Key Factors

- Giovanni Ravazzotti’s stake in Italtile misplaced over $30 million in worth in simply 9 days amid waning investor confidence.

- Italtile shares dropped 6.73% since July 10, dragging market cap under $745 million and erasing June good points.

- Broader financial stress, together with inflation and weak GDP, is hitting South Africa’s house enchancment sector exhausting.

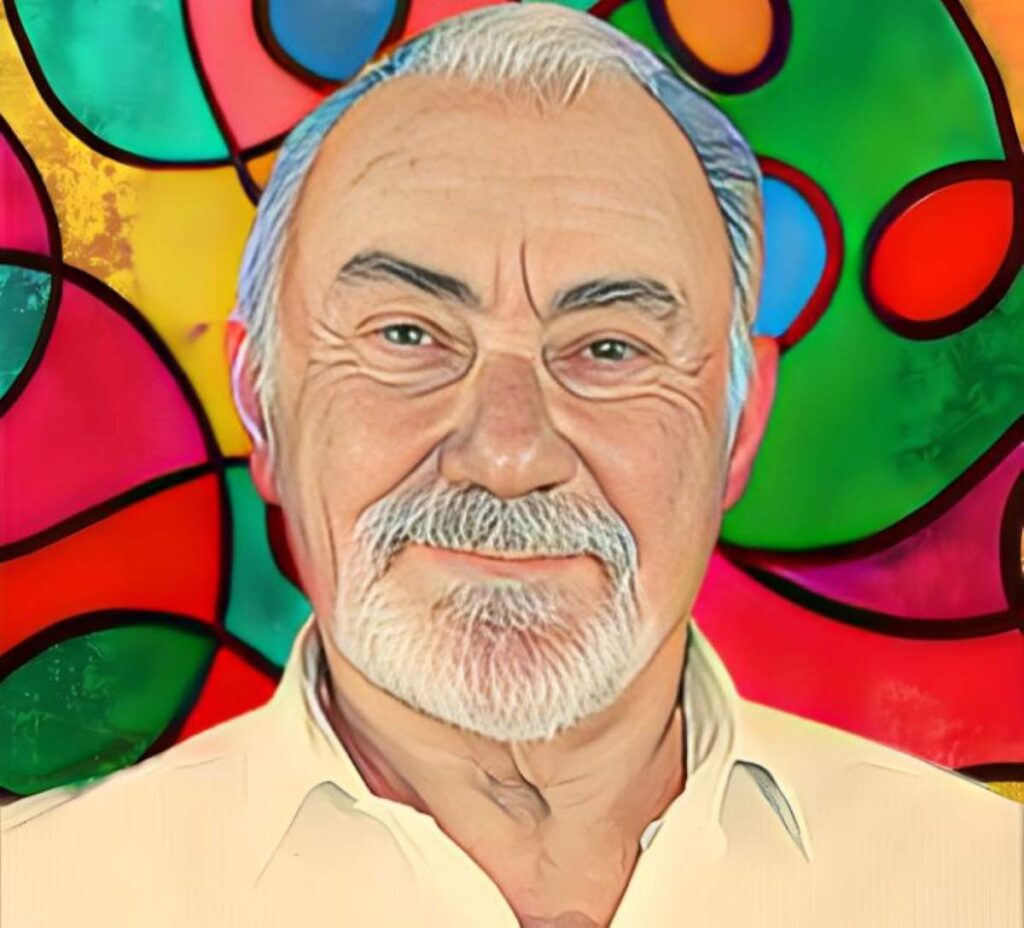

South African retail tycoon Giovanni Ravazzotti has seen the market worth of his controlling stake in Italtile Restricted decline by greater than $30 million in simply over per week, as investor confidence wanes amid rising financial considerations.

Ravazzotti’s Italtile stake drops sharply

Ravazzotti, who based Italtile in 1969 and nonetheless serves as its chairman, owns a 56.46-percent stake within the firm, about 746.24 million shares. That stake was price R7.98 billion ($450.49 million) at first of July 10 however has since fallen to R7.45 billion ($420.18 million), reflecting a R537.30 million ($30.31 million) loss on paper.

The sharp decline displays broader investor unease about South Africa’s financial outlook, significantly in sectors tied to client spending. Simply weeks in the past, between June 19 and June 23, Ravazzotti’s holdings had added $18.22 million in value. However these good points have now been greater than erased by the most recent selloff.

Share value sinks 6.73 %

Italtile, whose retail manufacturers embody CTM, TopT, U-Mild, and its flagship Italtile Retail, has lengthy been a staple in South African households. However its inventory has struggled recently. Over the past nine trading days, shares have dropped by 6.73 %, from R10.7 ($0.6) on July 10 to R9.98 ($0.56) per share.

That decline has dragged the corporate’s market capitalization under $745 million and sparked renewed considerations amongst traders. For Ravazzotti, one among South Africa’s most distinguished businessmen, the losses mark a pointy reversal from earlier within the yr.

Harder instances for the house enchancment sector

The sell-off mirrors broader considerations about South Africa’s financial outlook. Rising inflation, weak GDP development, and falling family disposable revenue are weighing closely on consumer-facing industries. Italtile, which is dependent upon householders and builders, is particularly uncovered.

Thus far in 2025, the corporate’s inventory is down 29.42 %. A $100,000 funding in Italtile at first of the yr would now be price about $70,580, an almost 30-percent drop in simply over six months. It’s a reminder of how market sentiment can shift, particularly in unsure instances.

Nonetheless standing, however challenges forward

Regardless of the setback, Ravazzotti stays a key determine in South Africa’s retail and manufacturing industries. His management and the power of Italtile’s manufacturers nonetheless supply the corporate a measure of resilience. However with stress constructing, the enterprise could have to take a tough have a look at its prices and rethink its plans for development within the close to time period.