Skip to content

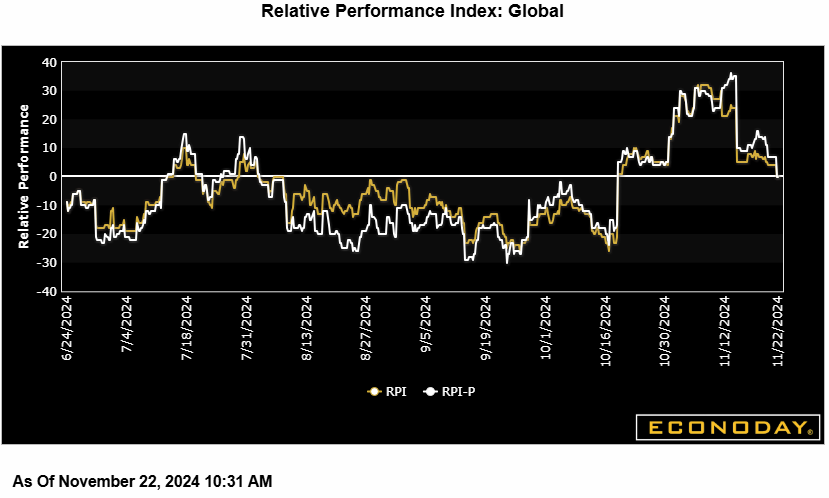

Econoday’s Relative Financial Efficiency Index (RPI) ended the week at minus 3, indicating that latest international exercise has behaved a lot as forecast. The U.S. continues to steer the pack forward of Canada, however whereas China and Japan have supplied few surprises, underperformance by the Eurozone and the UK has turn out to be extra marked.

Within the U.S., the most recent releases have been, on steadiness, on the agency aspect of market expectations and the RPI and RPI-P (each 17) have been little modified on the week. Financial exercise generally continues to outperform modestly, supporting Federal Reserve Chair Jerome Powell’s view that the central financial institution want be in no hurry to decrease rates of interest.

In Canada, a collection of stronger than anticipated information lifted each the RPI (8) and RPI-P (1) again into constructive shock territory. Nevertheless, neither studying is far above zero, which means that financial exercise generally is simply marginally outpacing the consensus. The reviews won’t dent widespread hypothesis about one other lower in Financial institution of Canada rates of interest in December.

Within the Eurozone, early proof of a surprisingly poor November for financial exercise noticed the RPI drop to minus 31 and the RPI-P to minus 44. Each values represent 5-month lows and may solely add to strain on the ECB to ease once more in December. The Governing Council might be cut up between a 25 foundation level or 50 foundation level lower so Friday’s November flash HICP report will likely be all of the extra vital.

Within the UK, the RPI (minus 24) and RPI-P (minus 34) equally slipped additional under zero on the again of additional indicators that the economic system has misplaced extra momentum than anticipated this quarter. Even so, with October inflation shocking on the upside, the probabilities of one other lower in Financial institution Price subsequent month have nonetheless receded.

In Switzerland, the absence of any important market information left the RPI at minus 35 and the RPI-P at minus 25. The Swiss Nationwide Financial institution maintains {that a} December ease just isn’t a performed deal however it’ll take some surprisingly sturdy information between from time to time to persuade monetary markets that a minimum of a 25 foundation level lower within the coverage price isn’t just across the nook.

In Japan, October inflation was barely firmer than forecast however the RPI (minus 4) and RPI-P (minus 21) each misplaced floor and present general financial exercise falling considerably wanting market forecasts. The jury continues to be out on the timing of the subsequent Financial institution of Japan tightening.

In China, an primarily clean information calendar made for no change in both the RPI (zero) or the RPI-P (20). If each measures can keep away from falling again into damaging shock territory, it’d imply that prime mortgage charges, which have been left on maintain final week, are both at, or very near, the underside of the present cycle.

Econoday’s RPI gives a useful abstract measure of how an economic system has not too long ago been evolving relative to market expectations.

A studying above zero implies that the economic system generally has been performing extra strongly than anticipated and vice versa for a studying under zero. The nearer is the worth to the utmost (+100) or minimal (-100) ranges, the better is the diploma to which markets have been under- or over-estimating financial exercise. A zero outturn would indicate that, on common, the market consensus has been right. Notice too that the index is sensitized to position additional weight upon these indicators that traders take into account to be a very powerful.

Share This Story, Select Your Platform!