See our latest analysis for Carpenter Technology.

After posting a 41.88% year-to-date share worth return and a exceptional 60.32% whole shareholder return over the previous yr, Carpenter Expertise’s newest climb to $249.00 means that investor optimism is holding regular, at the same time as momentum has cooled off barely from earlier highs. The inventory’s sturdy multi-year positive aspects nonetheless put it far forward of the place it began, which additional reinforces its development story within the capital items house.

In the event you’re inquisitive about different shares exhibiting sturdy upward traits, now is an effective second to broaden your search and uncover fast growing stocks with high insider ownership

With shares up sharply over the previous yr however nonetheless buying and selling about 31 % beneath the typical analyst worth goal, the query stays: is Carpenter Expertise undervalued at present ranges, or has the market already factored in its future development potential?

Most In style Narrative: 23.6% Undervalued

In comparison with its final shut of $249.00, the narrative’s honest worth for Carpenter Expertise factors to appreciable upside and spotlights sturdy catalysts driving the consensus view.

The continuing ramp in international aerospace demand, highlighted by prolonged lead instances, pressing protection orders, and sturdy multi-year provide contracts, positions Carpenter to speed up income development as OEM construct charges enhance, notably in next-generation and extra fuel-efficient plane. This helps each top-line growth and recurring revenues.

Wish to know what’s supercharging analyst optimism? There’s a daring prediction about earnings and margins often reserved for business giants. The complete narrative exposes which monetary shifts gasoline such a premium worth goal. Curious what’s behind these bold development calls?

Consequence: Truthful Worth of $325.72 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

Nevertheless, the corporate’s reliance on cyclical aerospace demand and the dangers of expensive capability growth may current challenges to the present upbeat outlook.

Find out about the key risks to this Carpenter Technology narrative.

One other View: Our DCF Mannequin Tells a Totally different Story

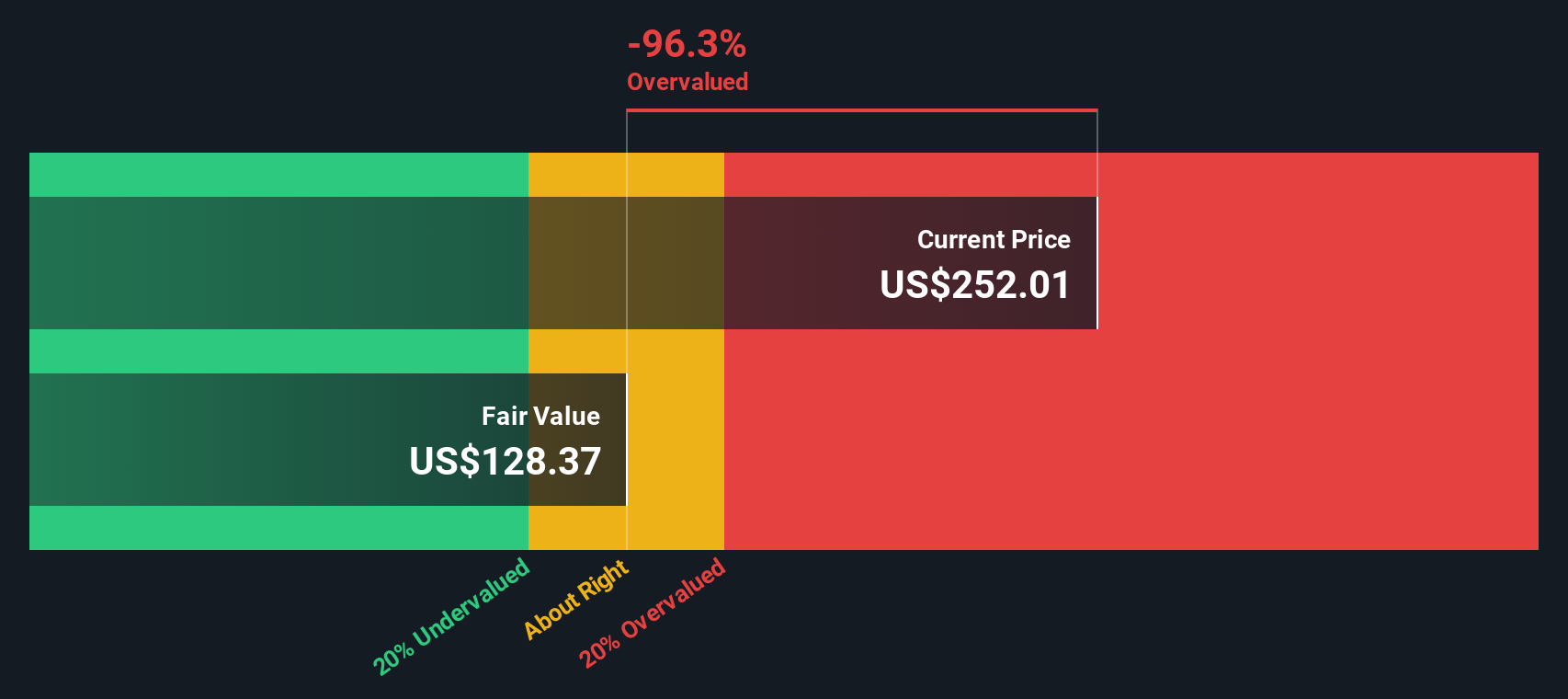

Carpenter Expertise by the lens of our DCF mannequin paints a extra cautious image. Whereas the consensus worth goal suggests the inventory is undervalued, our SWS DCF mannequin factors to Carpenter’s present worth being properly above its estimated honest worth. This hints at higher draw back threat if optimistic assumptions don’t materialize. Is the market’s confidence too far forward of itself, or is there extra upside to unlock?

Look into how the SWS DCF model arrives at its fair value.

Construct Your Personal Carpenter Expertise Narrative

In the event you’d fairly dig into the details firsthand and form your individual perspective, you’ll be able to craft a Carpenter Expertise narrative with your individual evaluation in simply minutes. Do it your way

An ideal place to begin on your Carpenter Expertise analysis is our evaluation highlighting 4 key rewards and 1 important warning sign that would impression your funding determination.

In search of Extra Funding Concepts?

Good traders by no means restrict their choices. Keep forward of market shifts by seizing alternatives others overlook with these highly effective inventory screeners from Merely Wall St:

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information

and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your

monetary scenario. We intention to carry you long-term targeted evaluation pushed by basic information.

Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials.

Merely Wall St has no place in any shares talked about.

New: AI Inventory Screener & Alerts

Our new AI Inventory Screener scans the market each day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Shopping for

• Excessive development Tech and AI Corporations

Or construct your individual from over 50 metrics.

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team@simplywallst.com