Rahul Bharti, govt director, company affairs, Maruti Suzuki India

Picture: Madhu Kapparath

In September, when Ford Motor Firm introduced its intention to reopen its Chennai plant—it had stopped operations in 2021—primarily for exports, the event grabbed headlines. Though the American automaker has not revealed particulars of its plans, there have been information studies of the corporate exploring choices within the mild industrial automobile and pick-up segments, in each inner combustion engine and electrical choices. There have additionally been information studies of potential partnerships with different automakers, with Volkswagen being named as a attainable candidate. Ford declined to remark for this story.

Ford’s announcement introduced into the limelight, as soon as once more, the varied components which have contributed to the unsure efficiency of European and American carmakers within the extremely price-sensitive and aggressive Indian vehicle market. Nonetheless, Ford’s announcement additionally places the highlight on the emergence of India as an export hub for overseas carmakers. Whether or not it’s Maruti Suzuki, which entered the Indian market in 1981, or Kia Motors, the youngest child on the block that entered India in 2017, exports have gotten an more and more important a part of their methods, and revenues. Whereas Indian exports have conventionally been despatched to markets in Africa and Latin America, Japanese carmakers comparable to Honda and Maruti (58 p.c of its fairness is held by the Japanese Suzuki Motor Company) are actually exporting passenger autos to their house nation as nicely, marking a shift away from a basic notion that Indian merchandise weren’t adequate for developed markets.

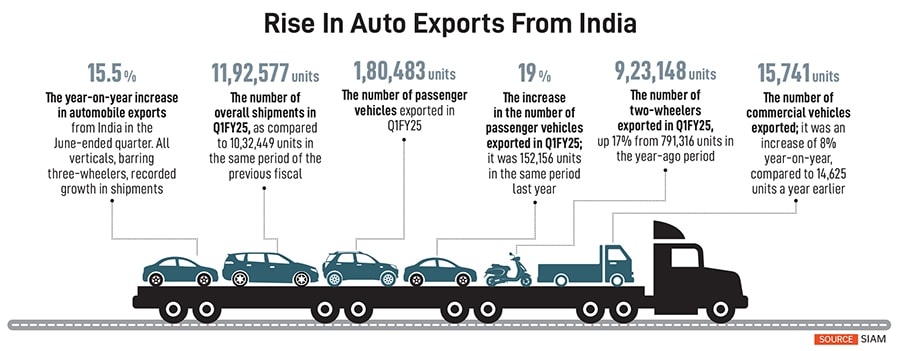

“In 2024, the variety of automobiles exported from India was about 6.7 lakh items,” says Hemal Thakkar, senior apply chief and director, Crisil. “Exports have elevated as a complete share of gross sales, to fifteen to 16 p.c.” He provides that earlier, greater than 50 to 60 p.c of exports comprised hatchbacks, whereas about 20 p.c was SUVs; as we speak, SUVs comprise about 40 p.c of exports.

Maruti Suzuki—the most important exporter of passenger autos from India (see field)—had been exporting autos to Europe since 1987-88, however this had remained a small variety of items and had by no means gone mainstream. “Given the imaginative and prescient of Prime Minister Narendra Modi’s Viksit Bharat programme, we realised that the ambition can’t be fulfilled by home demand alone. India has to take a bigger share of the worldwide market, which is by exporting extra. And it grew to become clear to us, whether or not it’s for India or for our personal enterprise, we have now to export extra and we have now to develop it exponentially,” says Rahul Bharti, govt director, company affairs, Maruti Suzuki India Restricted (MSIL).

Consequently, the corporate’s exports have elevated by thrice over what they had been round 4 years in the past. “And, by the flip of the last decade, we must always develop by one other thrice from the place we’re at the moment. So, we had been exporting round 96,000 items in FY21, whereas final 12 months we did about 2,83,000 items. We hope to export one thing like 8,00,000 by 2030-31,” says Bharti. “We’re not rising in share phrases; we’re rising in multiples.”

Bharti additionally feels that exports are the fireplace check of worldwide competitiveness in know-how, price and high quality. “If you’re exporting, and in good numbers to an excellent variety of international locations, it’s fairly clear that your product is globally well-accepted and aggressive,” he explains, including that customers in India, too, could be delighted to get a automobile that’s at par with world requirements.

