Skip to content

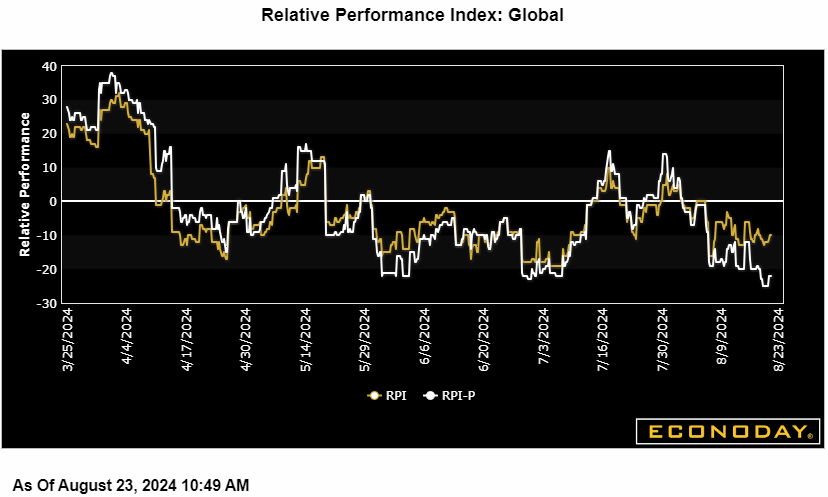

World knowledge held regular within the underperformance column, ending the week at minus 8 on Econoday’s Relative Efficiency Index (RPI) and at minus 21 when excluding worth knowledge (RPI-P), the latter indicating higher underperformance in actual financial exercise.

Within the Eurozone, financial exercise continued to undershoot market forecasts and put the RPI at minus 18 and the RPI-P at minus 32, the latter matching its weakest mark for the reason that begin of July. The financial system would welcome one other ECB ease in September however that would want additional proof that inflation is behaving itself.

Within the UK, upside and draw back surprises successfully cancelled one another out. This left each the RPI and RPI-P at minus 5 and so shut sufficient to zero to point total financial exercise performing a lot as anticipated. One other reduce on the BoE MPC’s September assembly hangs within the stability.

In Japan, the RPI (6) and the RPI-P (4) remained in optimistic shock territory, however solely simply. The BoJ nonetheless intends to tighten however the broader financial image continues to argue in opposition to any aggressive strikes.

There have been no important knowledge releases in China leaving the RPI at minus 29 and the RPI-P at a lowly minus 60. Such ranges weren’t weak sufficient to immediate one other reduce in mortgage prime charges however should a minimum of hold the door open to additional financial easing down the highway.

Lifted at week’s finish by new house gross sales, each the RPI and RPI-P for the US ended at plus 13 to now point out that latest US knowledge, which had been flat to underperforming, at the moment are coming in simply forward of Econoday’s consensus estimates.

On the prime is Canada which is more and more outperforming, at 37 on the RPI and 42 on the RPI-P in power that would appear to make a 3rd straight fee reduce on the Financial institution of Canada’s September 4 assembly pointless, particularly given cooling in client costs to 2.5 % in July.

Share This Story, Select Your Platform!