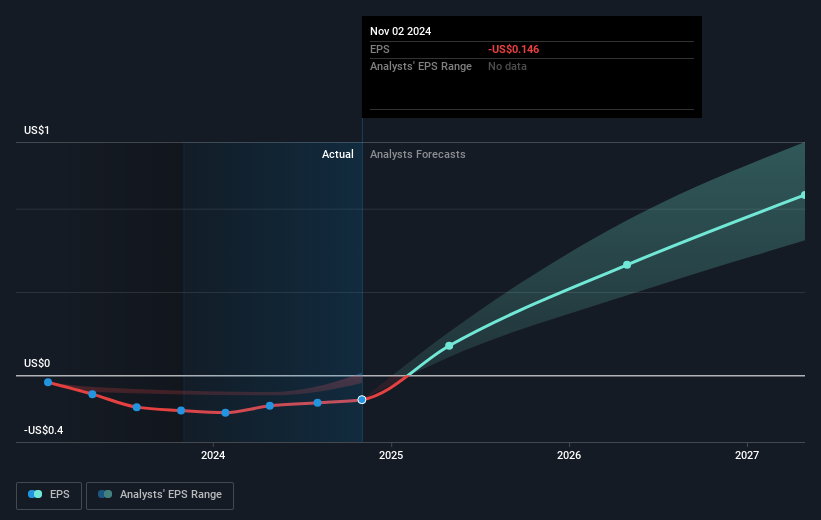

Credo Technology Group Holding (NasdaqGS:CRDO) skilled a 15.44% value improve within the final quarter, a interval that featured a number of important developments. The corporate’s earnings steering for the third quarter of fiscal 2025, projecting revenues between $115 million and $125 million, may have performed an important function. Moreover, their earnings announcement confirmed improved monetary efficiency, with second-quarter income rising to $72.03 million and internet losses shrinking by almost $2.4 million in comparison with the earlier yr. This monetary progress aligns with broader market tendencies, the place the tech-heavy Nasdaq witnessed fluctuations as a consequence of various sentiments about inflation and rates of interest. Regardless of a 5.5% month-to-month decline for the Nasdaq, different key tech shares confirmed resilience, maybe reflecting investor optimism in sure know-how sectors. The general market context, together with fluctuating inflation information impacting the tech sector, might need added context for traders assessing Credo’s prospects and contributing to its constructive inventory efficiency.

Get an in-depth perspective on Credo Technology Group Holding’s performance by reading our analysis here.

Over the previous three years, Credo Know-how Group Holding has delivered a complete shareholder return of 252.36%. Throughout this era, the corporate’s annual development considerably outpaced the US Semiconductor trade, which noticed a return of 19.3% over the previous yr. Key occasions contributing to this efficiency embrace launching progressive merchandise just like the Toucan and Magpie Retimers, which have been launched in October 2024 to reinforce efficiency in purposes equivalent to generative AI infrastructure. Moreover, collaboration with Internet One Techniques, introduced in November 2024, expanded the distribution of Credo’s merchandise in Japan, boosting their market presence.

The corporate additionally noticed enhancements in monetary efficiency, with constant income development amid monetary restructuring. Noteworthy was the increase of $175 million via a follow-on fairness providing accomplished in December 2023, which was instrumental in supporting additional growth. Concurrently, govt adjustments, equivalent to appointing a brand new Chief Authorized Officer in August 2024, mirrored inner changes aimed toward strengthening governance and future-proofing the corporate’s trajectory.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information

and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your

monetary scenario. We goal to deliver you long-term targeted evaluation pushed by elementary information.

Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials.

Merely Wall St has no place in any shares talked about.

New: AI Inventory Screener & Alerts

Our new AI Inventory Screener scans the market on daily basis to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Shopping for

• Excessive development Tech and AI Corporations

Or construct your individual from over 50 metrics.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e mail editorial-team@simplywallst.com