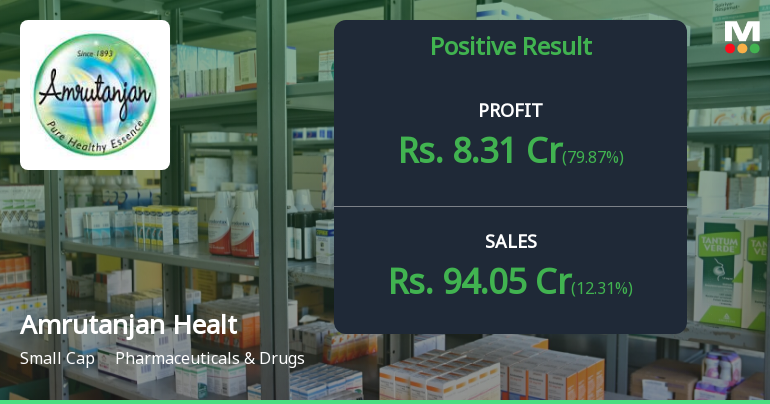

Amrutanjan Health Care, a small-cap participant within the Prescription drugs & Biotechnology sector, has just lately reported its monetary outcomes for the quarter ending June 2025. The outcomes, declared on August 12, 2025, point out a notable shift within the firm’s analysis, with its rating reflecting a optimistic adjustment from the earlier quarter.

The monetary knowledge reveals that Amrutanjan Health Care’s Revenue Earlier than Tax (PBT) has proven vital development, reaching Rs 6.86 crore, which represents a year-on-year enhance of 261.05%. Equally, the Revenue After Tax (PAT) stands at Rs 8.31 crore, marking a year-on-year development of 79.9%. These figures counsel a good near-term pattern in profitability.

Nevertheless, the corporate faces challenges as nicely. A substantial portion of its revenue, 39.24% of PBT, is derived from non-operating actions, elevating issues concerning the sustainability of its enterprise mannequin. Moreover, the Debtors Turnover Ratio has reached its lowest level within the final 5 half-year intervals at 8.09 instances, indicating a slowdown within the tempo of settling money owed.

Total, Amrutanjan Health Care’s current monetary outcomes spotlight each optimistic developments and areas that require consideration.