NEWNow you can take heed to Fox Information articles!

Whereas it seems that each day Americans may be DOGE-ing more waste, fraud and abuse within the federal authorities, sadly, America is on an unsustainable monetary path and the numbers don’t lie. The nationwide debt has surged previous $36.5 trillion, with no indicators of slowing down. Each events are complicit, however it’s the left’s relentless push for presidency enlargement, social applications, and reckless spending that has put us on the trajectory towards an inevitable $40 trillion in debt.

The fiscal funds line gadgets no one mentions

Once you carefully look at what’s happening with the fiscal budget, there are solely four-line gadgets which are substantive to the general expenditures in the US. Right here they’re:

1. Healthcare applications (Medicare and Medicaid)

These applications collectively account for about $1.67 trillion a 12 months of spending, representing 24% of the federal funds. Medicare supplies well being protection to seniors, whereas Medicaid assists low-income people. The growing old inhabitants and rising healthcare prices make it difficult to curtail spending on this space.

DOGE INITIAL FINDINGS ON DEFENSE DEPARTMENT DEI SPENDING COULD SAVE $80M, AGENCY SAYS

2. Social Safety

With an annual expenditure of about $1.5 trillion, Social Security constitutes 21% of the funds. It provides retirement and incapacity advantages to eligible residents. Given its function as a major earnings supply for a lot of retirees, any makes an attempt to cut back advantages face vital political resistance.

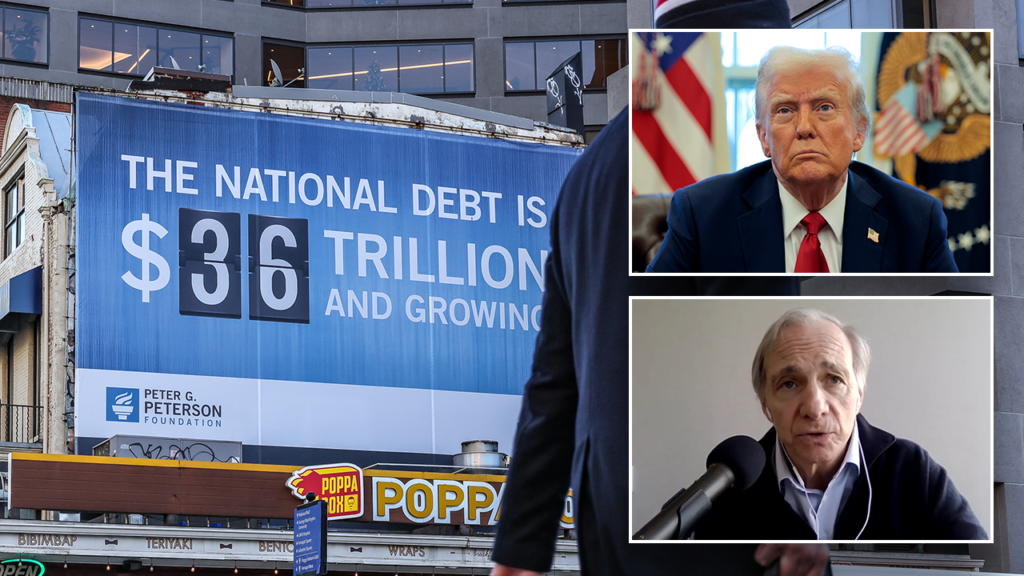

DOGE is slicing the funds. It is a good begin and never sufficient. FILE: The U.S. nationwide debt has exceeded $36 trillion. (All-In Podcast/Jemal Countess/Peter G. Peterson Basis/Chip Somodevilla/Getty Pictures)

3. Web curiosity on the debt

Right here lies the a part of the issue on why $40 trillion in debt is inevitable. Curiosity funds on the nationwide debt are at a staggering $1.1 trillion {dollars} a 12 months, comprising 15.6% of the funds. Because the debt grows and rates of interest rise, these debt funds are akin to a family that has runaway bank card debt on a one-way dead-end path to chapter.

4. Protection spending

The protection funds stands at roughly $884 billion, accounting for 12.5% of federal spending. This consists of funding for navy operations, personnel, tools, and analysis. Nationwide safety considerations and geopolitical dynamics make protection cuts politically delicate.

Once you add up all 4 of those line gadgets, it’s nearly 73% of the general fiscal funds. For sure, it is sensible to shake the federal authorities the other way up such as you have been searching for cash in a sofa as a result of that may be a begin to cut back the general authorities spending. Nevertheless, it gained’t make up for the cash we nonetheless must run these three main applications and as rates of interest keep excessive, our personal debt sinks us deeper and deeper right into a gap.

Decreasing spending in these areas is fraught with challenges. Healthcare and Social Safety are very important to tens of millions, and any cuts might have widespread social implications. Protection spending is carefully tied to nationwide safety, making reductions politically contentious. Curiosity funds are compulsory; because the debt escalates, so do these funds, making a vicious cycle.

