New Delhi: Diageo India, a subsidiary of British liquor large Diageo Plc, anticipates that the recently-announced India-UK free commerce settlement (FTA) will assist decrease costs for imported spirits, with some classes seeing a excessive single-digit discount, probably lifting demand for its alcoholic drinks.

Additionally Learn | Why Diageo’s Hina Nagarajan is leaving on a high

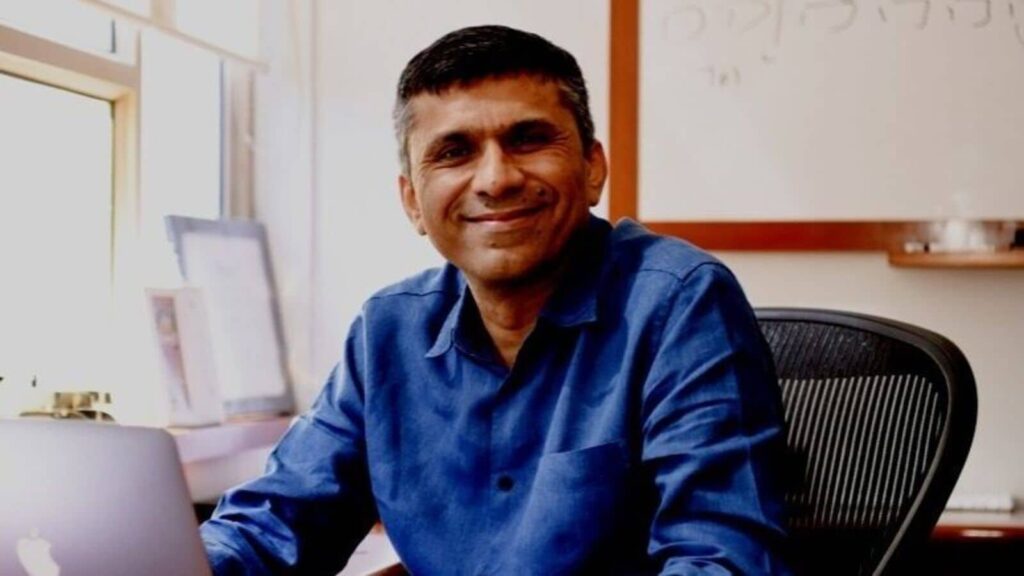

“The India-UK free commerce settlement, which has halved the responsibility on scotch from 150% to 75%, is landmark. It shall improve accessibility of scotch on this planet’s largest whiskey market. As a class captain, for USL, it presents a priceless alternative to drive deeper penetration and introduce new premium choices that cater to India’s evolving repertoire of customers,” Praveen Someshwar, chief govt officer and managing director, mentioned through the firm’s earnings name on Friday.

USL, or United Spirits Ltd, is an Indian drinks firm and a subsidiary of Diageo.

Earlier this month, India and the UK finalized the FTA, agreeing to scale back the 150% import responsibility on scotch whisky and gin to 75% initially, with an extra lower to 40% over the following decade.

Additionally Learn | We strictly adhere to regulations: Diageo’s Varun Koorichh

Diageo India manufactures, sells, and distributes manufacturers similar to Johnnie Walker, Ketel One, Tanqueray, Captain Morgan and McDowell’s No1, with a portion of its portfolio made domestically and one other half imported.

The corporate’s chief monetary officer, Pradeep Jain, mentioned that the responsibility discount from 150% to 75% might end in roughly a high-single digit lower in shopper costs.

This may also assist carry volumes for the corporate, he added.

Additionally Learn | Indian single malts keep up spirits despite Trump’s tariff heat

“Not simply we, my sense is that the federal government may also insist that we go on the pricing profit to the buyer. We’re completely of the identical view that we’d need to go on this profit utterly to the buyer. And subsequently, conserving the buyer spend fixed, it’s affordable to imagine that on this a part of the portfolio, a excessive single digit extra quantity progress ought to happen—that is on the bottled in origin (BIO) portfolio,” he mentioned.

For spirits bottled in India, or BII, the worth discount might be within the vary of 4-5%.

To make sure, BII refers to spirits which are shipped to India in bulk and bottled throughout the nation, together with each worldwide manufacturers and domestically blended spirits. These merchandise dominate the ₹1,000–2,000 value phase. This consists of manufacturers similar to 100 Pipers and Trainer’s scotch.

BIO refers to spirits which are completely produced and bottled exterior of India earlier than being imported on the market—as an example merchandise made and packaged within the UK like scotch whisky.

“There can be a profit that accrues into the uncooked materials costs additionally, however once more, we are going to take a name on that as and when that occurs. There’s nonetheless some quantity of labor to occur earlier than this really turns into laws. So, in all probability the profit will begin coming solely within the monetary yr 2026-2027,” Jain mentioned.

Commenting on potential improve in competitors on account of responsibility discount, Someshwar mentioned, “Any play by a competitor will develop the pie—to me, that’s an thrilling house to be in.”

Diageo is a big participant within the Indian liquor market, competing with corporations like Pernod Ricard and Allied Blenders and Distillers Ltd.

For the complete yr ended March 2025, the corporate reported gross revenues of ₹26,780 crore, a 5.4% year-on-year improve. Within the March quarter, the corporate noticed a ten.5% rise in reported web gross sales to ₹2,946 crore, attributed to portfolio resilience and the resumption of enterprise in Andhra Pradesh. Revenue after tax for the quarter was ₹451 crore, up 17.4%, and gross revenue elevated by 13.4%, resulting in a gross margin of 44.5%.