MSIL is exporting 17 of its 18 fashions to about 100 international locations. Its main markets embody Latin America, Africa, Southeast Asia and Center East, and is coming into Europe and Japan. As MSIL begins to launch electrical autos (EVs) in 2025, these can even kind a part of its export portfolio. Exports to Japan embody the Fronx, which commenced not too long ago, and Baleno previously.

Bharti claims that previously 4 years, MSIL’s compounded annual development charge (CAGR) for passenger automobile exports has been greater than 5 instances (44 p.c) over its competitors, whose exports CAGR was 8 p.c. “We goal to extend our quantity by thrice within the subsequent 6 years, between 2025 and 2031,” he says.

The quantity of automobiles being exported by MSIL has led to the corporate establishing a railway siding throughout the premises of its Gujarat plant; it was inaugurated in March. This was accomplished with the intent to minimise damages and enhance effectivity throughout transportation to the port. The corporate additionally plans to make use of the siding to extend the quantity of automobiles it sends to different components of India.

Nissan Motor India sells the Magnite, in its home and export markets. Between FY24 and FY26, the Japanese carmaker is focusing on to promote 1,00,000 items in exports

Nissan Motor India sells the Magnite, in its home and export markets. Between FY24 and FY26, the Japanese carmaker is focusing on to promote 1,00,000 items in exports

“Export is a crucial piece of our general technique,” says Saurabh Vatsa, managing director, Nissan Motor India. “Our enterprise technique is predicated on three pillars: One is a powerful give attention to the home market, second is an equally sturdy give attention to the export enterprise, and third is the relaunch of our CBU [completely built up] enterprise in India.”

Presently, Nissan India sells the Magnite, in its home and export markets. Alongside, it has X-Path, which is a part of its CBU phase. As a part of its mid-term plan, one which it calls The Arc and which stretches between FY24 and FY26, the Japanese carmaker is focusing on to promote 1,00,000 items in exports. The corporate goes to introduce two new compact SUVs in India: One will likely be a five-seater and the opposite a seven-seater. Additionally it is engaged on introducing an inexpensive EV. Together with rising its export goal to 1,00,000 items, Nissan India additionally plans to promote the identical variety of items in India by FY26.

The prevailing Magnite (out there as a right-hand drive variant) was being exported to about 20 international locations, whereas the brand new model that was launched in October, showcases the primary left-hand drive variant, which will likely be exported to greater than 45 international locations. “So, the whole variety of markets that we’re going to be exporting this automobile to goes to be greater than 65,” says Vatsa. “We’re growing India as a large Nissan export hub, and no matter automobiles that we’re going to introduce in India, they’ll be exported as nicely.”

Vatsa says as we speak’s client in India is well-versed with applied sciences, and can also be demanding the place options are involved. “Subsequently, once you cater to the Indian market, you’ll be able to meet the necessities of shoppers in a big a part of the world. We don’t intend to distinguish between the automobiles we promote in India versus what we export.”

Nissan has a plant in Sunderland, UK, which is certainly one of its greatest export hubs, with India rising as one of many greatest export hubs within the AMIEO (Africa, Center East, India, Europe and Oceania) area.

Additionally learn: How safe are the cars you are driving on Indian roads?

What’s fuelling exports?

A number of components have spurred the quantity of vehicle exports from India. Whereas a few of these have been direct penalties of the federal government’s function in signing varied sorts of commerce agreements with the governments of different international locations, others are outcomes of improved technological and manufacturing knowhow and prowess amongst carmakers.

“International unique tools producers (OEMs) have realised that the price of manufacture is decrease in India, due to the decrease price of labour and different enter supplies, and better productiveness ranges,” says Thakkar of Crisil. “Earlier, German producers, for instance, would make their autos in India, however would import their transmission components from their house international locations or different manufacturing centres. This has now modified in favour of India, as these carmakers are getting extra assured about making fully in India, and exporting as nicely.”

