Please word that we’re not authorised to offer any funding recommendation. The content material on this web page is for data functions solely.

Alibaba (NYSE: BABA) inventory is buying and selling increased in early US worth motion at present after Chinese language President Xi Jinping met the nation’s entrepreneurs together with Alibaba’s co-founder Jack Ma at a symposium yesterday.

Alibaba shares have in any case gained over 60% from their 2025 lows and look set to stretch the rally even additional in at present’s worth motion.

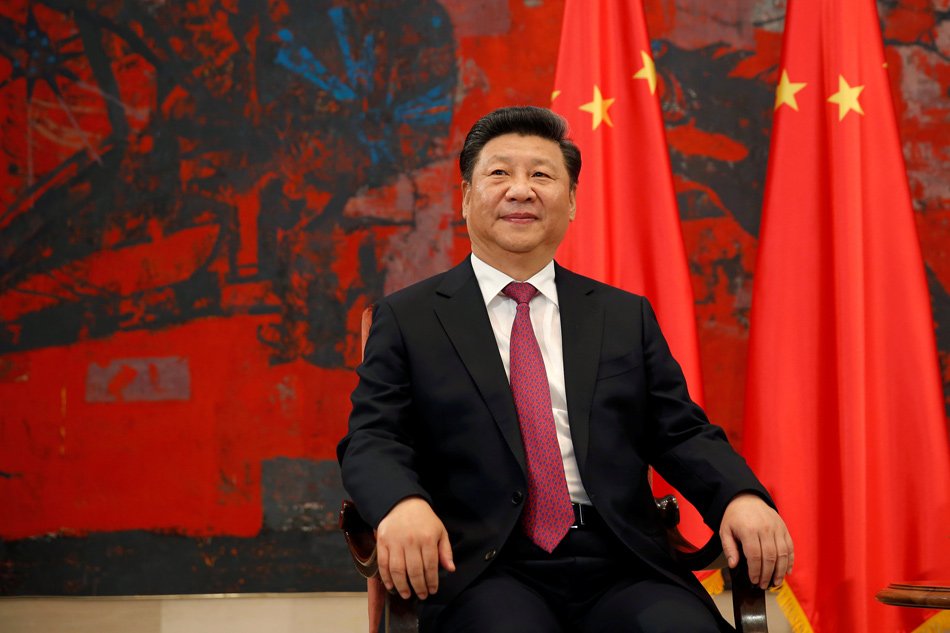

Jinping Meets Chinese language Entrepreneurs

In accordance with Xinhua, Xi advised Chinese language entrepreneurs “It’s essential to resolutely take away all types of obstacles to the equal use of manufacturing components and truthful participation in market competitors.” He added the nation ought to “proceed to advertise the truthful opening of the aggressive area of infrastructure to all types of enterprise entities, and proceed to make nice efforts to resolve the issue of inauspicious and costly financing for personal enterprises.”

Xi, who cracked down on Chinese language tech firms in 2021 harassed, “Now’s the proper time for personal enterprises and entrepreneurs to thrive.” He referred to as upon Chinese language firms and entrepreneurs to “present their expertise” whereas including, “The brand new period and new journey have broad prospects for the event of the personal financial system and nice potential.”

China’s Development Has Sagged

Notably, China has been attempting to revive its sagging economy that hardly met the 2024 GDP development goal of 5% after the flurry of financial and financial stimulus measures that had been unleashed within the again half of the 12 months.

Analysts see Xi assembly tech leaders from firms together with Alibaba, Huawei, and DeepSeek as a constructive. “That is the strongest sign China might launch to spice up social confidence. The truth that Xi Jinping himself reveals as much as meet with the entrepreneurs highlights the political significance of this assembly,” stated You Chuanman, senior lecturer on the College of Regulation, Singapore College of Social Sciences.

