Together with the various advantages of synthetic intelligence – from offering actual time navigation to early illness detection – the explosion in its use has elevated alternatives for fraud and deception.

Giant and small companies and even the Australian Taxation Workplace (ATO) could also be hit with fraudulent reimbursement claims, that are virtually unimaginable to tell apart from legit receipts and invoices.

People additionally must be cautious.

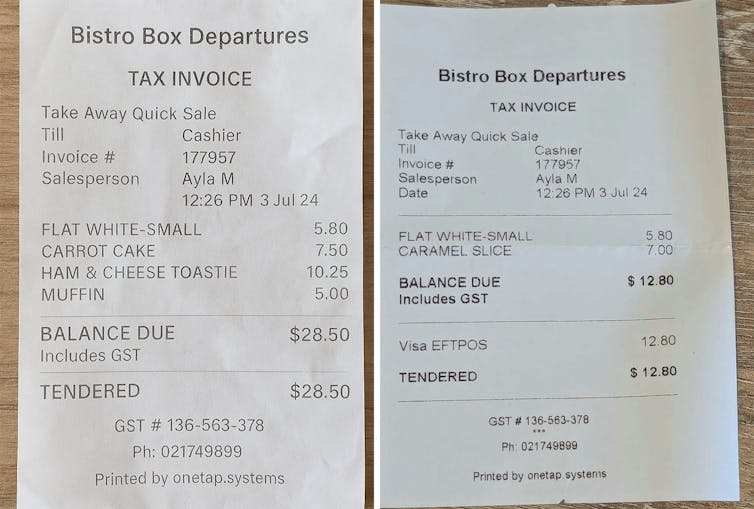

Have a look at the pictures of the receipts proven under. One paperwork a real transaction. The opposite was created utilizing ChatGPT. Can you notice the faux?

Writer supplied.

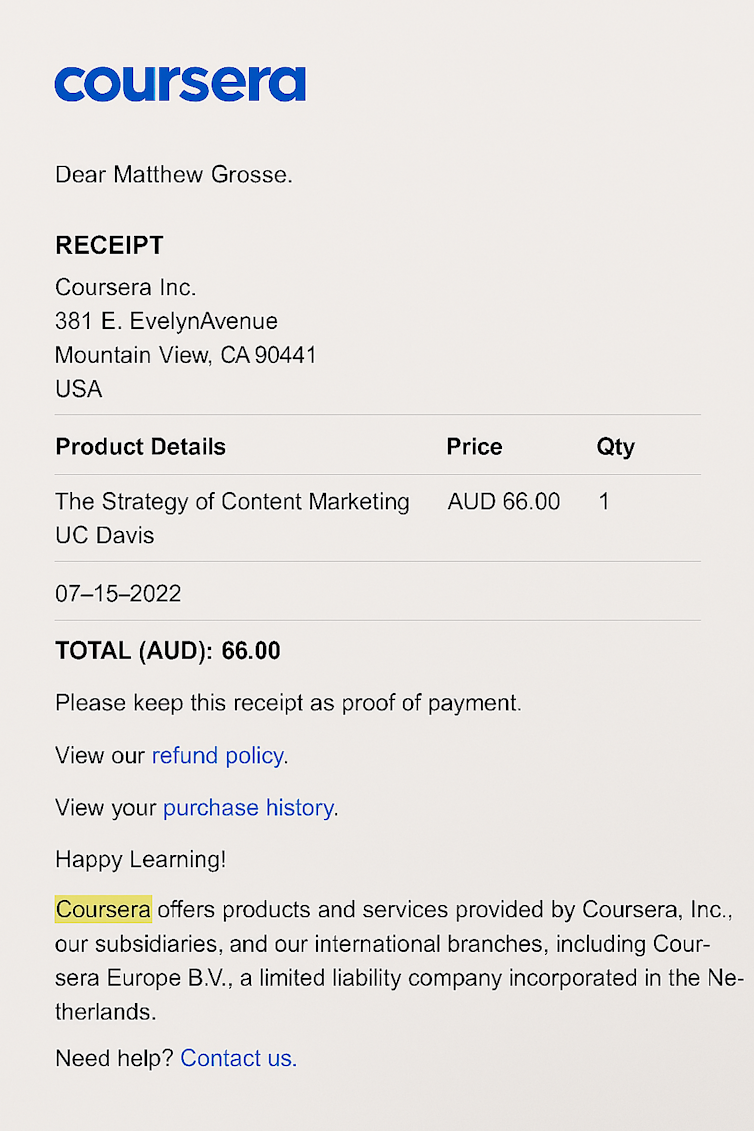

Now take a look at this one.