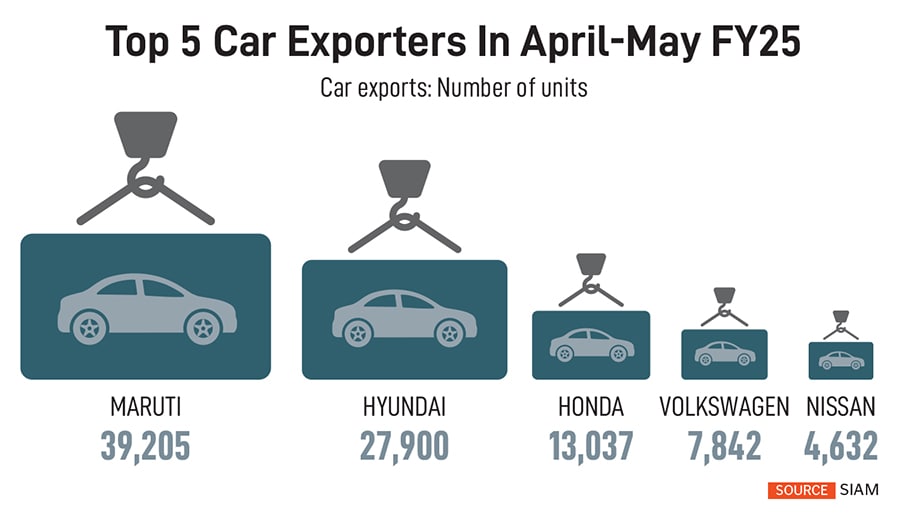

Proving Thakkar’s level is Volkswagen India, which skilled sturdy export demand in FY24 and shipped 44,180 items. It recorded a 63 p.c year-on-year development, from 27,137 items in FY23, thus changing into the fourth largest auto exporter from India, up from being the sixth largest in FY23.

Behind Volkswagen’s rise has been the German carmaker’s made-in-India Virtus, a worldwide sedan, with 31,495 items exported, a rise of 74 p.c from FY23, and the mid-size SUV Taigun with 12,621 items, up 59 p.c from FY23.

Thakkar provides that the presence of huge ports comparable to Mundra in Gujarat, JNPT in Navi Mumbai, and in Chennai has been an enabling issue. “Congestion ranges at these ports have eased, which has a optimistic influence on logistic prices,” he provides.

That is evident in the truth that MSIL’s manufacturing facility in Gujarat is the one from which it exports most of its items, whereas Nissan exports from its Chennai plant. In line with studies, the plant at Oragadam has the capability to provide 480 automobiles per day; as of March, it was producing 178 automobiles a day, half of which had been being exported.

In July, media studies stated that Tata Motors is planning to arrange a ₹9,000-crore Jaguar Land Rover (JLR) plant over 400 acres close to Panapakkam within the Ranipet district of Tamil Nadu, in shut proximity of the Chennai and Ennore ports. The plant is anticipated to be operational by 2025-26, and will likely be manufacturing luxurious autos in India, which up to now had been assembled on the Pune plant. “The JLR plant in Chennai is anticipated for use for exports to markets comparable to Australia, Norway and Switzerland, the place Indian exports will get zero-duty entry,” says Thakkar.

Until a couple of years in the past, auto exports from India had been largely to Africa, Latin America, Sri Lanka and Bangladesh. Though they’re nonetheless dominated by Africa and Latin America, new markets such because the Center East, Europe and Australia are opening up. In March, India introduced a brand new free commerce take care of the European Free Commerce Affiliation (EFTA), which incorporates Iceland, Liechtenstein, Norway, and Switzerland—international locations not within the European Union. The deal was finalised after greater than 15 years of negotiations and can take away import tariffs on industrial items from EFTA states. The settlement entails $100 billion price of investments throughout a variety of sectors in India, together with manufacturing. The EFTA deal adopted the signing of commerce agreements between India and Australia, and the UAE.

Thakkar provides that some international locations throughout the African continent additionally need to be seen as a bloc—akin to the European bloc—which eases issues like negotiations, infrastructure, forms and logistics. The ASEAN (Affiliation of Southeast Asian Nations) area has a number of international locations with auto manufacturing hubs, and due to this fact presents a number of competitors to exports from India. Subsequently, taking a look at different geographies turns into crucial.

Different export limitations previously had been components comparable to autos made in India having BS4 emission norms whereas developed nations just like the US having Euro VI emission norms. In 2020, India applied BS6 emission norms, that are virtually equal to Euro VI norms. Final 12 months, the federal government launched the Bharat New Automotive Evaluation Programme, to supply security rankings to automobiles made in India. Together with making passenger autos safer for Indian roads, these rankings are additionally meant to make India-made autos extra saleable in overseas markets.

(This story seems within the 01 November, 2024 difficulty

of Forbes India. To go to our Archives, click here.)