Some buyers depend on dividends for rising their wealth, and should you’re a kind of dividend sleuths, you may be intrigued to know that Detection Know-how Oyj (HEL:DETEC) is about to go ex-dividend in simply 4 days. The ex-dividend date is often two enterprise days earlier than the report date, which is the deadline for shareholders to be current on the corporate’s books to be eligible for a dividend fee. The ex-dividend date is a vital date to concentrate on as any buy of the inventory made on or after this date may imply a late settlement that does not present on the report date. In different phrases, buyers should buy Detection Know-how Oyj’s shares earlier than the twenty eighth of March so as to be eligible for the dividend, which will likely be paid on the seventh of April.

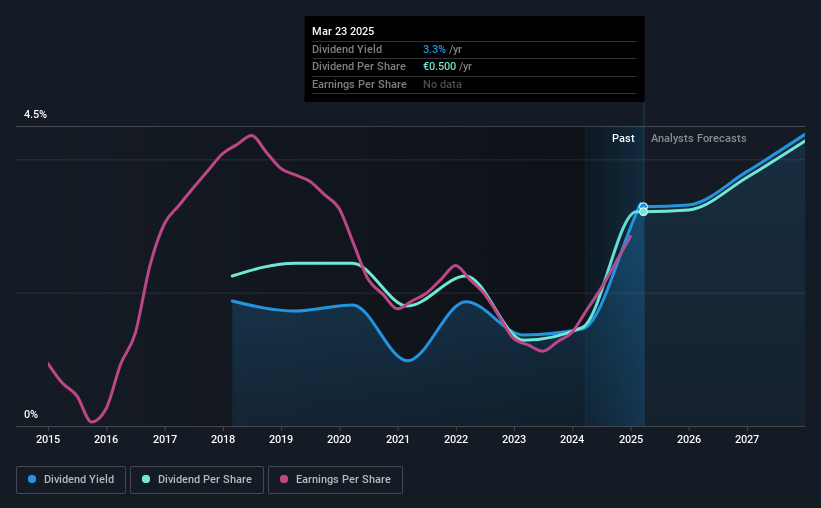

The corporate’s upcoming dividend is €0.50 a share, following on from the final 12 months, when the corporate distributed a complete of €0.50 per share to shareholders. Primarily based on the final 12 months’s value of funds, Detection Know-how Oyj inventory has a trailing yield of round 3.3% on the present share worth of €15.20. Dividends are an vital supply of earnings to many shareholders, however the well being of the enterprise is essential to sustaining these dividends. We have to see whether or not the dividend is roofed by earnings and if it is rising.

If an organization pays out extra in dividends than it earned, then the dividend may grow to be unsustainable – hardly a perfect scenario. Detection Know-how Oyj is paying out a suitable 66% of its revenue, a standard payout stage amongst most corporations. But money flows are much more vital than earnings for assessing a dividend, so we have to see if the corporate generated sufficient money to pay its distribution. What’s good is that dividends have been properly lined by free money stream, with the corporate paying out 19% of its money stream final 12 months.

It is encouraging to see that the dividend is roofed by each revenue and money stream. This usually suggests the dividend is sustainable, so long as earnings do not drop precipitously.

View our latest analysis for Detection Technology Oyj

Click on here to see the company’s payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Rising?

Companies with shrinking earnings are difficult from a dividend perspective. If earnings fall far sufficient, the corporate could possibly be pressured to chop its dividend. So we’re not too excited that Detection Know-how Oyj’s earnings are down 2.7% a 12 months over the previous 5 years.

The principle manner most buyers will assess an organization’s dividend prospects is by checking the historic price of dividend progress. Previously seven years, Detection Know-how Oyj has elevated its dividend at roughly 5.2% a 12 months on common. That is attention-grabbing, however the mixture of a rising dividend regardless of declining earnings can usually solely be achieved by paying out extra of the corporate’s earnings. This may be worthwhile for shareholders, however it could actually’t go on endlessly.

To Sum It Up

Is Detection Know-how Oyj a beautiful dividend inventory, or higher left on the shelf? The payout ratios are inside an affordable vary, implying the dividend could also be sustainable. Declining earnings are a severe concern, nevertheless, and will pose a risk to the dividend in future. All issues thought of, we aren’t notably enthused about Detection Know-how Oyj from a dividend perspective.

If you happen to’re not too involved about Detection Know-how Oyj’s capability to pay dividends, you must nonetheless be conscious of a number of the different dangers that this enterprise faces. For instance, we have discovered 1 warning sign for Detection Technology Oyj that we suggest you think about earlier than investing within the enterprise.

A typical investing mistake is shopping for the primary attention-grabbing inventory you see. Right here you could find a full list of high-yield dividend stocks.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join an infinite variety of Portfolios and see your whole in a single forex

• Be alerted to new Warning Indicators or Dangers through electronic mail or cellular

• Observe the Truthful Worth of your shares

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to deliver you long-term centered evaluation pushed by elementary knowledge. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.