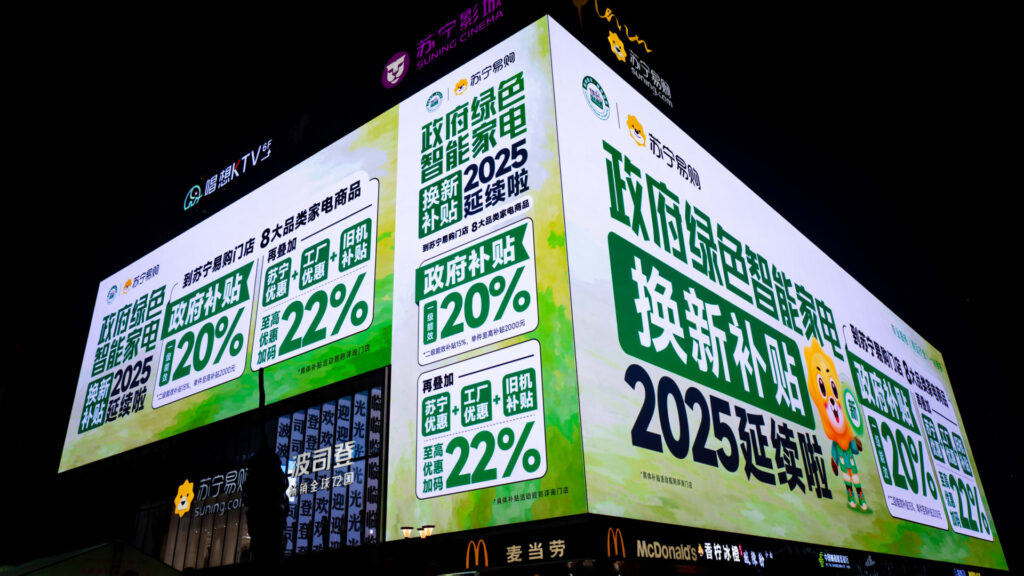

China financial coverage kicked off 2025 with an expanded client stimulus program that analysts count on will profit a handful of particular shares. Whereas the nation has rejected handing out money on to shoppers, since late summer season it has backed some residence equipment purchases by a trade-in program. Officers on Wednesday added microwaves, water purifiers, dishwashers and rice cookers to an present checklist of eight product classes eligible for subsidies of as much as 20% the retail value. “The brand new measures ought to principally profit main residence equipment producers like Midea , Gree and Haier ,” Morningstar fairness analyst Jeff Zhang stated in a mid-week observe. The businesses have been the highest three air conditioner producers by income in China final 12 months. “We carry our 2025-28 income forecasts on Midea, Haier and Gree by 2%-5% to mirror greater gross sales expectations,” Zhang stated. He additionally raised 12-month value targets on all three shares. Midea’s Hong Kong-listed shares gained almost 38% final 12 months. Shares may soar about 26% from Friday’s shut primarily based on Morningstar’s value goal of 96.70 Hong Kong {dollars}. After gaining 29% final 12 months, Haier’s Hong Kong-listed shares nonetheless have almost 48% upside, measured from Friday’s near Morningstar’s value goal of HKD 38.90. Gree, traded in Shenzhen, noticed its shares surge by almost 50% final 12 months. Morningstar has a value goal of 51 yuan, equal to about 10% upside from Friday’s shut. Citigroup analysts maintained their purchase rankings on the identical three Chinese language residence equipment shares after Wednesday’s client stimulus announcement. Citi has greater value targets than Morningstar on all three: 64.50 yuan for Gree, HKD 50.60 for Haier and HKD 119.30 for Midea. Dangers to progress Nonetheless, Citi cautioned that value wars and additional weak spot in the true property market may additionally weigh on the inventory costs. House equipment costs fell by 3.3% in December from a 12 months in the past, in response to official information launched Thursday. The figures underscored how client demand in China has remained lackluster for the reason that pandemic as households keep centered on future revenue. China is because of launch retail gross sales and full-year GDP numbers on Friday Jan. 17. The most recent stimulus coverage stated shoppers who benefited from residence equipment subsidies in 2024 can get pleasure from them once more this 12 months. The eight product classes on final 12 months’s checklist have been fridges, washing machines, tv units, air conditioners, computer systems, water heaters, family stoves and vary hoods. Officers stated Wednesday they already allotted 81 billion yuan ($11.05 billion) to assist the trade-in subsidies this 12 months by the Spring Pageant, which runs from late January to early February. Subsidies for the complete 12 months are attributable to be introduced at an annual parliamentary assembly in early March. Within the final a number of months, China’s main e-commerce platforms have highlighted how they’ve benefited from the trade-in subsidies program. Among the many firms, JD.com stays Citi web analysts’ high decide for taking part in the patron stimulus program within the 12 months forward, in response to a Jan. 8 observe. “JD.com is comparatively higher/positioned to profit from the continuation of this supportive trade-in program particularly given its prior expertise, ready system and procedures and robust provide chain capabilities to seize rising demand on this new spherical of trade-in initiatives,” the Citi analysts stated. Extra electronics, much less meals Relative to its friends, JD.com tends to promote extra electronics and residential home equipment than garments or meals. However there may be growing product overlap because the e-commerce platforms have grown over time. Alibaba is Citi’s second favourite e-commerce play on the Chinese language client stimulus coverage. The web purchasing large sells merchandise from giant manufacturers on its Tmall platform, and smaller retailers by Taobao. “Due to Tmall’s energy with main manufacturers and their giant distributors, Baba may also probably profit from the constructive coverage,” the analysts stated. They count on PDD will profit much less relative to JD and Alibaba. Citi has a value goal of $51 on JD’s U.S.-traded American depositary receipts , and $133 on Alibaba ADRs, implying upside of 54% and 65%, respectively, from Friday’s shut.