Sadly, investing is dangerous – corporations can and do go bankrupt. However whenever you decide an organization that’s actually flourishing, you may make greater than 100%. For instance, the Chanjet Info Expertise Firm Restricted (HKG:1588) share value has soared 124% within the final 1 12 months. Most can be very pleased with that, particularly in only one 12 months! It is also up 17% in a few month. Nonetheless, the inventory hasn’t executed so properly in the long term, with the inventory solely up 9.4% in three years.

Since it has been a powerful week for Chanjet Info Expertise shareholders, let’s take a look at development of the long term fundamentals.

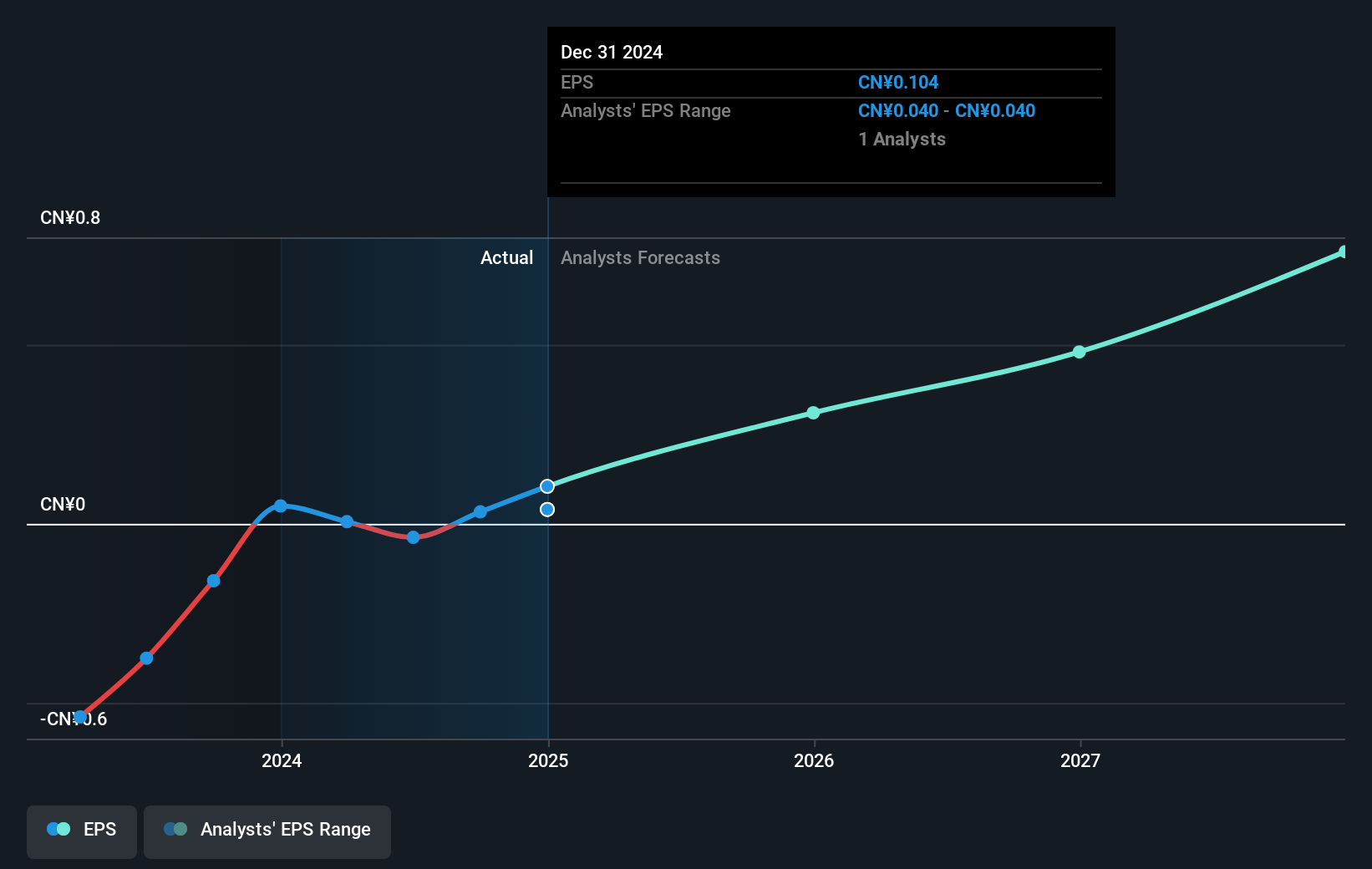

There is no such thing as a denying that markets are typically environment friendly, however costs don’t at all times mirror underlying enterprise efficiency. By evaluating earnings per share (EPS) and share value adjustments over time, we are able to get a really feel for the way investor attitudes to an organization have morphed over time.

Chanjet Info Expertise went from making a loss to reporting a revenue, within the final 12 months.

The corporate was near break-even final 12 months, so earnings per share of CN¥0.10 is not notably stand out. However from the appears to be like of the share value achieve, the market is actually happy the corporate is now worthwhile. Some traders scan for corporations which have simply change into worthwhile, since that is an essential enterprise improvement milestone.

The corporate’s earnings per share (over time) is depicted within the picture under (click on to see the precise numbers).

It’s after all wonderful to see how Chanjet Info Expertise has grown income through the years, however the future is extra essential for shareholders. In case you are pondering of shopping for or promoting Chanjet Info Expertise inventory, it’s best to try this FREE detailed report on its balance sheet.

A Totally different Perspective

It is good to see that Chanjet Info Expertise has rewarded shareholders with a complete shareholder return of 124% within the final twelve months. Because the one-year TSR is healthier than the five-year TSR (the latter coming in at 5% per 12 months), it will appear that the inventory’s efficiency has improved in latest instances. Given the share value momentum stays sturdy, it is perhaps price taking a better have a look at the inventory, lest you miss a possibility. Earlier than forming an opinion on Chanjet Info Expertise you would possibly need to think about these 3 valuation metrics.

We’ll like Chanjet Info Expertise higher if we see some huge insider buys. Whereas we wait, try this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please notice, the market returns quoted on this article mirror the market weighted common returns of shares that at the moment commerce on Hong Kong exchanges.

New: AI Inventory Screener & Alerts

Our new AI Inventory Screener scans the market day-after-day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Shopping for

• Excessive development Tech and AI Firms

Or construct your individual from over 50 metrics.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to carry you long-term targeted evaluation pushed by basic information. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.