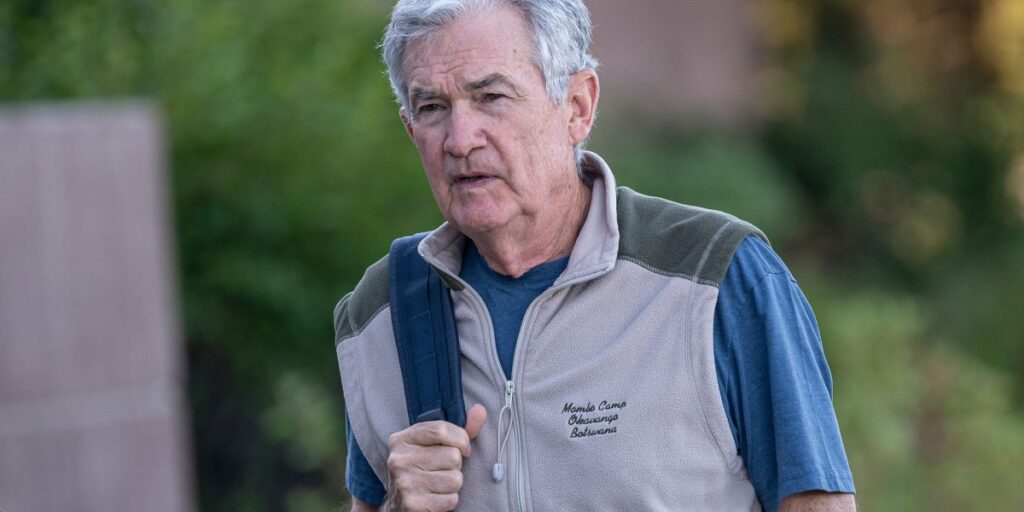

All eyes will flip to Federal Reserve Chairman Jerome Powell on Friday, when he’s scheduled to ship a extremely anticipated speech at a central financial institution convention in Jackson Gap, Wyo.

The annual occasion beforehand has served as a possibility for policymakers to tease forthcoming charge strikes. Final 12 months, Powell signaled a pivot to cuts, saying “the time has come for coverage to regulate” and that “my confidence has grown that inflation is on a sustainable path again to 2%.”

Wall Street overwhelmingly expects the Fed to resume rate cuts in September, after holding off for months as President Donald Trump’s tariffs ripple by way of the economic system. That’s as Trump and the White Home have put immense stress on the Fed to ease whereas a extra dovish governor was named to the board of governors.

However Powell might not drop large hints this 12 months.

For one factor, some analysts don’t suppose a September charge reduce is within the bag as a result of inflation stays above the Fed’s 2% goal and is ticking larger as tariffs put upward stress on costs.

In the meantime, economists are debating whether or not deteriorating jobs knowledge are as a consequence of weak demand for workers or weak supply. If the issue is provide, then charge cuts would worsen inflation.

“Tariffs are feeding by way of inconsistently and can proceed to push inflation larger within the coming months,” wrote Michael Pearce, deputy chief U.S. economist at Oxford Economics, in a observe on Friday. “Will probably be troublesome for policymakers to tease out one-off tariff results from longer-lasting inflationary pressures.”

For now, he thinks the Fed will stay on maintain till December, however a weak August jobs report would change his view.

Market veteran Ed Yardeni has maintained a “none-and-done” forecast for this 12 months, saying the Fed will maintain off on cuts as a consequence of still-elevated inflation and the continued resilience of the U.S. economic system.

As for the Jackson Gap speech, a observe from Yardeni Analysis on Sunday predicted Powell would maintain his playing cards near his vest.

“Odds are that he will probably be extra of an owl—ready and watching—than both a hawk or a dove,” it mentioned. “In different phrases, he’ll say {that a} Fed charge reduce is feasible on the September assembly, however the Fed’s choices are data-dependent.”

Bank of America has equally been skeptical about charge cuts this 12 months and identified that Powell recommended in July he could be snug with low job positive factors so long as the unemployment charge stays in a good vary.

That situation now appears prefer it’s changing into actuality, and BofA mentioned Powell’s Jackson Gap speech will give him an opportunity to “stroll the discuss.”

“If Powell desires to lean in opposition to a September reduce, he might say that the coverage stance stays applicable given the info at hand. We observe that this phrasing would enable him to retain the optionality of reducing if the August jobs report may be very weak,” the financial institution mentioned in a observe Wednesday. “In fact, he may additionally telegraph a reduce by saying it’s applicable to maneuver to a much less restrictive coverage stance.”

Wall Road has so totally priced in a September reduce that any signal traders might have to attend longer wouldn’t solely be a extreme letdown—it could really feel like a charge hike.

Preston Caldwell, chief US economist at Morningstar, wrote Tuesday that given how lengthy the market has been anticipating a discount, “suspending cuts a lot additional would represent an efficient tightening of financial coverage at this stage.”

‘We don’t suppose Powell can firmly information towards easing’

However even some economists who do suppose the Fed will reduce subsequent month are uncertain that Powell will tip his hand on Friday.

JPMorgan mentioned the stress within the Fed’s twin mandate between combating inflation and maximizing employment now favors the latter.

Regardless of current inflation knowledge indicating tariffs are filtering into costs extra, the disappointing jobs report ought to tilt the Fed towards reducing charges subsequent month.

“Nonetheless, with a number of Fed audio system lately stating that the case for a reduce has not been made, and with extra employment knowledge to return, we don’t suppose Powell can firmly information towards easing on the subsequent assembly,” JPMorgan mentioned in a observe Friday.

Citi Analysis chief US economist Andrew Hollenhorst thinks Powell will trace at a reduce, however received’t transcend that.

The trace might come within the type of a comment that dangers to employment and inflation are coming into stability. In July, Powell mentioned in the event that they had been in stability, then charges must be extra impartial. Provided that he referred to as the present charge degree “modestly restrictive,” that means balanced dangers would advantage a reduce.

Since then, jobs knowledge present the labor market has softened, permitting Powell to say that dangers are extra balanced and that charge cuts could be applicable subsequent month if that pattern continues, Hollenhorst wrote in a observe Friday.

“We anticipate Chair Powell to verify market pricing for a return to charge cuts in September, however cease in need of explicitly committing to chop at that assembly,” he mentioned. “We don’t anticipate he’ll touch upon the dimensions of the reduce, however it’s protected to imagine the bottom case in the meanwhile is for a 25bp reduce.”