These holding Beijing CTJ Data Expertise Co., Ltd. (SZSE:301153) shares could be relieved that the share value has rebounded 25% within the final thirty days, but it surely must maintain going to restore the current injury it has brought on to investor portfolios. Not all shareholders might be feeling jubilant, for the reason that share value remains to be down a really disappointing 13% within the final twelve months.

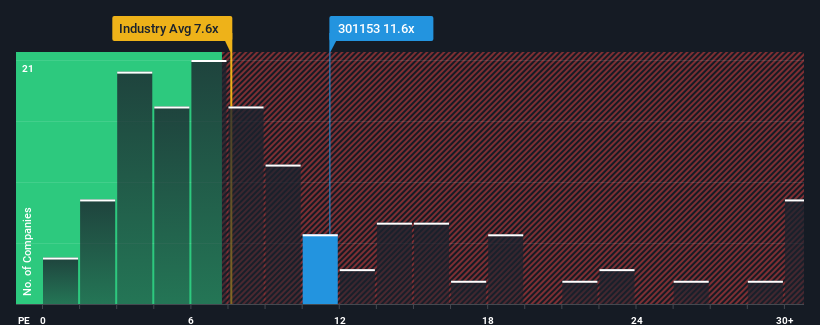

Following the agency bounce in value, you can be forgiven for considering Beijing CTJ Data Expertise is a inventory to avoid with a price-to-sales ratios (or “P/S”) of 11.6x, contemplating nearly half the businesses in China’s Software program {industry} have P/S ratios under 7.6x. Nonetheless, we would have to dig a bit of deeper to find out if there’s a rational foundation for the extremely elevated P/S.

Check out our latest analysis for Beijing CTJ Information Technology

What Does Beijing CTJ Data Expertise’s P/S Imply For Shareholders?

Whereas the {industry} has skilled income development recently, Beijing CTJ Data Expertise’s income has gone into reverse gear, which isn’t nice. It may be that many count on the dour income efficiency to get better considerably, which has saved the P/S from collapsing. If not, then current shareholders could also be extraordinarily nervous concerning the viability of the share value.

Eager to learn how analysts assume Beijing CTJ Data Expertise’s future stacks up towards the {industry}? In that case, our free report is a great place to start.

Do Income Forecasts Match The Excessive P/S Ratio?

As a way to justify its P/S ratio, Beijing CTJ Data Expertise would want to supply excellent development that is properly in extra of the {industry}.

In reviewing the final yr of financials, we have been disheartened to see the corporate’s revenues fell to the tune of 19%. Regardless, income has managed to elevate by a helpful 25% in mixture from three years in the past, due to the ancient times of development. So we will begin by confirming that the corporate has usually performed job of rising income over that point, regardless that it had some hiccups alongside the best way.

Turning to the outlook, the following yr ought to generate development of twenty-two% as estimated by the three analysts watching the corporate. With the {industry} predicted to ship 26% development, the corporate is positioned for a weaker income end result.

With this in consideration, we imagine it would not make sense that Beijing CTJ Data Expertise’s P/S is outpacing its {industry} friends. It appears most traders are hoping for a turnaround within the firm’s enterprise prospects, however the analyst cohort shouldn’t be so assured this may occur. Solely the boldest would assume these costs are sustainable as this stage of income development is more likely to weigh closely on the share value finally.

The Remaining Phrase

Beijing CTJ Data Expertise’s P/S has grown properly during the last month due to a helpful enhance within the share value. Typically, our desire is to restrict the usage of the price-to-sales ratio to establishing what the market thinks concerning the general well being of an organization.

Regardless of analysts forecasting some poorer-than-industry income development figures for Beijing CTJ Data Expertise, this does not seem like impacting the P/S within the slightest. Once we see a weak income outlook, we suspect the share value faces a a lot better danger of declining, bringing again down the P/S figures. This locations shareholders’ investments at important danger and potential traders in peril of paying an extreme premium.

Earlier than you agree in your opinion, we have found 3 warning signs for Beijing CTJ Information Technology (2 are probably critical!) that you have to be conscious of.

After all, worthwhile corporations with a historical past of nice earnings development are usually safer bets. So you might want to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

In the event you’re seeking to commerce Beijing CTJ Data Expertise, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With purchasers in over 200 international locations and territories, and entry to 160 markets, IBKR helps you to commerce shares, choices, futures, foreign exchange, bonds and funds from a single built-in account.

Get pleasure from no hidden charges, no account minimums, and FX conversion charges as little as 0.03%, much better than what most brokers supply.

Sponsored Content material

Valuation is advanced, however we’re right here to simplify it.

Uncover if Beijing CTJ Data Expertise may be undervalued or overvalued with our detailed evaluation, that includes truthful worth estimates, potential dangers, dividends, insider trades, and its monetary situation.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to carry you long-term targeted evaluation pushed by elementary information. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.