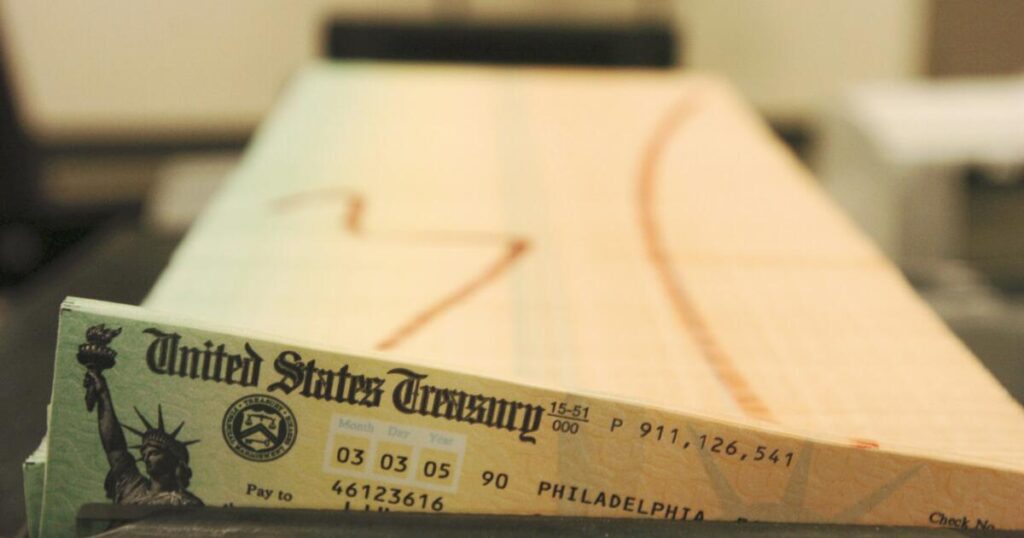

To the editor: There’s a easy answer that might resolve Social Safety’s “operating out of cash” downside merely and pretty — take away earnings limits for paying the tax, presently $168,600. (“Trump promised he won’t cut Social Security. Should you trust him?” column, Dec. 10)

I’ve had years the place my pay went past the restrict, so Social Safety taxes weren’t withheld on earnings above that. It was good to get a number of further bucks in my paycheck, however let’s be trustworthy: When you cross these limits, the tax break is just not massive sufficient to make a cloth distinction in day-to-day dwelling.

Nevertheless, reducing advantages to retirees by 30%, as is predicted in a decade or so, would have a major influence on many individuals’s lives. It might additionally have an effect on society, the financial system and doubtlessly our nation’s standing on the earth, notably because the retired inhabitants swells and outnumbers that of youthful generations.

Kathi Weiner, Dana Level