Key Factors

- Adebayo Ogunlesi’s web price rose $800 million in 2025, reaching $2.5 billion, pushed by good points in his BlackRock stake.

- BlackRock, the place Ogunlesi is a board member, leads a $10 billion Saudi Aramco fuel infrastructure funding.

- Ogunlesi acquired $600 million money and 1.82 million BlackRock shares from the $12.5 billion sale of World Infrastructure Companions.

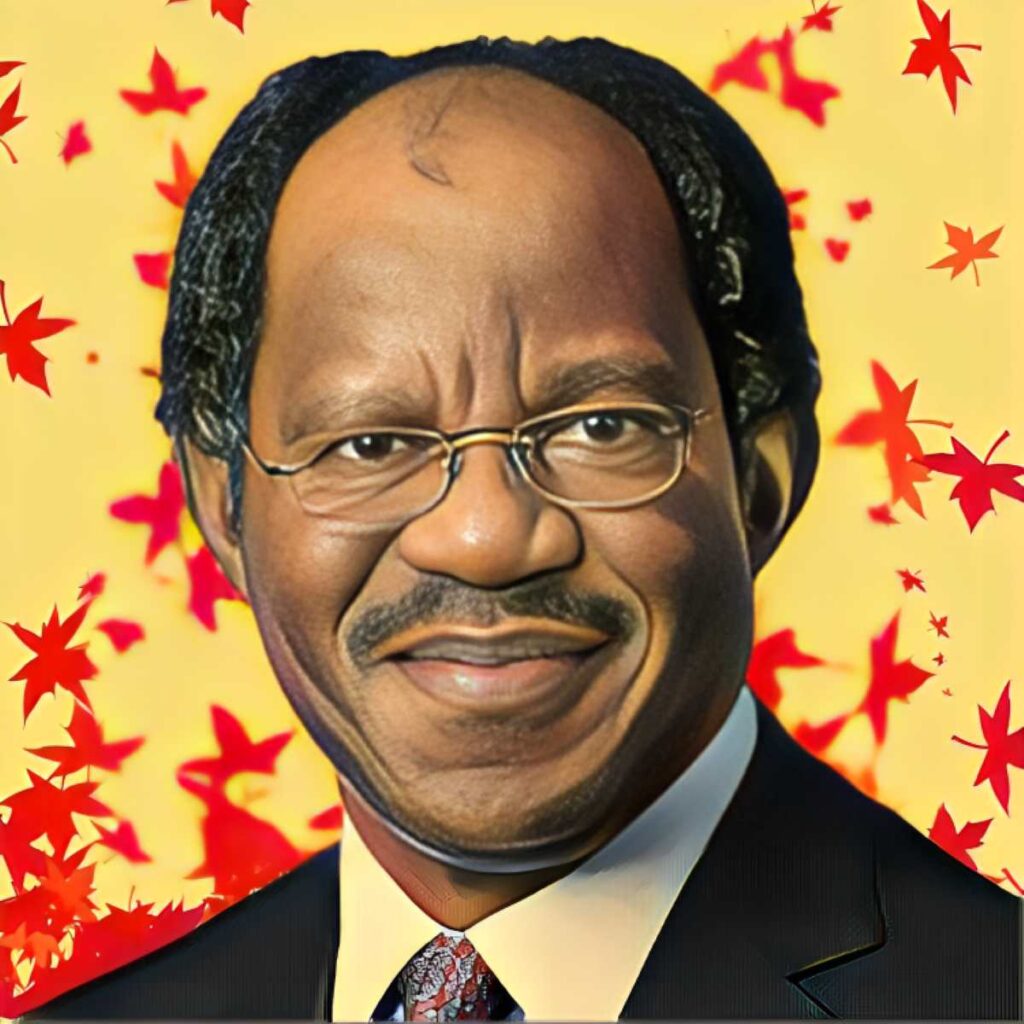

Nigerian billionaire Adebayo Ogunlesi has seen a pointy rise in his fortune this yr, becoming a member of plenty of African billionaires whose wealth has grown steadily in 2025. His investments, which embody a significant stake in U.S. asset administration large BlackRock, have pushed his web price to $2.5 billion, putting him firmly among the many world’s richest folks.

Ogunlesi’s web price hits $2.5 billion

In keeping with Forbes, Ogunlesi’s wealth has climbed by $800 million since January, rising from $1.7 billion initially of the yr to $2.5 billion on the time of this report. That achieve makes him the 1,531st richest individual on this planet, based mostly on Forbes’ real-time billionaire rankings.

A big a part of this improve comes from the efficiency of his stake in BlackRock. The worth of his holding has grown from $1.7 billion in January to $1.9 billion, reflecting a ten % year-to-date rise. The enhance follows BlackRock’s $12.5 billion acquisition of Global Infrastructure Partners (GIP), the infrastructure funding fund Ogunlesi co-founded.

Ogunlesi joins BlackRock in Aramco enterprise

For the reason that acquisition, BlackRock—the place Ogunlesi now sits on the board—has wasted little time pursuing new alternatives. Considered one of its newest strikes is main a consortium in a $10 billion investment in Saudi Aramco’s Jafurah gas infrastructure. The deal, much like different financing preparations within the Gulf, helps oil-producing nations increase funds for broader financial plans whereas giving buyers dependable long-term returns.

The Jafurah mission, valued at about $100 billion, is poised to be the most important shale fuel improvement exterior america. It’s a key a part of Aramco’s push to extend pure fuel manufacturing by 60 % by 2030, in contrast with 2021 ranges. BlackRock and Aramco have partnered earlier than, together with in 2021 when the agency joined different buyers to amass lease rights to Aramco’s pipeline networks in two transactions price almost $28 billion.

Ogunlesi holds BlackRock, OpenAI seats

Ogunlesi’s enterprise pursuits prolong nicely past GIP and BlackRock. As a part of the GIP sale, he personally acquired 1,822,926 BlackRock shares and $600 million in money. Now 71, he sits on BlackRock’s board and joined the board of OpenAI, the analysis group behind ChatGPT. His portfolio additionally contains stakes in Kosmos Power Holdings LLC, Topgolf Callaway Manufacturers Corp., and Goldman Sachs Group.