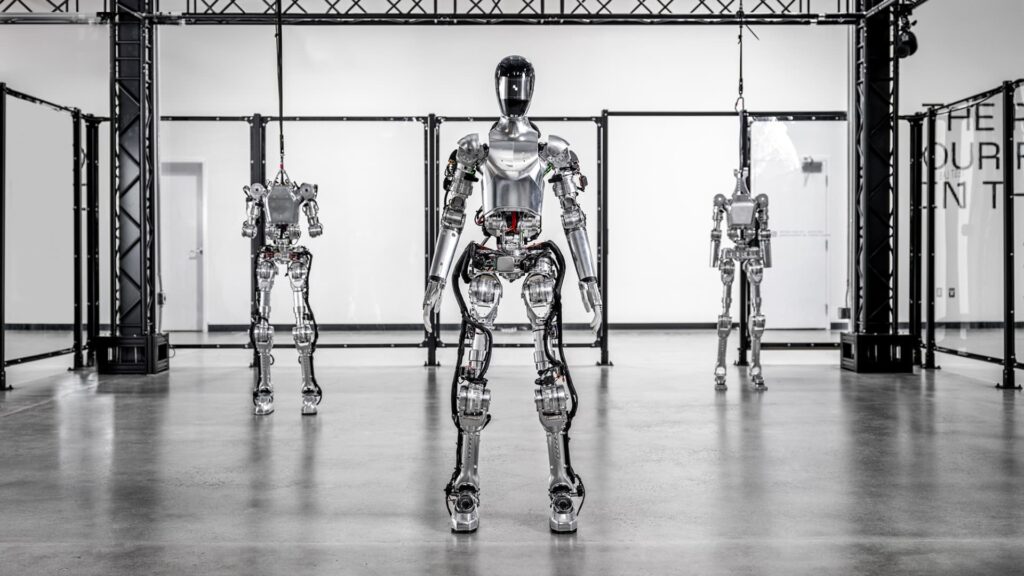

Brookfield Company’s partnership with humanoid robotic startup Determine AI might enhance the worth of its portfolio corporations and provides it a leg up within the synthetic intelligence race, in response to Wall Road analysts. Determine AI on Wednesday introduced a strategic partnership with Brookfield — one of many world’s largest various funding administration corporations with over $1 trillion of property — to develop what the businesses mentioned could be the world’s largest real-world humanoid pretraining dataset. The 2 corporations may even work to facilitate the deployment of autonomous humanoid robots throughout a number of industries. Moreover, Brookfield invested in Determine AI’s newest funding spherical of over $1 billion, which valued the humanoid maker at $39 billion. Morgan Stanley and RBC Capital Markets every reiterated their obese scores on Brookfield following the information, noting the settlement might drive productiveness positive aspects and, due to this fact, increased returns for buyers throughout Brookfield’s portfolio. The corporate owns a number of publicly listed and personal subsidiaries, together with Brookfield Asset Administration, Brookfield Renewable Companions, Brookfield Infrastructure Companions and Brookfield Enterprise Companions. “We see scope for humanoid robots to extend working margins of portfolio corporations throughout the Brookfield ecosystem, which incorporates the asset supervisor, BAM, and the infrastructure, renewables, personal fairness, and actual property holding corporations BIP, BEP, BBU, and BPG,” Morgan Stanley analyst Michael Cyprys mentioned in a observe to shoppers, including that the deal “helps OW name as BN creatively seems to extract larger returns, whereas increasing AI capabilities.” “Deploying humanoid robots probably improves the return profile of BAM investments and the funds from operation (FFO) of the working corporations, offering upside to distributions to buyers … and will drive higher efficiency payment earnings throughout the advanced,” Cyprys mentioned. Morgan Stanley’s and RBCs respective worth targets of $76 and $83 on Brookfield shares indicate 4.5% and 14% potential upside from Monday’s shut. The inventory is up 26% this 12 months and reached an all-time excessive on Monday. Cyprys and RBC analyst Bart Dziarski famous that the Brookfield-Determine AI settlement might be essential to unlocking positive aspects throughout Brookfield’s huge but undervalued actual property portfolio. That assortment consists of over 100,000 residential items, 500 million sq. toes of business workplace house and 160 million sq. toes of logistics house. Determine AI may even achieve crucial coaching information for its AI humanoids that can train the robots tips on how to transfer, understand and act throughout areas designed for people. The information assortment in Brookfield environments will enable the agency to see the way it can deploy humanoid robots inside its portfolio, analysts say. “Information assortment can permeate past Brookfield’s actual property footprint into its different property/working corporations throughout personal fairness, renewable, and infrastructure, of which Brookfield has main positions in every,” Dziarski mentioned, including that Brookfield’s actual property enterprise “stays closely discounted within the inventory.” BN 1Y mountain Brookfield Company inventory efficiency over the previous 12 months. Trying forward, Morgan Stanley’s Cyprys mentioned he wouldn’t be stunned to see different various funding managers search comparable partnerships to the Brookfield-Determine AI deal, as they’ve an enormous quantity of property, datasets and alternative for higher funding returns as robots get deployed. The agency forecasts the worldwide humanoid robots will generate $5 trillion in annual income by 2050. “We view Brookfield as notably properly suited to guide in partnership with corporations creating AI-leveraged robotics given their skew in direction of extra industrial-adjacent and actual asset industries the place we see significant alternative to deploy autonomous robots,” Cyprys mentioned. Echoing Cyprys, Morgan Stanley analyst Adam Jonas in a Monday observe mentioned that Brookfield, alongside Meta and Tesla, that has a number one “agentic alternative” in imaginative and prescient information that can be used for AI robotic improvement. ( Be taught one of the best 2026 methods from contained in the NYSE with Josh Brown and others at CNBC PRO Dwell. Tickets and data right here . )