.19 million, from $118 million to $106 million, following a dip in Edita’s share worth. The current rally displays renewed investor confidence within the firm’s prospects.

Egypt snack maker hits $580 million market cap

Edita Meals Industries is one in every of Egypt’s main packaged snack producers. Its merchandise, which embody desserts, croissants, rusks, and wafers, are offered nationwide by an intensive retail community. The corporate has steadily benefited from rising shopper demand, a development supported by Egypt’s rising inhabitants.

Within the eight days since Sept. 23, Edita’s inventory has climbed 25.79 p.c, rising from EGP15.90 ($0.33) to EGP20 ($0.42). This enhance has pushed the corporate’s market capitalization previous $580 million and delivered notable returns for shareholders.

For Berzi, the rebound added EGP1.26 billion ($26.41 million) to his holdings, lifting the worth of his stake from EGP4.91 billion ($102.43 million) to EGP6.17 billion ($128.84 million).

Edita shares acquire 42 p.c

Edita’s inventory has been probably the greatest performers on the EGX this yr, rising 42.35 p.c since January. A $100,000 funding within the firm firstly of 2025 would now be price $142,350. The surge has strengthened Berzi’s private wealth and underscored his function in Egypt’s shopper items sector.

Analysts say that sustained demand for packaged meals and the corporate’s broad product vary might proceed to assist Edita’s development. Berzi has overseen a gentle growth technique, guaranteeing the corporate stays aggressive whereas responding to evolving shopper preferences.