Key Factors

- Ethiopia’s richest man is again among the many world’s prime 500 billionaires, with a internet value of $7.41 billion.

- His fortune rebounded after promoting Corral Petroleum, the dad or mum of Sweden’s Preem, to Switzerland’s VARO Vitality.

- Regardless of earlier setbacks, Al-Amoudi’s diversified holdings throughout oil, mining, and business proceed to drive his wealth restoration.

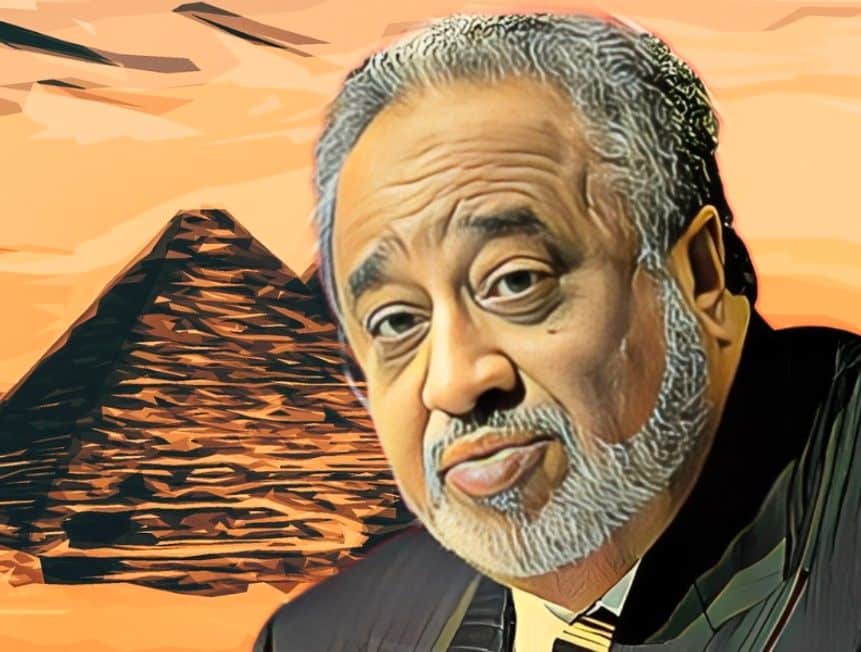

Ethiopia’s richest man, Mohammed Al-Amoudi, has seen his fortune develop by $1 billion, bringing his internet value to over $7.4 billion, based on the Bloomberg Billionaires Index.

This comes after the recent sale of Corral Petroleum Holdings AB—the dad or mum firm of Sweden’s largest oil refiner, Preem AB—to Switzerland’s VARO Vitality. The deal closed simply 42 days in the past.

Al-Amoudi returns to prime 500

Again on Could 8, 2025, Al-Amoudi had dropped off Bloomberg’s record of the world’s 500 richest individuals after his internet value slipped under $6.45 billion, the cutoff to stay on the rating.

On the time, the five hundredth spot belonged to NFL group proprietor Steve Bisciotti. However since then, Al-Amoudi has regained floor, along with his wealth rising to $7.41 billion. That $1 billion rebound not solely introduced him again onto the record however pushed him as much as 455th place.

Enterprise empire proves its resilience

As Ethiopia’s richest man, the current upswing in Al-Amoudi’s internet value underscores the resilience of his enterprise empire. His wide-ranging pursuits, from gold mining in Ethiopia to Morocco’s Samir refinery and different industrial ventures, proceed to play a serious function in Africa’s financial panorama.

Earlier this 12 months, Bloomberg minimize his estimated wealth by $4 billion, citing the sale of Svenska Petroleum Exploration and a revised valuation of his gold property. However a more moderen overview of his holdings has helped get better a portion of that loss, providing a clearer image of his fortune.

Preem property, fairness fall

Al-Amoudi’s stake in Preem was valued at $5.09 billion on April 4, 2025, shortly earlier than the announcement of the sale to VARO Vitality. The refiner confronted powerful challenges within the first quarter of 2025, together with weaker margins on diesel and gasoline and sudden outages at its Synsat unit.

These operational difficulties affected Preem’s monetary well being. Its whole property dropped by almost 13 % to SEK45.76 billion ($4.7 billion), down from SEK52.44 billion ($5.39 billion), whereas whole fairness fell virtually 4 % to SEK24.53 billion ($2.52 billion).