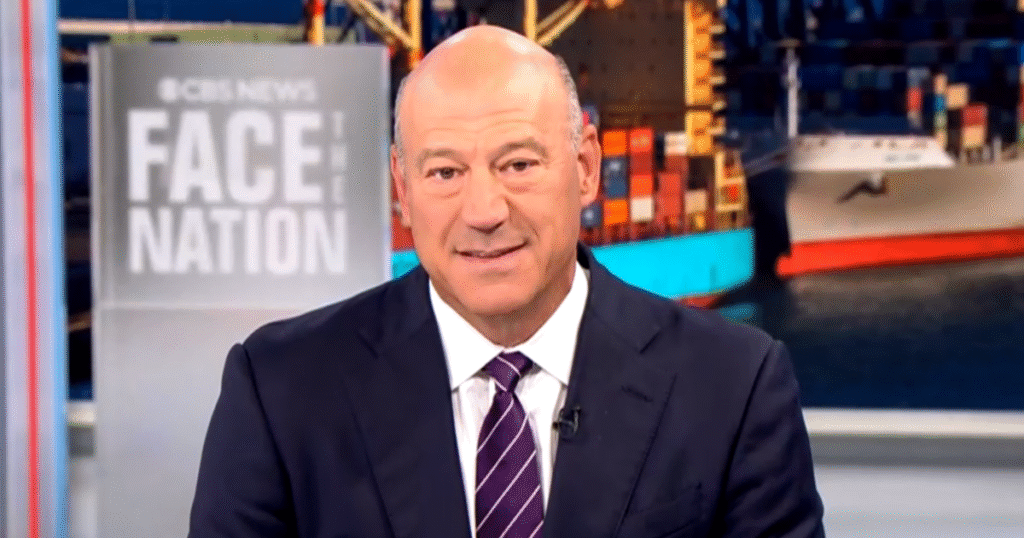

Washington — Gary Cohn, IBM vice chair and former Nationwide Financial Council director in President Trump’s first time period, mentioned Sunday that “we have seen the job market degrade,” although he famous that it could be “short-term.”

“The Federal Reserve itself and the board of governors admitted that we’re having a declining job market. And we see that,” Cohn said on “Face the Nation with Margaret Brennan.”

Final week, the Federal Reserve lowered its benchmark rate of interest by 0.25 proportion factors, within the first charge lower since December, amid slower financial progress and a stalling labor market. Fed Chair Jerome Powell, who has a twin mandate to make sure that each inflation and unemployment stay low, mentioned “what’s completely different now’s that you just see a really completely different image of the dangers to the labor market.” And although Powell famous that he did not wish to put “an excessive amount of emphasis on payroll job creation,” he mentioned “it is simply one of many issues that implies that the labor market is basically cooling off.”

“That tells you that it is time to take that into consideration,” Powell mentioned.

In the meantime the roles numbers, which have proven an ongoing slowdown within the labor market, have been underneath scrutiny in latest weeks, because the administration has questioned the validity of the federal government knowledge. Final month, President Trump fired former Bureau of Labor Statistics Commissioner Erika McEntarfer after a disappointing July jobs report.

Cohn pointed to job knowledge on Sunday, saying, “during the last three or 4 months, we’ve got gone from creating effectively over 100,000 jobs a month to creating lower than 50,000 jobs a month.” And he famous that “I do assume that we’ve got seen corporations reduce on the quantity of staff they’ve.”

CBS Information

The IBM vice chair outlined that when corporations are put in a “very tough atmosphere,” with enter prices going up on account of tariffs and different causes, they usually’re unable to boost costs on customers, “the one lever they will pull to ensure they maintain their margins intact is they will lower down on the price of labor.”

“We got here out of a tricky scenario in COVID the place corporations had been really afraid about with the ability to appeal to and retain individuals, so that they had been hoarding labor,” Cohn mentioned. “So we went from a hoarding labor scenario to a scenario as we speak the place corporations are being very aggressive about managing their bills, and the one expense they will handle is the price of labor.”

Cohn mentioned corporations are actually “letting their labor power decline naturally as individuals retire out of the labor system.” He mentioned within the knowledge, “I feel it is clearly exhibiting up, and the Federal Reserve acknowledged that on this week’s motion.”

Cohn mentioned he did not assume this modification is restricted to tech, however “throughout the board.” He famous that he is “heard it straight from company CEOs in each enterprise line that they’ve gone out of their method to lower their human capital overhead.”

On the speed lower extra broadly, Cohn mentioned “the Fed gave us loads of essential data this final week,” pointing to the speed lower, together with Fed officers offering their outlook, with projections of the place they assume rates of interest are going. And he additionally famous that “what can also be essential is the committee was pretty unanimous,” acknowledging issues in regards to the independence of the Fed which have come to a head in latest weeks.

“I feel the Fed clearly confirmed themselves to be unbiased thinkers,” he mentioned. “They took into consideration the entire financial knowledge, they usually got here out with a projection that made sense based mostly on what’s going on within the economic system as we speak.”