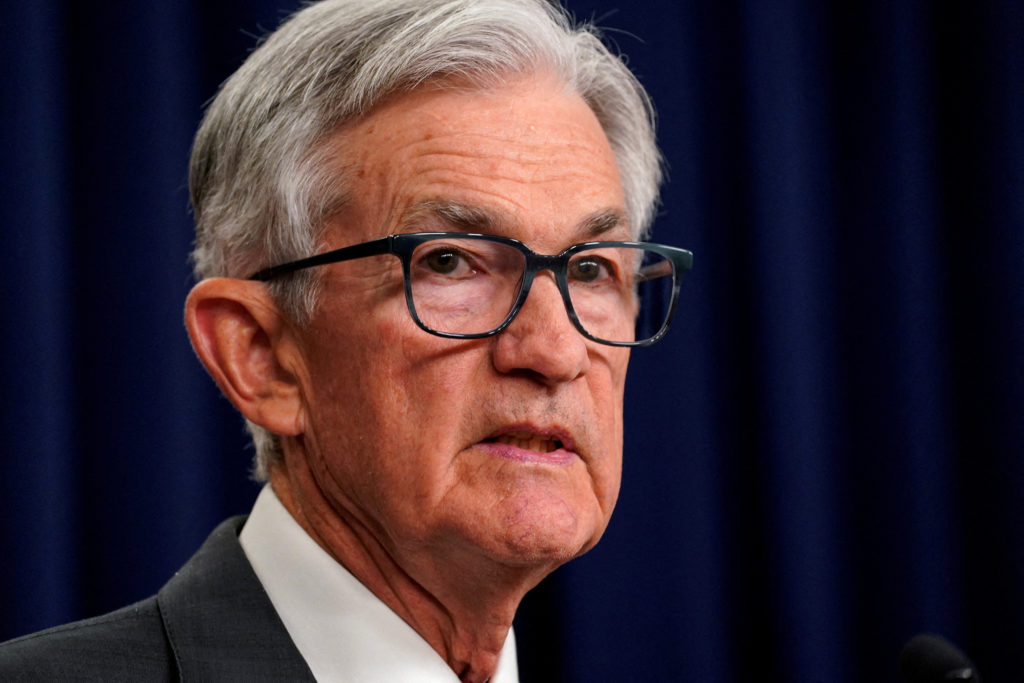

WASHINGTON (AP) — The U.S. financial system is usually in fine condition however that isn’t saving Federal Reserve chair Jerome Powell from a spell of angst.

Because the Fed considers its subsequent strikes throughout a two-day assembly this week, most financial knowledge seems to be stable: Inflation has been steadily fading, whereas the unemployment price remains to be a traditionally low 4.2%. But President Donald Trump’s widespread tariffs might push inflation increased within the coming months, whereas additionally presumably slowing progress.

READ MORE: Consumer sentiment rises for first time in 2025 as inflation remains tame

With the outlook unsure, Fed policymakers are anticipated to maintain their key rate of interest unchanged on Wednesday at about 4.4%. Officers will even launch a set of quarterly financial projections which are anticipated to point out inflation will speed up later this yr, whereas unemployment my additionally tick up a bit.

The projections may additionally sign that the Fed will minimize its key price twice later this yr, economists say.

The prospect of upper inflation would usually lead the Fed to maintain charges unchanged and even increase them, whereas rising unemployment would often lead the Fed to chop its key price. With the financial system probably pulling in each instructions, Powell and different Fed officers have underscored in latest remarks that they’re ready to attend for clearer indicators on which technique to transfer.

The Fed is in “an uncomfortable purgatory,” mentioned Diane Swonk, chief economist at accounting big KPMG. “With out the specter of tariffs, we’d be seeing the Fed minimize. That’s not the place we’re at due to the uncertainty and the menace and the consequences (of tariffs) that we don’t know but.”

The Trump White Home has sharply ramped up the strain on Powell to scale back borrowing prices, with Trump himself calling the Fed chair a “numbskull” for not reducing and different officers, together with Vice President JD Vance and Commerce Secretary Howard Lutnick, additionally calling for a price discount.

When the Fed reduces its key short-term price, it usually — although not at all times — results in decrease prices for client and enterprise borrowing, together with for mortgages, auto loans, and bank cards. But monetary markets additionally affect the extent of longer-term charges and might preserve them elevated even when the Fed reduces the shorter-term price it controls.

For instance, if traders fear that inflation will stay elevated, they will demand increased rates of interest on longer-term Treasury securities, which affect different borrowing prices.

Although Trump has mentioned the financial system is doing properly, he has additionally argued {that a} price minimize would trigger the financial system to take off “like a rocket.”

However Trump has additionally highlighted one other concern: If the Fed doesn’t minimize charges, the federal authorities should pay extra curiosity on its big funds deficits, that are projected to develop even bigger underneath the White Home’s proposed tax and funds laws presently being thought of by the Senate.

“We’re going to spend $600 billion a yr, $600 billion due to one numbskull that sits right here (and says), ‘I don’t see sufficient purpose to chop the charges now,’” Trump mentioned final week.

READ MORE: Trump meets with Jerome Powell, the Fed chairman he has repeatedly scorned

Pushing the Fed to chop charges merely to avoid wasting the federal government on its curiosity funds usually raises alarms amongst economists, as a result of it will threaten the Fed’s congressional mandate to give attention to steady costs and most employment.

But the markets haven’t reacted a lot to Trump’s latest assaults on the Fed, now that the Supreme Courtroom, in a ruling final month, urged {that a} president doesn’t have the authorized energy to fireside the Fed chair.

Nonetheless, with inflation remaining low, thus far, regardless of the imposition of tariffs, the Fed might come underneath better strain within the coming months from economists and traders to chop charges. Policymakers estimate that the rate of interest that may neither stimulate the financial system nor sluggish it down — often called the “impartial price” — is about 3%.

In the meantime, inflation — based on the Fed’s most popular measure — is simply 2.1%, nearly again to the central financial institution’s 2% goal. Such a low studying suggests the Fed’s price needs to be nearer to impartial, beneath its present degree of 4.4%, as a result of it doesn’t want a excessive price to sluggish inflation.

“It’s an inexpensive case for the Fed to grapple with,” mentioned Jon Hilsenrath, a visiting scholar at Duke College.

But based on a survey Hilsenrath performed for Duke of former Fed officers and workers, they anticipate the Fed to chop rates of interest simply as soon as this yr. “There’s a danger that inflation strikes up and so they don’t need to get forward of themselves,” he mentioned.

It’s doable that tariffs might not push up inflation as a lot as economists have feared. However one purpose for that may very well be that the financial system might sluggish, lifting unemployment and making customers unwilling to pay increased costs, which would scale back inflation.

Economists at Goldman Sachs mentioned in a latest analysis observe that they anticipate inflation will rise to three.6% by December, however that the rise will solely be short-term.

“The primary purpose we’re much less frightened is that we anticipate the financial system to be weak this yr, with … a modest rise within the unemployment price,” Jan Hatzius, chief economist at Goldman, and his colleagues wrote.

A noticeable weakening of the financial system that slows client spending and holds down inflation would seemingly lead the Fed to rapidly minimize charges. However they are going to be extra comfy doing so as soon as they’ve a greater sense of the total affect of tariffs.

Michael Gapen, chief U.S. economist at Morgan Stanley, mentioned in a observe Monday that the Fed “will want a number of months to evaluate the consequences of coverage adjustments, believing that ‘later and proper is healthier than sooner and fallacious.’”