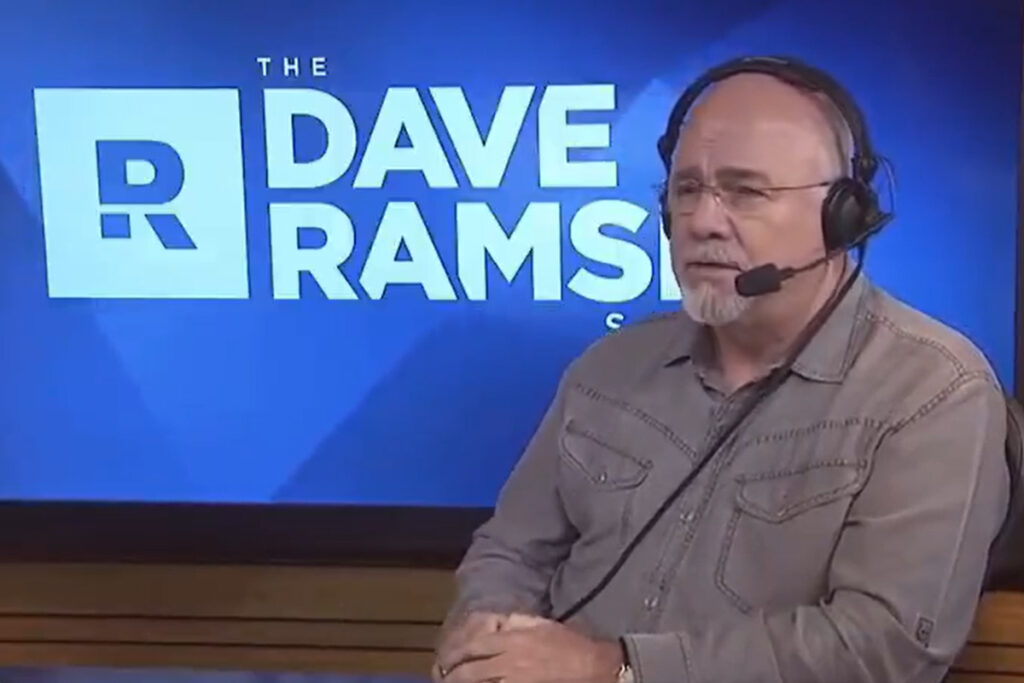

In the case of constructing a powerful monetary basis, cash guru Dave Ramsey believes that age or beginning late will not be an element – and that one may be steady with only a few, sensible monetary selections.

That is what Ramsey informed a 50-year-old girl who has been widowed for 15 years, who just lately called the Dave Ramsey present looking for recommendation on the right way to save for retirement. She helped put her youngsters via school and ran the family singlehandedly for over a decade.

She disclosed that her obligations did not permit her to prioritise her life targets, together with retirement plans. Though she now has the bandwidth to begin constructing retirement financial savings, she is clueless about the place to start, the investments to make, and the way a lot she ought to contribute to them each month.

Ramsey Presents a Simple Resolution

Upon listening to in regards to the girl’s monetary ordeal, the monetary guru disclosed a easy method to assist her scenario. He defined that if she saves and invests $1,000 month-to-month for 15 years beginning at present, she’d have property value virtually $500,000 at age 65.

Nonetheless, Ramsey clarified that she will not be wealthy, however half one million {dollars} will guarantee she would not spend her retirement chilly and hungry. Whereas the technique may also help attain a extra steady state by retirement, there are a number of extra methods the widow can attempt to enhance her financial savings additional.

Apart from this tip, listed below are different methods that can assist you construct a pleasant honey pot even afterward in life:

Leverage Catch-up Contributions

Individuals age 50 or older could make additional contributions to their tax-advantaged retirement plans like 401(ok)s or particular person retirement accounts (IRAs) on high of the annual contribution restrict to cowl misplaced time. In 2024, 401(ok) account holders can contribute a most of $23,000.

Nonetheless, these 50 and older can make investments an extra $7,500 as catch-up contributions to take the overall quantity they will put right into a 401(ok) to $30,500. Individuals with out entry to 401(ok)s can contribute as much as $7,000 yearly into IRAs in 2024. Nonetheless, these above 50 can contribute an extra $1,000 or $8,000 to the tax-deferred retirement account.

If the lady on the Dave Ramsey present maxes out her 401(ok), contemplating she has one, beginning on the age of fifty till 65, she may amass a fortune north of $800,000, contemplating annual funding returns of 8%.

Rent A Monetary Adviser

Beginning retirement planning from scratch at age 50 may very well be intimidating for many. An individual’s threat tolerance typically tanks as they age, making investing in progress shares in a risky market troublesome. The scenario turns into extra advanced in the event you lack monetary information.

Therefore, it’s crucial for the widow to rent a monetary adviser following fiduciary requirements as a result of these consultants are mandated by regulation to work in one of the best curiosity of their purchasers. Skilled advisers assist create a complete, customised monetary roadmap that matches your monetary conditions and targets.

Licensed monetary planners may also help optimise capital allocation, provide publicity to progress shares whereas hedging market dangers, and navigate monetary pitfalls throughout financial upheavals. This fashion, you may keep on monitor until you retire whereas making certain you aren’t being misguided by advisers into shopping for merchandise that profit them or paying exorbitantly excessive charges that many cost.

Discovering the best monetary adviser is essential since these relationships final for years and will make or break your future desires. SmartAsset, a billion-dollar firm, is fixing the issue of discovering advisers that swimsuit consumer wants by matching you with as much as three vetted fiduciary consultants if you fill in a brief online questionnaire.

SmartAsset’s concierge staff will organize so that you can communicate with the advisers at no cost, empowering you to resolve if they’re best for you. The corporate claims to match over 50,000 individuals with fiduciary monetary advisers each month.

Disclaimer: Our digital media content material is for informational functions solely and never funding recommendation. Please conduct your individual evaluation or search skilled recommendation earlier than investing. Bear in mind, investments are topic to market dangers and previous efficiency would not point out future returns.