Aerospace Nanhu Digital Info Know-how (SHSE:688552) Full 12 months 2024 Outcomes

Key Monetary Outcomes

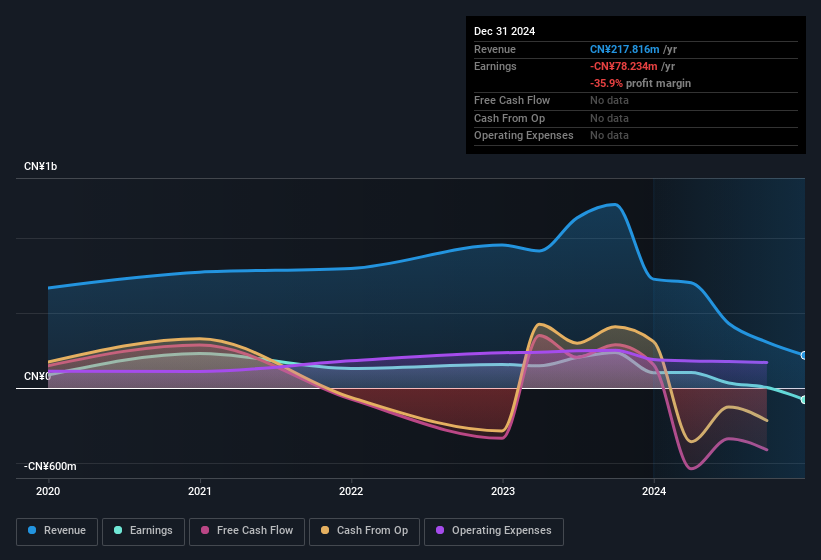

- Income: CN¥217.8m (down 70% from FY 2023).

- Internet loss: CN¥78.2m (down by 176% from CN¥102.5m revenue in FY 2023).

- CN¥0.23 loss per share (down from CN¥0.34 revenue in FY 2023).

All figures proven within the chart above are for the trailing 12 month (TTM) interval

Aerospace Nanhu Digital Info Know-how Revenues and Earnings Miss Expectations

Income missed analyst estimates by 67%. Earnings per share (EPS) was additionally behind analyst expectations.

Wanting forward, income is forecast to develop 63% p.a. on common in the course of the subsequent 2 years, in comparison with a 26% progress forecast for the Aerospace & Protection business in China.

Performance of the Chinese Aerospace & Defense industry.

The corporate’s shares are down 1.4% from per week in the past.

Steadiness Sheet Evaluation

Simply as traders should think about earnings, it’s also vital to take note of the power of an organization’s steadiness sheet. We have finished some evaluation and you can see our take on Aerospace Nanhu Electronic Information Technology’s balance sheet.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory traders, and it is free.

• Join an infinite variety of Portfolios and see your whole in a single forex

• Be alerted to new Warning Indicators or Dangers by way of e mail or cellular

• Monitor the Truthful Worth of your shares

Have suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to deliver you long-term targeted evaluation pushed by basic information. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.