- In current days, Seagate Know-how Holdings has been the main focus of heightened analyst optimism and collaboration initiatives amid fast advances in knowledge storage and AI applied sciences.

- An actual-time demonstration with ZeroPoint Applied sciences on the OCP World Summit spotlighted improvements poised to handle effectivity and efficiency wants for hyperscale workloads.

- We’ll study how mounting analyst optimism about Seagate’s AI-driven progress prospects influences its total funding narrative.

Uncover the following massive factor with financially sound penny stocks that balance risk and reward.

Seagate Know-how Holdings Funding Narrative Recap

To personal Seagate Know-how Holdings inventory, you have to imagine within the firm’s capacity to profit from rising demand for knowledge storage amid fast AI adoption and cloud infrastructure progress. The current analyst optimism and breakthroughs in reminiscence compression expertise could affect sentiment, however near-term efficiency will nonetheless hinge on Seagate’s capacity to ramp up and monetize its newest storage options. A very powerful short-term catalyst stays execution on its HAMR-based Mozaic drive technique, whereas a excessive stage of debt continues to be an essential danger. The fast impression of the most recent analyst upgrades and expertise demonstration is constructive for momentum, however doesn’t materially change the profile of those important elements.

Among the many key current bulletins, Seagate’s partnership with ZeroPoint Applied sciences on the OCP World Summit stands out. The actual-time demonstration of hardware-accelerated reminiscence compression, concentrating on hyperscale workloads, is immediately associated to the central catalyst: gaining share and boosting effectivity in high-demand knowledge middle environments. This alignment with large-scale cloud and AI tendencies highlights how product innovation could play a task in shaping Seagate’s subsequent income cycle.

But, traders must also have in mind the chance that, even amid technological innovation and robust analyst backing, Seagate’s excessive debt load means any money circulate shortfalls may have an effect on each its monetary flexibility and future shareholder returns…

Read the full narrative on Seagate Technology Holdings (it’s free!)

Seagate Know-how Holdings’ outlook anticipates $12.0 billion in income and $2.5 billion in earnings by 2028. That is based mostly on a 9.5% annual income progress charge and a $1.0 billion improve in earnings from the present $1.5 billion.

Uncover how Seagate Technology Holdings’ forecasts yield a $204.35 fair value, a 3% draw back to its present worth.

Exploring Different Views

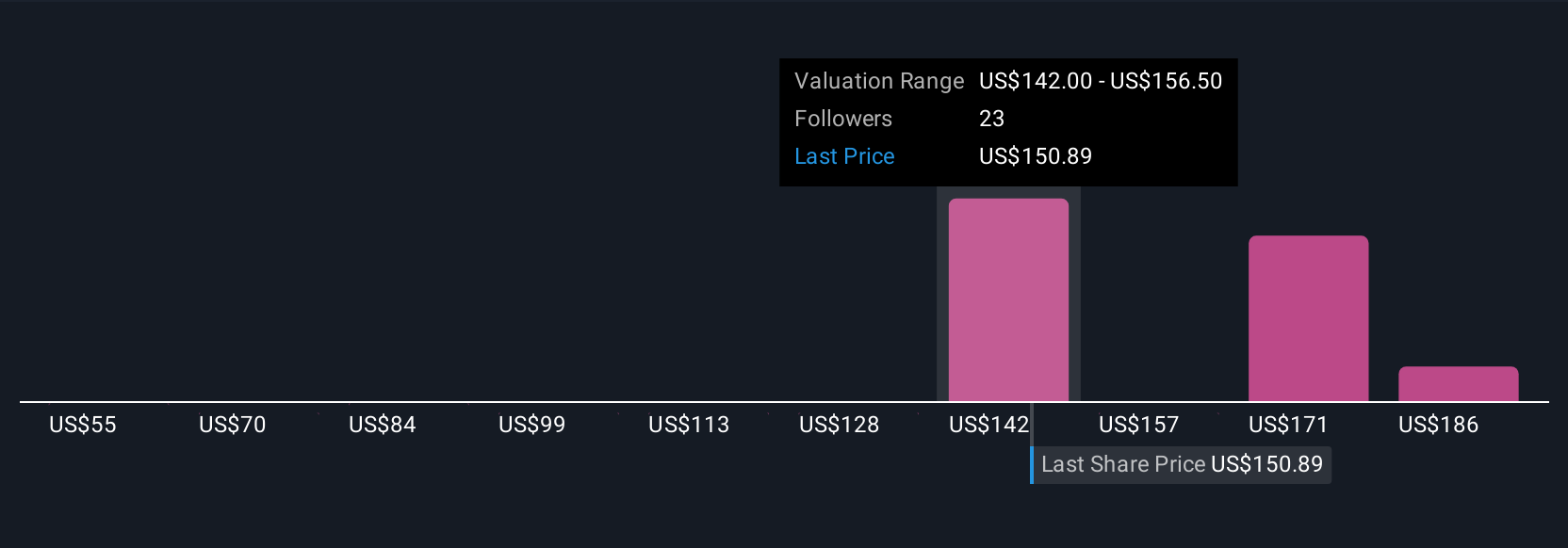

Truthful worth estimates from the Merely Wall St Neighborhood vary from as little as US$55 to as excessive as US$231, with 5 distinct views represented. With nearline exabyte demand and cloud build-outs seen as a core catalyst, you possibly can discover very totally different opinions on how a lot future progress is value.

Explore 5 other fair value estimates on Seagate Technology Holdings – why the inventory could be value as a lot as 9% greater than the present worth!

Construct Your Personal Seagate Know-how Holdings Narrative

Disagree with current narratives? Create your own in under 3 minutes – extraordinary funding returns hardly ever come from following the herd.

Need Some Alternate options?

Do not miss your shot on the subsequent 10-bagger. Our newest inventory picks simply dropped:

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge

and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your

monetary scenario. We intention to carry you long-term targeted evaluation pushed by elementary knowledge.

Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials.

Merely Wall St has no place in any shares talked about.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory traders, and it is free.

• Join a vast variety of Portfolios and see your complete in a single forex

• Be alerted to new Warning Indicators or Dangers by way of electronic mail or cell

• Monitor the Truthful Worth of your shares

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team@simplywallst.com