Skip to content

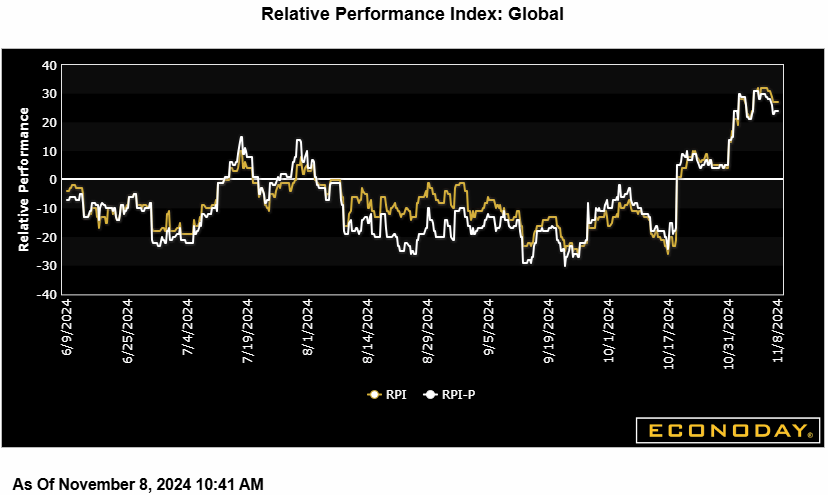

Econoday’s Relative Financial Efficiency Index (RPI) closed out final week at 30, displaying world financial exercise working fairly properly forward of market forecasts. Though the U.S. index remained near zero and its Canadian counterpart moved deeper into adverse territory, the Eurozone and, particularly, China continued to outperform.

Within the U.S., the RPI and RPI-P each ended the interval little modified at 1, indicating that the general economic system is basically matching expectations. The newest readings duly assist the Federal Reserve’s choice to chop rates of interest by simply 25 foundation factors.

In Canada, the labour market proved slightly softer than anticipated in October and trimmed the RPI to minus 30 and the RPI-P to minus 24. Financial exercise basically, and inflation particularly, proceed to favour one other minimize in Financial institution of Canada rates of interest in December.

Within the Eurozone, the RPI (18) and RPI-P (8) misplaced slightly floor however remained in constructive shock territory with Germany (RPI 21) extending its interval of outperformance. The area’s total financial exercise is working barely forward of market expectations, however to not the extent that will forestall one other 25 foundation level ease by the European Central Financial institution subsequent month.

Within the UK, the info had been once more primarily on the tender aspect of forecasts. With the RPI at now minus 25 and the RPI-P at minus 30, the most recent stories present extra justification for the broadly anticipated minimize in Financial institution Fee.

In Switzerland, October’s labour market lived as much as expectations, however surprisingly tender client confidence ensured that the RPI (minus 31) and RPI-P (minus 25) slipped additional beneath zero. There’s nonetheless nothing within the information to dent hypothesis concerning the Swiss Nationwide Financial institution easing coverage once more in December.

In Japan, surprisingly weak family spending was not sufficient to forestall the RPI creeping as much as 10. With the RPI-P now at minus 1, financial exercise basically is performing a lot as forecast and buyers stay unsure about when the central financial institution will tighten once more. Forward of Thursday’s third quarter GDP replace, the yen can be a serious point of interest this week.

In China, indicators of unexpectedly robust exercise in October, partially resulting from surging exports, boosted each the RPI and RPI-P to 86, the latter’s strongest print up to now in 2024. Current stimulus packages appear to have helped confidence however worldwide commerce relations could possibly be extra of a menace to development following the U.S. presidential election.

Econoday’s RPI offers a helpful abstract measure of how an economic system has lately been evolving relative to market expectations.

A studying above zero implies that the economic system basically has been performing extra strongly than anticipated and vice versa for a studying beneath zero. The nearer is the worth to the utmost (+100) or minimal (-100) ranges, the larger is the diploma to which markets have been under- or over-estimating financial exercise. A zero outturn would suggest that, on common, the market consensus has been appropriate. Notice too that the index is sensitized to position further weight upon these indicators that buyers take into account to be an important.

Share This Story, Select Your Platform!