Please word that we’re not authorised to offer any funding recommendation. The content material on this web page is for info functions solely.

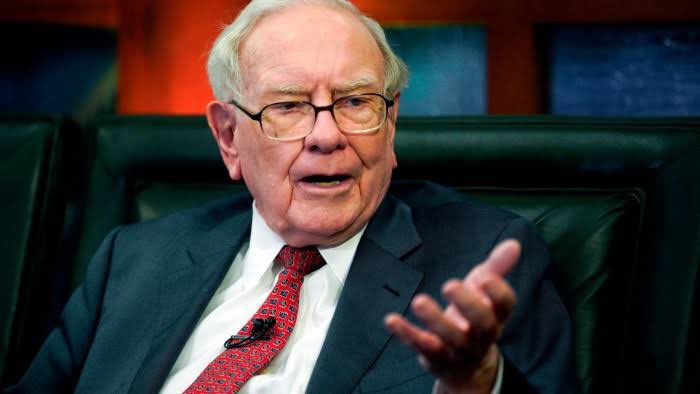

Berkshire Hathaway held its annual assembly yesterday. At that occasion, CEO Warren Buffett introduced his retirement after heading the corporate for six a long time. Listed below are the important thing takeaways from the corporate’s annual assembly.

“Tomorrow, we’re having a board assembly of Berkshire, and we have now 11 administrators. Two of the administrators, who’re my youngsters, Howie and Susie, know of what I’m going to speak about there. The remainder of them, this can come as information to, however I feel the time has arrived the place Greg ought to change into the chief govt officer of the corporate at 12 months finish,” stated Buffett on the assembly.

Buffett Declares His Retirement from Berkshire

In the meantime, although Buffett introduced his retirement, he pressured that he didn’t intend to promote his stake within the conglomerate. I’ve no intention, zero, of promoting one share of Berkshire Hathaway. It would get given away step by step,” stated Buffett.

He added, “I’d add this: The choice to maintain each share is an financial resolution, as a result of I feel the prospects of Berkshire shall be higher beneath Greg’s administration than mine.”

“However I’ll are available in, and there might come a time after we get an opportunity to speculate some huge cash. When that point comes, I feel it could be useful with the board — the truth that they know I’ve bought all my cash within the firm, and I feel it’s sensible, and I’ve seen what Greg has achieved,” stated the “Oracle of Omaha” reaffirming his religion in Abel’s management.

Abel, on his half, signaled continuity on the conglomerate that owns a number of companies aside from stakes in publicly traded firms. “It’s actually the funding philosophy and the way Warren and the staff have allotted capital for the previous 60 years,” stated Abel. He added, “Actually, it is not going to change. And it’s the method we’ll take as we go ahead.”

Buffett Weighed in On Tariffs

Whereas Buffett’s retirement, which was disclosed in the direction of the tip of the annual assembly, is making all of the information, there have been another key takeaways from the occasion. For example, Buffett weighed in on the tariffs and stated, “Commerce shouldn’t be a weapon.”

He added, “I do suppose that the extra affluent the remainder of the world turns into, it received’t be at our expense, the extra affluent we’ll change into, and the safer we’ll really feel, and your youngsters will really feel sometime.”

Beforehand additionally Buffett took a swipe at the tariffs, saying, “Over time, they’re a tax on items. I imply, the tooth fairy doesn’t pay ’em!”

A number of economists have warned of a recession as a result of President Trump’s tariffs. JPMorgan, as an illustration, has raised the chances of a US recession this 12 months to 60% as in comparison with 40% earlier than the tariff announcement. In his word, Bruce Kasman, head of worldwide financial analysis, stated, “These insurance policies, if sustained, would probably push the US and probably international financial system into recession this 12 months.”

Whereas Trump sees tariffs as a software to handle the nation’s burgeoning commerce and price range deficit, many economists consider that they might solely find yourself elevating prices for Individuals. Jeremy Siegel, professor on the College of Pennsylvania’s Wharton College, stated, “I feel that is the largest coverage mistake in 95 years.”

Most of Berkshire’s Holdings Are within the US

Buffett, who predominantly invests in US firms, doesn’t see the tariffs as a severe headwind to US management. He stated, “We’ve gone by way of nice recessions, we’ve gone by way of world wars, we’ve gone by way of the event of an atomic bomb that we by no means dreamt of on the time I used to be born, so I’d not get discouraged about the truth that it doesn’t appear to be we’ve solved each drawback that’s come alongside.”

The nonagenarian added, “If I had been being born in the present day, I’d simply preserve negotiating within the womb till they stated you might be in the US.”

Buffett Warns on Hovering Deficit

In the meantime, Buffett warned in regards to the hovering price range deficit, saying, “We’re working at a fiscal deficit now that’s unsustainable over a really lengthy time frame. We don’t know whether or not meaning two years or 20 years, as a result of there’s by no means been a rustic like the US, however that is one thing that may’t go on perpetually.”

The US price range deficit has spiked ever for the reason that nation opened up its coffers to help the financial system amid the COVID-19 pandemic. Deficit hit a report excessive of $3.13 trillion within the fiscal 12 months 2021 however subsequently got here all the way down to $2.77 trillion within the subsequent fiscal 12 months. The deficit fell to $1.38 trillion within the fiscal 12 months 2023, however within the fiscal 12 months 2024, the price range deficit elevated to $1.8 trillion.

Because of the elevated deficit, the US nationwide debt has surpassed $36 billion and is sort of 123% of the GDP. For context, the ratio was beneath 60% firstly of this century and has risen considerably since then.

The deficit has continued to rise within the present fiscal 12 months. The US authorities’s price range deficit rose to $1.3 trillion within the first six months of the present fiscal 12 months, which is the second highest ever.

Fed Chair Jerome Powell has Been Cautioning on the Ballooning Deficit

Fed chair Jerome Powell has additionally been sounding an alarm over the ever-rising US debt pile. “It’s most likely time, or previous time, to get again to an grownup dialog amongst elected officers about getting the federal authorities again on a sustainable fiscal path,” stated the Fed chair final 12 months in an interview with CBS’s “60 Minutes.”

Extra not too long ago, talking on the Financial Membership of Chicago final month, Powell warned that “the federal debt in the US is on an unsustainable path, nevertheless it has not but reached an unsustainable stage, and nobody actually is aware of how a lot additional we will go.”

Powell pressured that the deficit will not be a “Federal Reserve drawback” and questioned the discretionary spending cuts focused by politicians whereas the true drawback lay elsewhere. “The biggest and fastest-growing parts are Medicare, Medicaid, Social Safety, and now curiosity funds, so that is certainly the place efforts must be centered, and these points can solely be resolved on a bipartisan foundation; neither facet can discover a resolution with out the involvement of each, so that is essential,” stated Powell.

Buffett Weighs in on Volatility

Berkshire’s cash pile rose to a record high of $347.7 billion on the finish of Q1, and whereas Buffett stated that the conglomerate was near doing a $10 billion deal,l however finally held again. Buffett, nevertheless, downplayed the recent market volatility and stated, “What has occurred within the final 30, 45 days … is basically nothing.”

Buffett stated that during the last six a long time, there have been three cases when Berkshire shares misplaced 50% in worth and added, “I don’t get fearful by issues that different folks … are afraid of in a monetary approach.”

He emphasised, “Let’s say Berkshire went down 50% subsequent week, I’d regard that as a improbable alternative, and it wouldn’t trouble me within the least.”