To discover a multi-bagger inventory, what are the underlying developments we must always search for in a enterprise? Firstly, we’ll wish to see a confirmed return on capital employed (ROCE) that’s rising, and secondly, an increasing base of capital employed. In the end, this demonstrates that it is a enterprise that’s reinvesting earnings at rising charges of return. Nonetheless, after investigating AUROS Know-how (KOSDAQ:322310), we do not assume it is present developments match the mould of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

For individuals who do not know, ROCE is a measure of an organization’s yearly pre-tax revenue (its return), relative to the capital employed within the enterprise. To calculate this metric for AUROS Know-how, that is the system:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Complete Property – Present Liabilities)

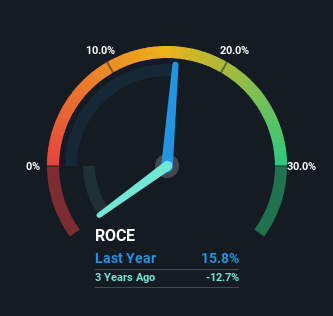

0.16 = ₩12b ÷ (₩96b – ₩21b) (Primarily based on the trailing twelve months to March 2025).

Subsequently, AUROS Know-how has an ROCE of 16%. By itself, that is a regular return, nevertheless it is significantly better than the 6.3% generated by the Semiconductor trade.

View our latest analysis for AUROS Technology

Above you possibly can see how the present ROCE for AUROS Know-how compares to its prior returns on capital, however there’s solely a lot you possibly can inform from the previous. In case you’re , you possibly can view the analysts predictions in our free analyst report for AUROS Technology .

What Can We Inform From AUROS Know-how’s ROCE Development?

When it comes to AUROS Know-how’s historic ROCE actions, the development is not improbable. During the last 5 years, returns on capital have decreased to 16% from 28% 5 years in the past. Though, given each income and the quantity of property employed within the enterprise have elevated, it may recommend the corporate is investing in development, and the additional capital has led to a short-term discount in ROCE. If these investments show profitable, this could bode very nicely for long run inventory efficiency.

The Backside Line

In abstract, regardless of decrease returns within the quick time period, we’re inspired to see that AUROS Know-how is reinvesting for development and has greater gross sales in consequence. In gentle of this, the inventory has solely gained 0.5% over the past three years. Subsequently we might suggest trying additional into this inventory to substantiate if it has the makings of funding.

If you wish to proceed researching AUROS Know-how, you is perhaps to know concerning the 1 warning sign that our evaluation has found.

Whereas AUROS Know-how is not incomes the very best return, take a look at this free list of companies that are earning high returns on equity with solid balance sheets.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join an infinite variety of Portfolios and see your complete in a single forex

• Be alerted to new Warning Indicators or Dangers through electronic mail or cellular

• Monitor the Truthful Worth of your shares

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to convey you long-term centered evaluation pushed by elementary knowledge. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.