What about producing extra income? The three largest income streams

Federal income is at present pacing to be just a little bit greater than $5 trillion {dollars} and, regardless of the excitement about tariffs and different taxes, we actually get income from three sources:

1. Particular person earnings taxes

These taxes contribute roughly 51.6% of whole federal income. Once you hear the rally cry of “tax the wealthy,” contemplating that nearly 50% of Individuals don’t pay any federal earnings tax in any respect, it’s a stark actuality that the principle method you develop income is to get the people who find themselves making a number of cash to pay extra. Rising earnings tax charges is politically difficult and will discourage financial development because the highest ranges of earnings are earned by those that begin the companies and create the roles for Individuals.

2. Payroll taxes

Accounting for about 33% of federal income, payroll taxes fund social insurance coverage applications like Social Safety and Medicare. Bear in mind, this largely consists of the 6.2% you pay for Social Safety, 1.45% for Medicare, and unemployment taxes. A number of proposals have been mentioned over the previous 25 years about learn how to overhaul earnings from these sources, together with an infinite tax in your earnings for Social Safety, rising the Social Safety tax over the subsequent ten years to 7.2%, and lengthening the conventional retirement age for these born in 1980 and after to the age of 70.

3. Company earnings taxes

Sadly, folks complain that if President Donald Trump lowers taxes on companies, it might badly harm the financial system. The truth is the taxes supplied by companies solely equal a paltry 9% of federal income. Even when tax charges on companies went again to 35%, the tax income earned from this alteration might pale compared to making the US aggressive for firms to find in our nation.

Elon Musk’s efforts to chop the federal authorities are solely chipping away the $36 trillion nationwide debt. FILE: Musk speaks on the Conservative Political Motion Convention (CPAC) on the Gaylord Nationwide Resort Lodge And Conference Middle on February 20, 2025 in Oxon Hill, Maryland. ((Picture by Andrew Harnik/Getty Pictures))

Increasing income from all these sources is problematic. Larger particular person taxes can dampen shopper spending and financial savings. Elevated payroll taxes place a burden on each workers and employers, probably affecting employment charges. Augmenting company taxes could drive companies to relocate operations overseas, diminishing the home tax base.

The political actuality: DOGE is a begin, however either side should give in to repair this drawback…

Thus far, DOGE estimates over $100 billion in financial savings. This can be a mixture of asset gross sales, contract/lease cancelations and renegotiations, fraud and improper fee deletion, grant cancelations, curiosity financial savings, programmatic adjustments, regulatory financial savings and workforce deductions. Let’s not make gentle of the truth that $100 billion {dollars} is significant, but it surely’s a far cry from closing the hole on the $2 trillion-dollar fiscal deficit we’re operating now, with half of that deficit being the web curiosity on the debt.

CLICK HERE FOR MORE FOX NEWS OPINION

What Individuals hate most is listening to dangerous information or troublesome information, which is why we elect new presidents who’ve nice approval rankings till they begin making the onerous adjustments. No person likes the onerous adjustments. Approval rankings go down and politicians alter to turn out to be extra favorable to the American public.

Whereas Republicans speak about fiscal accountability, they’ve largely deserted the struggle for balanced budgets. We’d like one now within the worst method attainable. The nationwide debt surged beneath each Presidents George W. Bush and Trump, proving that even so-called conservatives are prepared to spend freely when it fits their agenda.

The truth is the taxes supplied by companies solely equal a paltry 9% of federal income. Even when tax charges on companies went again to 35%, the tax income earned from this alteration might pale compared to making the US aggressive for firms to find in our nation.

In the meantime, Democrats overtly embrace large authorities enlargement, arguing that “deficits don’t matter” and that the wealthy can merely be taxed extra to cowl the associated fee. It is all the time the Democratic reply, play Robin Hood. Take from the wealthy and provides to those that deserve it extra (even after you busted your tail to earn it).

The reality is, taxing the rich won’t ever be sufficient. Even when the federal government confiscated all of the wealth of America’s billionaires, it might barely make a dent within the nationwide debt. The one actual answer is to each reduce spending and improve taxes on the similar time, however there is no such thing as a political will on both facet to take action. Any try at fiscal restraint is met with fierce opposition from particular curiosity teams and politicians, media outrage and accusations of cruelty on one facet or the opposite.

The trail ahead: we’re caught, and it’s why we’ll hit $40 trillion

The U.S. is racing towards $40 trillion in debt, and the implications can be extreme. Inflation, financial stagnation and a declining international standing are only a few of the dangers we face if we don’t get our fiscal home so as.

CLICK HERE TO GET THE FOX NEWS APP

When your children cry within the sweet retailer, do you all the time give in and purchase them a bit of sweet? The reply isn’t any. The reply isn’t what Individuals need to hear. The reply is it’s time to keep away from a full-blown financial disaster by way of severe spending cuts, entitlement reform and a return to sound fiscal coverage. This gained’t be straightforward, and it gained’t be well-liked, however the different — a bankrupt America — is much worse.

Until we do one thing quickly, Washington’s habit to spending and a political class unwilling to make powerful selections, hitting $40 trillion in debt isn’t simply attainable — it’s inevitable.