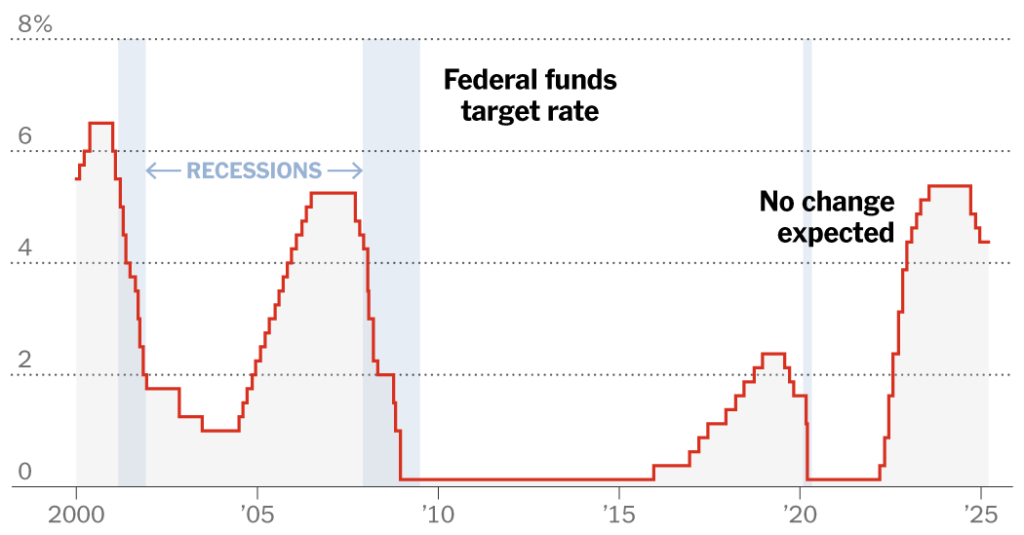

The Federal Reserve is anticipated to maintain its key price regular on Wednesday, after a sequence of cuts that lowered charges by a full proportion level final 12 months.

Which means customers seeking to borrow are prone to have to attend a bit longer for higher offers on many loans, however savers will profit from steadier yields on financial savings accounts.

Economists don’t anticipate one other price lower for some time, because the central financial institution waits for extra readability on an more and more unsure outlook given President Trump’s policies on tariffs, immigration, widespread federal job cuts, amongst different issues.

The Fed’s benchmark price is ready at a variety of 4.25 to 4.5 p.c. In an effort to tamp down sky-high inflation, the central financial institution started lifting charges quickly — from close to zero to above 5 p.c — between March 2022 and July 2023. Costs have cooled significantly since then, and the Fed pivoted to price cuts, reducing charges in September, November and December.

Extra not too long ago,Mr. Trump’s inflation-stoking polices might immediate the Fed to delay extra price cuts. However on the identical time, longer-term rates of interest set by the markets have been drifting down, influencing a variety of shopper and enterprise borrowing prices.

Auto Charges

What’s occurring now: Auto charges have been trending increased and automotive costs stay elevated, making affordability a challenge. And that’s earlier than U.S. tariffs threaten to push prices up even more.

Automobile loans have a tendency to trace with the yield on the five-year Treasury word, which is influenced by the Fed’s key price. However different elements decide how a lot debtors truly pay, together with your credit score historical past, the kind of car, the mortgage time period and the down fee. Lenders additionally consider the degrees of debtors turning into delinquent on auto loans. As these move higher, so do charges, which makes qualifying for a mortgage harder, notably for these with decrease credit score scores.

The common price on new automotive loans was 7.2 p.c in February, according to Edmunds, a automotive buying web site, up from 6.6 p.c in December and seven.1 p.c in February 2024 . Charges for used vehicles had been increased: The common mortgage carried an 11.3 p.c price in February, in contrast with 10.8 p.c in December and 11.6 p.c in February 2024.

The place and methods to store: As soon as you identify your price range, get preapproved for a automotive mortgage by way of a credit score union or financial institution (Capital One and Ally are two of the most important auto lenders) so you might have a degree of reference to check financing obtainable by way of the dealership, for those who determine to go that route. At all times negotiate on the value of the automotive (together with all charges), not the month-to-month funds, which might obscure the mortgage phrases and what you’ll be paying in whole over the lifetime of the mortgage.

Credit score Playing cards

What’s occurring now: The rates of interest you pay on any balances that you simply carry had edged barely decrease after the latest Fed cuts, however the decreases have slowed, consultants mentioned. Final week, the typical rate of interest on bank cards was 20.09 p.c, based on Bankrate.

A lot relies upon, nevertheless, in your credit score rating and the kind of card. Rewards playing cards, for example, typically cost higher-than-average rates of interest.