Angela Huyue Zhang, a legislation professor on the College of Southern California who wrote a e-book about China’s regulation of tech companies additionally echoed comparable views and told CNN, “With the home financial system slowing and geopolitical pressures escalating, the federal government is making it clear that it values and depends on the personal sector to drive innovation and stimulate development.”

Alibaba Nonetheless Trades Properly Under Its 2020 Highs

Whereas US tech shares have rallied and delivered double-digit returns within the earlier two years, Chinese language tech shares, particularly Alibaba have sagged after peaking in 2020. That 12 months, China cracked down on the corporate and Alibaba needed to cancel the IPO of its subsidiary Ant Monetary. The tech crackdown solely worsened in 2021 and though Alibaba paid a document $2.8 billion advantageous to settle the antitrust case, markets weren’t too satisfied that the worst is over for the corporate.

Ma wasn’t seen in public for a number of weeks after the cancelation of Ant IPO in November 2020 and appeared in an internet interplay solely in January 2021. Ma’s participation within the occasion with Jinping grew to become all of the extra notable because the Chinese language billionaire was the face of China’s crackdown on its tech moguls whom the Communist Occasion believed had turn out to be too massive for his or her sneakers.

As Christopher Beddor, deputy China analysis director at Gavekal Dragonomics in Hong Kong aptly stated, “Having Jack Ma specifically would offer a symbolic finish to the tech-sector crackdown, which primarily began with him again in 2020.” He added, “In follow, the crackdown has been over for some time now. However the optics of Xi telling Ma and different tech leaders to go forth and prosper would ship a crystal-clear message that the federal government’s stance has been fully reversed.”

Renewed Curiosity In the direction of Chinese language Shares

There was a renewed curiosity in Chinese language shares ever since DeepSeek introduced that its synthetic intelligence (AI) mannequin which it constructed for nearly $6 million carried out higher than Western rivals like OpenAI on a number of parameters. Final week, Chinese language electrical car big BYD soared to a record high after it launched an assisted driving system in partnership with DeepSeek.

The driving system which is called “DiPilot” can be supplied free together with BYD automobiles. This may make BYD the one automaker providing assisted self-driving in automobiles priced beneath $10,000.

What has aided the rally in Chinese language shares like Alibaba has been their underperformance during the last 5 years which made their valuations fairly enticing.

Jefferies Raised Its Goal Value for Alibaba

As Sandy Pei, a senior portfolio supervisor for China equities at Federated Hermes stated, “Chinese language equities have been buying and selling at extraordinarily depressed valuations with most dangers nicely mentioned and mirrored within the costs.” He added, “The DeepSeek occasion has acted as a catalyst, boosting sentiment round Chinese language equities. Regardless of current efficiency, the market stays attractively valued.”

In the meantime, Jefferies raised its goal costs on a number of Chinese language shares together with Alibaba because it sees the asset class as undervalued.

Alibaba Apple Partnership

Notably, Apple has partnered with Alibaba and can combine its AI into iPhones in China. The corporate hasn’t been providing its “Apple Intelligence” features in China as a consequence of regulatory points. The unavailability of those AI-powered options was among the many causes Apple’s gross sales in China fell sharply in December quarter and it misplaced its place as the biggest smartphone firm within the nation.

In the meantime, growing US-China tensions are additionally working to the detriment of US manufacturers. China is more and more changing into a troublesome marketplace for international manufacturers like Apple, Common Motors, and Starbucks and so they have been shedding market share to home Chinese language firms.

Notably, other than being the second largest marketplace for Apple, China can also be the important thing sourcing vacation spot for the iPhone maker. Nonetheless, it has been trying to enhance sourcing from different Asian international locations, and Foxconn, which makes most iPhones globally is increasing its footprint in India.

With the Alibaba partnership, Apple may be capable to present its AI options in China which might assist buoy its gross sales. Throughout the fiscal Q1 2025 earnings name final month, Apple CEO Tim Prepare dinner stated that iPhone 16 gross sales fared higher in areas the place the corporate supplied Apple Intelligence options.