Writer supplied.

You probably couldn’t – and that’s precisely the purpose. Techniques which may reproduce close to good counterfeits of legit monetary paperwork are more and more prevalent and complicated.

Final week, OpenAI launched an improved picture era mannequin which may create pictures with photorealistic outputs together with textual content.

Why ought to we care?

Fraud involving faux monetary paperwork is a large world situation. The worldwide Association of Certified Fraud Examiners estimate organisations lose roughly 5% of income to fraud every year.

In its 2024 report, the affiliation paperwork losses exceeding US$3.1 billion throughout 1,921 circumstances. Billing and expense fraud represent 35% of asset misappropriation circumstances, with companies reporting median losses of US$150,000 per incident.

Most regarding, fraudsters primarily conceal these crimes by creating faux paperwork or altering recordsdata, precisely what AI now simplifies.

Faux paperwork allow fraud in numerous methods. An worker would possibly create a fictitious receipt for a enterprise lunch that by no means occurred, or a contractor would possibly fabricate receipts for bills by no means incurred. In every case, the fraudster makes use of counterfeit documentation to extract cash they’re not entitled to.

This downside is probably going extra widespread than recognised. A 2024 survey revealed 24% of workers admitted to expense fraud, with one other 15% contemplating it.

Much more regarding, 42% of UK public sector resolution makers confessed to submitting fraudulent claims.

AI removes limitations to deception

Understanding how AI expertise might result in a surge in potential fraud requires analyzing the traditional “fraud triangle”. This explains that fraud requires three parts: incentives, rationalisation and alternative.

Traditionally, technical limitations restricted the flexibility to create faux documentation even when motivation existed.

AI eliminates these limitations by making faux documentation straightforward to create. Research confirms when alternative expands, fraud will increase.

When faux claims change into everybody’s downside

When faux receipts assist tax deductions, all of us pay.

Take into account a advertising guide incomes $120,000, who makes use of an AI picture generator to create a number of convincing receipts for non-existent bills totalling $4,000. At their marginal tax fee of 30%, this fraud saves them about $1,200 in taxes – if they aren’t caught.

The Australian Taxation Workplace estimates a $2.7 billion annual annual hole from incorrectly over-claimed deductions by small companies. With digital forgery changing into extra accessible, this hole might widen considerably.

Writer supplied.

Faux receipts and invoices

Customers are additionally changing into more and more weak to scammers utilizing AI-generated receipts and invoices.

Think about receiving what seems to be like an official bill out of your power supplier. The one distinction? The cost particulars direct funds to a scammer’s account.

That is already occurring. The Australian Competitors and Shopper Fee reported greater than $3.1 billion lost to scams in 2023, with cost redirection fraud rising quickly.

As AI instruments make creating and enhancing convincing enterprise documentation simpler, these rip-off numbers have the potential to extend.

The rising menace

This vulnerability for each companies and shoppers is amplified by our rising reliance on digital documentation.

As we speak, many companies situation receipts in digital codecs. Expense administration programs sometimes require workers to submit pictures or scans of receipts. Tax authorities additionally settle for electronically saved documentation.

With paper receipts changing into more and more uncommon and paper’s bodily security measures gone, digital forgeries change into practically unimaginable to identify via visible inspection alone.

Is digital authentication the reply?

One potential countermeasure is the Content Provenance and Authenticity (C2PA) standard. The C2PA commonplace embeds AI generated pictures with verifiable details about file origin.

Nevertheless, a significant weak point stays, as customers can take away metadata by taking a screenshot of a picture. For companies and tax authorities, digital authentication requirements are simply a part of the reply to stylish digital forgery. But reverting to paper documentation isn’t possible in our digital period.

Seeing is not believing

AI’s means to create real looking faux monetary paperwork basically adjustments our method to expense verification and monetary safety.

The standard visible inspection of receipts and invoices is quickly changing into out of date.

Companies, tax authorities and people must adapt shortly by implementing verification programs that transcend merely documentation.

This would possibly embody transaction matching with financial institution data, and automatic anomaly detection programs that flag uncommon spending patterns. Maybe using blockchain expertise will broaden to assist confirm transactions.

The hole between what AI can create and what our programs can reliably confirm continues to widen. So how can we keep belief in monetary transactions in a world the place seeing is not believing?