The Workers’ Provident Fund Organisation (EPFO) has introduced new guidelines to make it extra handy for its customers to hyperlink Aadhaar with their Common Account Quantity (UAN) and make modifications to their private particulars.

The contemporary guidelines are geared toward dashing up entry to provident fund providers, scale back paperwork, and guarantee well timed payouts, particularly in delicate circumstances like these involving minors, with out pointless procedural hurdles.

Direct Aadhaar-UAN linking if particulars match

- Simplified course of: In case your identify, gender and date of start in each Aadhaar and UAN information match, now you can immediately strategy your employer.

- Employer portal: The employer can then full the Aadhaar seeding by the KYC perform on the employer portal.

- No further approval: This course of now not requires further approval from EPFO, dashing up what was beforehand time consuming as even easy matches used to get delayed on account of a number of verification layers.

Simplified Joint Declaration for mismatched particulars

The Joint Declaration (JD) mechanism has additionally been streamlined for circumstances the place the Aadhaar and UAN particulars don’t match, or the place a incorrect Aadhaar has been linked.

- On-line Rectification: Employers can now submit on-line JD requests to appropriate particulars like identify, gender or date of start. This additionally applies to circumstances the place a incorrect Aadhaar quantity was linked by mistake.

- Bodily submission: If an organization is closed or an employer is unavailable, a member can submit a bodily JD type. This way, attested by licensed officers, may be submitted on the Public Relations Officer (PRO) counter, who will then add it for processing put up verification.

Nonetheless, it’s essential to notice that modifications to Aadhaar particulars which have already been verified is not going to be cleared.

Well timed payouts for minor beneficiaries

- No guardianship certificates required: In a significant reduction for minor beneficiaries, the EPFO now not requires guardianship certificates for declare settlements to a deceased member’s minor kids.

- Direct financial institution credit score: Advantages, together with each lump sum settlements and pension quantities, may be immediately credited to the kid’s checking account.

- PRO help: To be able to streamline this course of, EPFO officers are instructed to assist claimants open accounts for minors to make sure well timed and hassle-free payouts.

Find out how to hyperlink Aadhaar to UAN on-line?

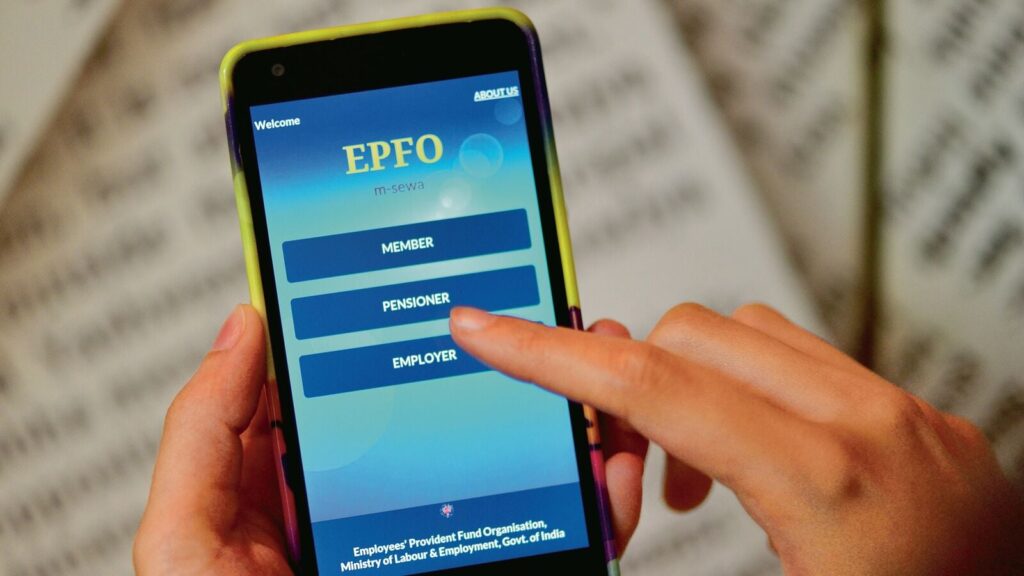

An person can simply hyperlink their Aadhaar to UAN utilizing a authorities arrange platform, known as UMANG cell app. So as to take action, observe these steps:

- Entry the UMANG app and log in utilizing your MPIN or OTP.

- Navigate to the “Providers” tab and choose “EPFO” possibility.

- Underneath the EPFO possibility, select “e-KYC providers”.

- Choose the “Aadhaar Seeding” possibility.

- Enter your UAN after which enter the OTP that’s despatched to the registered cell quantity.

- Enter your Aadhaar particulars and confirm OTP despatched to Aadhaar-linked cell quantity and e mail.

As soon as the verification course of is over and profitable, your Aadhaar shall be linked to UAN.

Whereas the preliminary linking may be carried out inside minutes, the precise verification and approval by the authorities can take as much as 15 days. Sometimes, it takes round 3-5 days for the method to finish.