The place and methods to store: Final 12 months, the Shopper Monetary Safety Bureau sent up a flare to let individuals know that the 25 largest credit-card issuers had charges that had been eight to 10 proportion factors increased than smaller banks or credit score unions. For the typical cardholder, that may add as much as $400 to $500 extra in curiosity a 12 months.

Take into account in search of out a smaller financial institution or credit score union which may give you a greater deal. Many credit score unions require you to work or stay someplace explicit to qualify for membership, however some greater credit score unions might have looser rules.

Earlier than you make a transfer, name your present card issuer and ask them to match the most effective rate of interest you’ve discovered within the market that you simply’ve already certified for. And for those who do transfer your balance, maintain an in depth eye on charges and what your rate of interest would soar to as soon as the introductory interval expires.

Mortgages

What’s occurring now: Mortgage charges have been volatile. Charges peaked at about 7.8 p.c late final 12 months and had fallen as little as 6.08 p.c in late September. Stable financial information and issues about Mr. Trump’s probably inflationary agenda pushed charges a bit increased once more, although they’ve steadied in latest weeks.

Charges on 30-year fixed-rate mortgages don’t transfer in tandem with the Fed’s benchmark, however as an alternative usually observe with the yield on 10-year Treasury bonds, that are influenced by quite a lot of elements, together with expectations about inflation, the Fed’s actions and the way buyers react.

The common price on a 30-year fixed-rate mortgage was 6.65 p.c as of Thursday, up barely from 6.63 p.c the earlier week however down from 6.74 p.c a 12 months in the past.

Different residence loans are extra carefully tethered to the central financial institution’s selections. Dwelling-equity strains of credit score and adjustable-rate mortgages — which carry variable rates of interest — usually modify inside two billing cycles after a change within the Fed’s charges.

The place and methods to store: Potential residence consumers can be smart to get a number of mortgage price quotes — on the identical day, since charges fluctuate — from a collection of mortgage brokers, banks and credit score unions.

That ought to embody: the speed you’ll pay; any discount points, that are elective charges consumers pays to “purchase down” their rate of interest; and different objects like lender-related charges. Look to the “annual percentage rate,” which often contains these things, to get an apples-to-apples comparability of your whole prices throughout completely different loans. Simply you should definitely ask what’s included within the A.P.R.

Financial savings Accounts and C.D.s

What’s occurring now: All the pieces from on-line savings accounts and certificates of deposit to money market funds have a tendency to maneuver according to the Fed’s coverage.

Savers are now not benefiting from the juiciest yields, however you’ll be able to nonetheless discover returns at on-line banks of 4 p.c or extra. “The Fed taking its foot off the gasoline with price cuts signifies that these yields are prone to keep excessive for some time, but it surely gained’t final ceaselessly,” mentioned Matt Schulz, chief shopper finance analyst at LendingTree, the web mortgage market.

Conventional industrial banks’ yields, in the meantime, have remained anemic all through this era of upper charges. The nationwide common financial savings account price was not too long ago 0.6 p.c, based on Bankrate.

The place and methods to store: Charges are one consideration, however you’ll additionally wish to take a look at providers’ history, minimal deposit necessities and any charges (high-yield financial savings accounts don’t often cost charges, however different merchandise, like cash market funds, do). DepositAccounts.com, a part of LendingTree, tracks charges throughout hundreds of establishments and is an efficient place to start out evaluating suppliers.

Try our colleague Jeff Sommer’s columns for more insight into money-market funds. The yield on the Crane 100 Money Fund Index, which tracks the most important money-market funds, was 4.14 p.c as of Tuesday, down from 5.15 p.c in February 2024.

Pupil Loans

What’s occurring now: There are two primary forms of pupil loans. Most individuals flip to federal loans first. Their rates of interest are fastened for the lifetime of the mortgage, they’re far simpler for youngsters to get and their compensation phrases are extra beneficiant.

Current rates are 6.53 p.c for undergraduates, 8.08 p.c for unsubsidized graduate pupil loans and 9.08 p.c for the PLUS loans that each dad and mom and graduate college students use. Charges reset on July 1 annually and observe a components based mostly on the 10-year Treasury bond public sale in Might.

Personal pupil loans are a little bit of a wild card. Undergraduates typically want a co-signer, charges might be fastened or variable and far is determined by your credit score rating.

The place and methods to store: Many banks and credit score unions need nothing to do with pupil loans, so that you’ll wish to store round extensively, together with with lenders specializing in personal pupil loans.

You’ll typically see on-line advertisements and web sites providing rates of interest from every lender that may vary by 15 proportion factors or so. In consequence, you’ll want to surrender a good bit of data earlier than getting an precise worth quote.